The Government Doesnít Just Tax Money Once

Friday, 25 Jan 2013 08:11 AM

By Bill Spetrino

Being that Iím a professional investor, an accounting major with 28 years experience doing tax planning and tax consulting and a life-long entrepreneur who started my first business at age 6, I get amused when the subject of raising taxes to get more revenue is brought up.

History has been clear that when individual tax rates are lowered or tax rates on dividends or capital gains are lowered, the next few yearsí tax receipts go up, not down. Presidents Ronald Reagan, George W. Bush, Bill Clinton and John F. Kennedy all lowered tax rates or capital gains and dividends rates and more tax revenues, not less revenues, were received.

The fact that both parties spent the money like drunken sailors had nothing to do with the fact that lowering tax rates raises revenues, not lowers them.

Recently the president got his way to raise marginal tax rates on the top earners and raise capital gains and dividend tax rates, as well. Also a 3.9 percent surcharge is put on all investment income for those who are single and earn over $200,000 and for those who are married and make over $250,000.

So why does this happen?

It's real simple. Most self-employed people can choose what their income will end up at. A client of mine has concentrated heavily this year on travel for employees in beautiful cities in lieu of a bonus and he is spending on research and development and capital spending.

He told me that his mission in 2013 is to personally do less, pay himself less and heís going to travel for business and visit his clients in warm weather climates all year.

He and his company will this year pay much less in taxes even though he will be paying at a higher rate.

Last year, thousands of investors took capital gains at 15 percent instead of 20 percent. I will not personally trade stocks in 2013, but instead focus on buy and hold, which has no income tax due the government until itís sold.

And Iím not selling. If I "need money," I will borrow it on my home, which is tax deductable, thereby lowering my income tax I will owe the government.

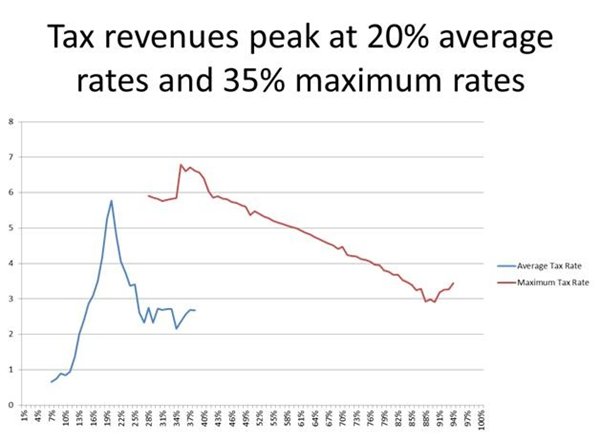

The following data prepared by my friend Timothy Clontz of Cornerstone Publications illustrates what tax rate is ideal to maximize the amount the U.S. government will receive.

When it comes to taxes, there is only one difference between conservatives and liberals.

They both want to raise as much money as possible. They even agree on a number for the tax rate: 35 percent.

The difference is that conservatives want a 35 percent maximum tax rate, and liberals want a 35 percent average tax rate. Now, in a progressive tax system, thatís a big difference.

Hereís how it works:

0 percent to 35 percent brackets gives an average of 20 percent (the conservative target).

0 percent to 65 percent brackets gives an average of 35 percent (the liberal target).

So, whoís right? Which raises as much money for the government as possible?

Well, the governmentís been tinkering with rates between 28 percent and 94 percent for over 70 years, and itís a simple matter of just looking at what happened during that long experiment. Since weíve been the guinea pigs, we might want to see how it worked out.

Hereís what we need to look at:

ē U.S. population

ē Inflation-adjusted tax revenues

ē Governmentís percent of gross national product (for average tax rates)

ē A list of the legislated tax brackets (for maximum tax rates)

ē Revenues per capita (to see how well those rates worked)

(A full table is available here: http://market-mousetrap.blogspot.com/2013/01/01152013-source-data_2926.html)

We then have two questions:

ē What maximum tax rate creates the most revenue per capita: 35 percent or 65 percent?

ē What average tax rate creates the most revenue per capita: 20 percent or 35 percent?

The good news is that the Republicans are right. The government gets the most money possible when the maximum tax rate is 35 percent, and the average is 20 percent.

The bad news is that the president just raised those rates, and government revenue should go down by about 14 percent.

In other words, they didnít raise revenue, they just threw it away.

http://www.moneynews.com/BillSpetrino/Clontz-tax-rates-revenue/2013/01/18/id/472009/

Above, we saw concrete proof that government revenue falls as tax rates are raised past 35 percent.

Why does it fall?

It's real simple. Most self-employed people can choose what their income will end up at. A client of mine has concentrated heavily this year on travel for employees in beautiful cities in lieu of a bonus and he is spending on research and development and capital spending.

He told me that his mission in 2013 is to personally do less and pay himself less and heís going to travel for business and visit his clients in warm weather climates all year.

He and his company will this year pay much less in taxes even though he will be paying at a higher rate.

Last year, thousands of investors took capital gains at 15 percent instead of 20 percent. I will not personally trade stocks in 2013, but instead focus on buy and hold, which has no income tax due the government until itís sold.

And Iím not selling. If I "need money," I will borrow it on my home, which is tax deductible, thereby lowering my income tax I will owe the government.

And if Iím not self-employed but work for someone else, I adjust in another way.

When Iím taxed too much I have to buy generic items at the grocery store and delay car and home repairs that are not imperative. I also may have to drive an older car, skip haircuts and cut back on entertainment or other luxuries.

That leaves the grocer, farmer, rancher, car dealer, carmaker and hair stylist with less money for the government to tax. And all the secondary folks who depend on them will also do less business. The private-sector pie gets smaller.

The government doesnít just tax money once ó it taxes money every time it moves. The higher you raise taxes, the less the money moves, which indirectly causes a trickle down effect despite the liberal mantra that it does not.

As you all know, when many sages psychics and doomsayers have been predicting doom the past four years, I have continued to help my Dividend Machine subscribers and my loyal readers of the weekly column an optimistic forecast.

However, I see a slowdown due to the anti-business rhetoric and policies, tax increases and the adoption and implementation of Obamacare. I still buy stocks, but the sectors and types of stocks have changed going forward.

About the Author: Bill Spetrino

Bill Spetrino is a member of the Moneynews Financial Brain Trust. Click Here to read more of his articles. He is also the editor of the Dividend Machine. Discover more by Clicking Here Now.

Read Latest Breaking News from Newsmax.com http://www.moneynews.com/BillSpetrino/tax-revenue-money-moves/2013/01/25/id/472920/?s=al&promo_code=122D9-1#ixzz2J7G5wSKN

Urgent: Should Obamacare Be Repealed? Vote Here Now!

Above, we saw concrete proof that government revenue falls as tax rates are raised past 35 percent.

Why does it fall?

It's real simple. Most self-employed people can choose what their income will end up at. A client of mine has concentrated heavily this year on travel for employees in beautiful cities in lieu of a bonus and he is spending on research and development and capital spending.

He told me that his mission in 2013 is to personally do less and pay himself less and heís going to travel for business and visit his clients in warm weather climates all year.

He and his company will this year pay much less in taxes even though he will be paying at a higher rate.

Last year, thousands of investors took capital gains at 15 percent instead of 20 percent. I will not personally trade stocks in 2013, but instead focus on buy and hold, which has no income tax due the government until itís sold.

And Iím not selling. If I "need money," I will borrow it on my home, which is tax deductible, thereby lowering my income tax I will owe the government.

And if Iím not self-employed but work for someone else, I adjust in another way.

When Iím taxed too much I have to buy generic items at the grocery store and delay car and home repairs that are not imperative. I also may have to drive an older car, skip haircuts and cut back on entertainment or other luxuries.

That leaves the grocer, farmer, rancher, car dealer, carmaker and hair stylist with less money for the government to tax. And all the secondary folks who depend on them will also do less business. The private-sector pie gets smaller.

The government doesnít just tax money once ó it taxes money every time it moves. The higher you raise taxes, the less the money moves, which indirectly causes a trickle down effect despite the liberal mantra that it does not.

As you all know, when many sages psychics and doomsayers have been predicting doom the past four years, I have continued to help my Dividend Machine subscribers and my loyal readers of the weekly column an optimistic forecast.

However, I see a slowdown due to the anti-business rhetoric and policies, tax increases and the adoption and implementation of Obamacare. I still buy stocks, but the sectors and types of stocks have changed going forward.

About the Author: Bill Spetrino

Bill Spetrino is a member of the Moneynews Financial Brain Trust. Click Here to read more of his articles. He is also the editor of the Dividend Machine. Discover more by Clicking Here Now.

© 2013 Moneynews. All rights reserved.

Read Latest Breaking News from Newsmax.com http://www.moneynews.com/BillSpetrino/tax-revenue-money-moves/2013/01/25/id/472920/?s=al&promo_code=122D9-1#ixzz2J7G5wSKN

Urgent: Should Obamacare Be Repealed? Vote Here Now!