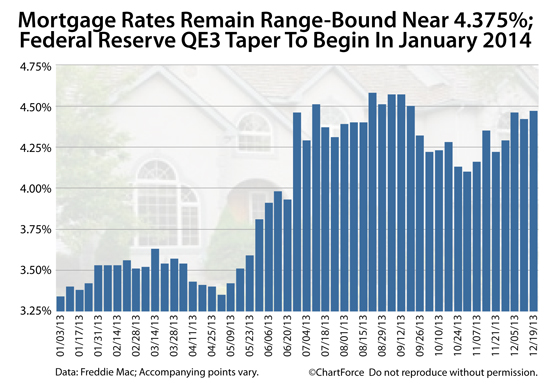

30-Year Fixed Rate Mortgage Climbs To 14-Week High; Not Too Late To Refinance

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Mortgage rates rose for the second straight week this week, with the 30-year fixed-rate mortgage rate adding 0.05 percentage points; and the 15-year fixed-rate mortgage adding 0.08 percentage points.

Rates have reached a 14-week high and just two weeks remains until the New Year. Recent trends suggest mortgage rates will begin 2014 on the upswing. Today's rates may be as low as mortgage rates get.

Click here for an immediate mortgage rate quote.

Freddie Mac : The Lowest Published Mortgage Rates

Each week, government-backed Freddie Mac surveys more than 100 U.S. lenders regarding their "going" mortgage rates for three common loan products -- the 30-year fixed, the 15-year fixed, and the 5-year ARM. The results are compiled into the Primary Mortgage Market Survey (PMMS).

This week's PMMS shows mortgage rates rising across the board.

Surveyed banks report that the average 30-year conventional fixed rate mortgage rate climbed 5 basis points last week to 4.47%. The rate is available to prime borrowers, and requires a full set of closing costs to be paid at closing which includes accompanying 0.7 discount points.

Discount points are a one-time, up-front loan cost where 1 point costs one percent of your borrowed amount. Lenders and the IRS consider points to be pre-paid mortgage interest. In exchange for paying discount points, lenders give applicants access to lower real mortgage rates.

Discount points are a trade-off. You can pay more costs at closing, then fewer costs over the life of the loan. Or, you can do the reverse.

The relationship between high discount points and low mortgage rates is one reason why Freddie Mac's weekly mortgage rate survey frequently "appears lower" than mortgage rate surveys published elsewhere.

Different surveys list discount points differently. Consider these three surveys :

- Freddie Mac Survey : 4.47% mortgage rate + 0.70 discount points

- Mortgage Bankers Association Survey : 4.62% mortgage rate + 0.38 discount points

- Bankrate.com Survey : 4.58% mortgage rate + 0.38 discount points

Each of the three surveys shows the same rates, mostly. When you pay more points, your mortgage rate is lower.

Click to compare today's low mortgage rates.

30-Year Fixed Rate Mortgage Rate At 4.47%

This week, Freddie Mac reports the 30-year fixed at 4.47%, its highest point in more than three months. To lock a 4.47% mortgage rate will require 0.7 discount points, on average, nationwide.

The complete survey results are below :

- 30-year fixed rate mortgage : 3.55% with 0.7 discount points

- 15-year fixed rate mortgage : 2.83% with 0.6 discount points

- 5-year adjustable rate mortgage : 2.75% with 0.6 discount points

Note that the Freddie Mac weekly mortgage rate survey does not differentiate between a purchase mortgage and a refinance mortgage. Your quoted mortgage rate may be also be higher or lower depending your loan's unique characteristics.

Furthermore, special mortgage types such loans for real estate investors with 5-10 properties financed may see slightly higher mortgage rates than the mortgage rates for "prime" borrowers.

As a real-life example of how today's rates affect payment, a buyer in Chicago, Illinois borrowing at the 2014 conforming loan limit of $417,000, should expect a monthly mortgage payment of $2,105 and discount points of $2,919 due at closing.

The same applicant borrowing at the Orange County, California jumbo loan limit of $625,500 would pay $3,158 monthly and $4,379 at closing.

Like most closing costs, however, discount points may be "rolled in" to your loan balance with a refinance (e.g. HARP 2.0), or waived in full with either a purchase or refinance. Mortgage applicants waiving all discount points should expect slightly higher rates from their lender, but markedly lower closing costs.

Zero-closing cost mortgages waive discount points and closing costs.

Get A Personalized, Free Rate Quote

For today's home buyers and rate shoppers, the market appears to have reached a bottom. An improving economy has pulled rates up, and the Federal Reserve has announced that it will begin tapering QE3, its mortgage rate-suppression program, beginning in January 2014.

Take a look at today's mortgage rates and see what money you'll save. Chances to save money my soon run out. Rates are available at no cost and with no obligation whatsoever.