The Fed Begins Its Taper And HARP 3 Remain In-Focus

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

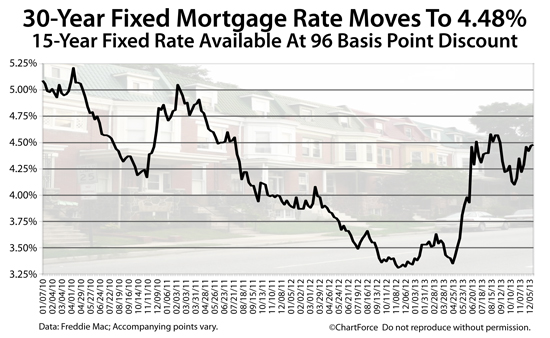

Mortgage rates rose for the third straight week last week and ended the year near four-and-a-half percent -- the first time this has happened in three years.

This week, though, with the start Federal Reserve's QE3 "taper" and a holiday-shortened trading week, U.S. rates could start a push toward 5%.

For buyers in search of low rates, the prudent move may be to lock something in today.

Shopping rates? Compare today's rates first.

FHA, VA, Conventional Mortgage Rates Higher

Mortgage rates worsened during last week's holiday-shortened week as bond prices climbed for across all government-backed loan types.Pricing on FHA loans, VA loans, conventional loans, and USDA loan climbed.

Today's home buyers and refinancing households are paying an additional 0.30 discount points to get the same mortgage rates versus last week's shoppers where 0.30 discount points is a fee equal to 0.3% of the borrower's loan size.

In Orange County, California, where the 2014 conforming loan limit is $625,500, loans at the maximum local loan size now require an additional $1,877 in closing costs.

The good news is that discount points are optional.

As an alternative to paying higher loan fees via points, lenders will allow a borrower to borrow at a higher rate of interest. 0.30 discount points can typically be substituted for a 0.125 percentage point increase to your mortgage rate, which adds roughly to $8 per $100,000 borrowed per month.

Mortgage rates rose last week, in part, because the Federal Reserve is about to begin slowing its QE3 program which, since September 2012, has helped hold mortgage rates artificially low.

As QE3 tapers, mortgage rates are expected to rise.

Click here for today's instant mortgage rates.

Into 2014 : Will Mortgage Rates Move Above 5%?

For U.S. mortgage rates, this week could be a bouncy one. In addition to holiday-slowed trading which can lead to volatility, the Federal Reserve will begin reducing the size of its current quantitative easing program -- QE3 -- at the start of the New Year.

QE3 is a program by which the Fed has purchased $40 billion of mortgage-backed securities on the open market monthly; and $45 billion in Treasury securities monthly since late-2012.

The additional Fed-led demand for bonds lifted mortgage bond prices which, in turn, drove bond yields down.

When bonds yields drop, mortgage rates follow. It's no coincidence that the lowest rates in history coincided with the launch of QE3. It's also no coincidence that even the specter of life after QE3 has caused mortgage rates to climb.

In May, for example, when the Fed first said that QE3's size might reduce, mortgage rates spiked. Within 8 weeks, the 30-year fixed rate mortgage rate climbed 1.25 percentage points.

It remains the fastest two-month jump in mortgage rates in history.

Since the surge, rates have held tight. Some weeks, rates rise and, some weeks, rates drop. Overall, though, there's been little net movement. Mortgage rates remain near 4.5 percent for prime borrowers willing to pay points.

This week, though, with the Federal Reserve's taper getting started, mortgage rates could climb. The Fed is reducing its net monthly purchases by $10 billion -- five billion dollars each from mortgage bonds and Treasuries. This will reduce demand for bond and nudge rates up.

There's little economic data set for release this week :

- Monday : Pending Home Sales Index

- Tuesday : Case-Shiller Index; Consumer Confidence

- Wednesday : Markets Closed

- Thursday : Initial Jobless Claims

- Friday : None

Also this week, there are five Federal Reserve members scheduled to speak, including Federal Reserve Chairman Ben Bernanke. Fed speakers can sometimes move markets based on what they say and how they say it.

All five Federal Reserve members speak Friday, adding late-week risk for mortgage rate shoppers.

See mortgage rates before the Fed adjourns.

HARP 3 Update : When Will It Pass?

Another piece of news to watch this week is the development of the HARP 3 storyline.

HARP 3 is the highly-anticipated successor to HARP 2.0. The program's passage may be imminent following the appointment of Mel Watt's to Director of the FHFA. Watt is known to be "consumer-friendly" with respect to housing issues.

HARP 3 would be the third iteration of the popular Home Affordable Refinance Program, first launched in early-2009. More than 2.9 million U.S. homeowners have used HARP since its inception and millions more remain eligible nationwide.

HARP 3 is also known as #MyRefi and "A Better Bargain For U.S. Homeowners".

There is a lot of speculation about what HARP 3 will include, with all of the following among the possibilities.

- HARP 3 may allow the "Re-HARP" of an existing HARP refinance

- HARP 3 may include non-Fannie Mae and non-Freddie Mac mortgages

- HARP 3 may change the program cut-off date to include more homeowners

- HARP 3 may waive certain documentation and credit score requirements

There are several HARP 3-like bills in committee in Congress. However, the FHFA has the ability to "skip" Congress, if it wants. This was how HARP 2 was born, after all -- the FHFA drafted the change and released it at-will.

HARP 3 may pass the exact same way. Instantly, millions of U.S. households would become HARP program-eligible. Many would save more than 27% on their mortgage each month.

Watt and the FHFA have already rolled-back costly loan fees put in place by outgoing director Ed DeMarco. The passage of HARP 3 would be another consumer-friendly advancement.

Take A Look At Today's Mortgage Rates

Mortgage rates have increased for three straight weeks and, because of New Year's Day and the QE3 taper, rates are expected to begin 2014 on the upswing. Pricing won't likely reach 5 percent immediately, but what if it does?

Compare today's mortgage rates and see for what you qualify. Rates can be drawn online with no cost, and with no obligation to proceed. Get started today.