Building Permits Surge To 5-Year High In June; Predicts Strong 2014 Housing Market

You can't always believe what you read in the papers.

Earlier this week, it was reported that Housing Starts dropped sharply in June, with some experts positing that the housing market was getting its come-uppance; that this year's gains were too fast, too soon. What was missed in those headlines, though, was relevance.

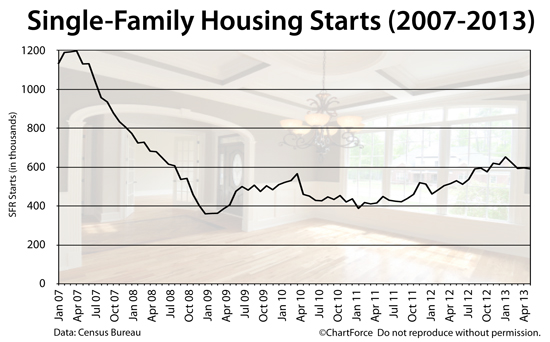

Yes, Housing Starts dropped in May 2013 but once we isolate the Housing Starts data for single-family homes -- the dominant home type for buyers like you and me -- the report looks much different.

Single-Family Housing Starts are 12% above the year-ago period and, furthermore, U.S. homebuilders are prepping for a blowout close to the year.

See today's new construction mortgage rates.

Single-Family Housing Starts Up 12% In 12 Months

Wednesday, the government released its most recent Housing Starts report. It showed Housing Starts down 9.9 percent in June 2013 as compared to the month prior, tallying 839,000 units on a nationwide, seasonally-adjusted, annualized basis.

The press eagerly ran these headlines :

- U.S. Housing Starts Fall To 10-Month Low (Reuters)

- 'Hiccup' In New Home Building (WSJ)

- Unexpected Drop In Starts Curbs U.S. Housing Rebound (Bloomberg)

And, although technically accurate, the above headlines are somewhat misleading.

A deeper look at the June Housing Starts report shows that Housing Starts did drop last month but when we remove the "5 or more units" grouping from the overall data, we're left with what's called the "Single-Family Housing Starts" data.

Single-family homes represent the overwhelming majority of property types nationwide; few individuals build or buy multi-unit homes. It's why buyers should ignore the combined Housing Starts data and focus on single-family figures instead.

Last month, Single-Family Housing Starts fell by five thousand units to 591,000 on a seasonally-adjusted, annualized basis.

SIngle-Family Housing Starts 12% improved versus one year ago and poised to remain elevated -- hardly the story you'd gather from the news sources above.

See today's new construction mortgage rates.

Single-Family Home Permits Jump 25% From 2012

It'a not just single-family housing starts that showed strongly in June -- the Building Permits report did, too.

Single-Family Building Permits rose 1% last month as compared to the month prior, climbing to 624,000 permits issued on a seasonally-adjusted, annualized basis. As compared to June 2012, permits climbed by one-quarter.

This, too, is a strong signal for housing because, according to the Census Bureau, 82% of homes begin construction within 60 days of permit-issuance.

It's also a likely reason why homebuilder confidence has moved to its strongest level since December 2005. Builders report huge volumes of foot traffic through model units and sales expectations are soaring.

The drop in single-family housing starts may be temporary, in other words, as builders ramp up meet new demand.

How Much "New Home" Can You Afford?

Today's home buyers face a different market as compared to last year at this time. Home values are rising nationwide and mortgage rates may be permanently etched north of 4 percent. The cost of homeownership is higher this year. Purchasing power has decreased.

The June Housing Starts and Building Permits data suggests that more homes will come online between now and 2014, but more buyers are expected to compete for homes, too. Prices are likely to face continued pressure higher.

Therefore, if you plan to buy a home in 2013 or 2014, make sure to know your budget and how much home you can afford. Get today's mortgage rates and see for how much home you'll qualify.

See today's new construction mortgage rates.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.