Why U.S. Homeowners Are Suddenly Ditching Their 30-Year Fixed Rate Mortgages

The 15-year fixed rate mortgage is popular.

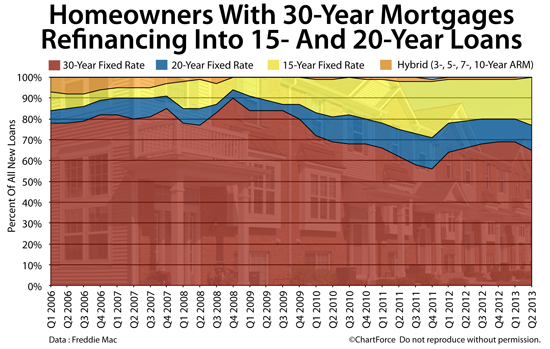

Last quarter, a growing number of U.S. households refinanced out of 30-year fixed rate mortgages, and into 15-year and 20-year ones. More refinancing households moved to shorter loan terms than during any quarter since 2011.

Low mortgage rates are part of the reason. The HARP refinance program is the other.

Click here to get today's 30-year and 15-year mortgage rates.

35% Of Refinancing Households Left The 30-Year Fixed

According to Freddie Mac's quarterly Product Transition report, between April - June 2013, 35 percent of refinancing U.S. households with an existing 30-year fixed rate mortgage elected to refinance into a new 15-year fixed rate mortgage or 20-year fixed rate mortgage.

The reading marks a 4 percentage point increase over the quarter prior, and the largest transition rate in more than a year.

The rush among homeowners to ditch their 30-year mortgages is noteworthy. Average 15-year mortgages are historically cheap as compared to their 30-year mortgage counterpart.

- Between 2000-2012, 15-year rates were 0.52 percentage points below 30-year rates

- Last quarter, 15-year rates were 0.84 percentage points below 30-year rates

Today's 15-year fixed rate mortgage is "on sale" and a savvy rate shoppers know a great deal when they see one. At today's rates, the total interest paid over the life of a 15-year loan is 66 percent lower as compared to a similar 30-year product.

Never in history could homeowners save this much. The spread is bigger than it's ever been before.

Click here to get today's 30-year and 15-year mortgage rates.

HARP 2.0 Below 105% LTV Dominated By 15-Year Fixed

Last quarter, the 15-year mortgage was especially popular among users of the Home Affordable Refinance Program (HARP). HARP is the government's mortgage program for underwater homeowners.

Via HARP, homeowners whose homes have lost equity are eligible to refinance without new, or additional, private mortgage insurance (PMI) coverage. This means that homeowners who put 10% down at the time of purchase can refinance into a loan with "10% down PMI", regardless of their home's current equity levels.

Similarly, homeowners who put 20% down at the time of purchase -- but who are now underwater -- can refinance via HARP without having being required to pay any amount of PMI at all.

HARP was initially launched as part of the American Reinvestment and Recovery Act of 2009. The program was expected to reach 7 million U.S. households.

By late-2011, though, HARP had little traction. Fewer than 1 million homes had been HARP-refinanced. The government took control.

Renaming the product "HARP 2.0", the Home Affordable Refinance Program was revamped and re-released. The number of eligible HARP households increased dramatically and so did the number of HARP closing.

More than 1,000,000 HARP 2.0 loans closed in 2012. Another one million are expected to close in 2013. The program is a hit.

Also, among HARP refinances, a pattern has emerged. The more equity that a HARP-refinance candidate has in its home, the more likely the homeowner will choose a "short" loan term.

- LTV of 80 - 105 percent : 29% refinanced into a 15-year or 20-year mortgage

- LTV of 105 - 125 percent : 21% refinanced into a 15-year or 20-year mortgage

- LTV of 125 percent or more : 18% refinanced into a 15-year or 20-year mortgage

As HARP 2.0 expands to reach more homeowners -- possibly in the form of HARP 3.0, which may launch next quarter -- the share of U.S. households which refinancing into 15-year fixed rate mortgages may increase as compared to other loan terms.

See All Of Today's HARP Mortgage Rates

The interest rate spread between 15-year and 30-year mortgages is at an historical high. For HARP households, the savings can be huge. Take a look at today's rates and see how they fit your budget. Zero-closing cost mortgages are available.

Get started with a rate quote online. It's fast, it's free, and there's no obligation whatsoever.

Click here to get today's 30-year and 15-year mortgage rates.