The numbers behind Keystone XL supporters’ claim of falling Venezuelan oil imports

By Meghan Gordon | February 21, 2013

Both sides in the Keystone XL pipeline battle staked out their positions years ago and have largely stuck to the same arguments for or against TransCanada’s project.

A few new angles include environmentalists’ concern for greenhouse gas emissions from burning petroleum coke contained in the diluted bitumen versus pipeline supporters’ concern for the greater risk of pollution and spills by trains and trucks that will move the supplies in the absence of more pipeline capacity.

One of the old standby arguments from Keystone XL supporters was that the diluted bitumen the pipeline would carry from Alberta would displace US Gulf Coast imports of heavy crude oil from Venezuela, Mexico and the Middle East.

“Really, it’s displacing oil from Venezuela,” Gary Doer, Canada’s ambassador to the US, said during a Maclean’s event Tuesday night in Washington. “That is the fundamental issue of the national interest in the United States. Two years ago, when the State Department looked at this, they evaluated that Canadian oil was 2% higher in GHGs than Venezuelan crude. The latest reports from Daniel Yergin have it at or below Venezuelan oil.”

Predicting that more Canadian oil flowing south will push out Venezuela imports is an exceedingly safe bet, because it’s already happening.

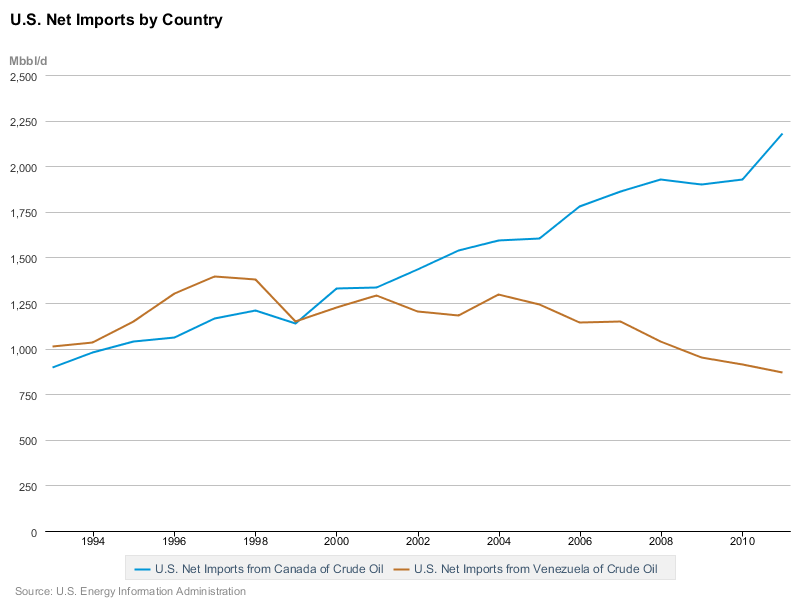

Canadian net crude imports to the US climbed 36% to 2.178 million b/d between 2005 and 2011, according to the US Energy Information Administration.

During the same period, Venezuelan imports fell 30% to 868,000 b/d by 2011.

The agency’s year-end stats for 2012, due out next week, will likely show another jump in Canadian imports. Monthly import data through November averaged 2.339 million b/d, or 7% higher than 2011 imports.

Venezuelan crude imports to the US ticked back up in 2012, with January-November monthly figures averaging 896,000 b/d, up 3% from 2011.

David Pumphrey at the Center for Strategic and International Studies said it’s safe to assume, as Keystone XL supporters do, that Venezuelan imports would drop further with the addition of pipeline capacity from Cushing, Oklahoma, to Gulf Coast refineries. But so could heavy crude imports from Mexico or the Middle East.

“While it’s useful to point out Venezuela, you really don’t know in the end how the balance will go and what the company decisions will be,” said Pumphrey, co-director of the think tank’s energy and national security program. “It’s all going to be a pricing choice.”

Venezuelan imports have certainly fallen as a result of more Canadian oil reaching the US Gulf Coast, Pumphrey said. But other factors include slowly declining Venezuelan production and President Hugo Chavez’ efforts to get into other markets like energy-hungry China.

“It really has come out of Chavez’ desire to build some distance between Venezuela and the United States, that he felt the previous regimes had been too close to the United States and he wanted to have special relationships with other major countries in the world,” he said. “So it was out of the tensions between the two countries that he started pushing hard on diversifying their export markets.”

© 2013 Platts, The McGraw-Hill Companies Inc. All rights reserved. To subscribe or visit go to: http://www.platts.com

http://blogs.platts.com/2013/02/21/keystone-oil/?WT.mc_id=&WT.tsrc=Eloqua