Freddie Mac : 30-Year Fixed Rate Mortgage Rates Drop To 4.31%; First Back-To-Back Drop Since May

Mortgage rates are on a roll.

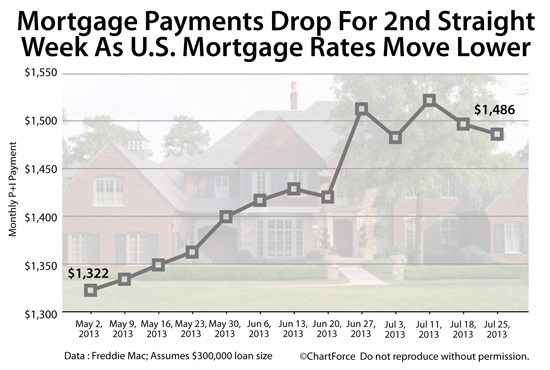

For the second straight week, Freddie Mac reports that U.S. rates improved, with the average 30-year fixed rate mortgage falling 0.06 percentage points to 4.31% nationwide.

15-year fixed rate mortgage rates improved, too, moving down 0.02 percentage points. The 15-year rate now averages 3.39%.

Click here for up-to-date U.S. mortgage rates.

Mortgage Rates On Mini-Winning Streak

Mortgage rates are recovering. After a tumultuous late-Spring which saw conventional 30-year fixed-rate mortgage rates rise more than 1 percentage point, a pullback in underway.

Home buyers have regained lost purchasing power. Homeowners have found reason to refinance.

Over the past two weeks, the typical new mortgage payment is down 2.3%, opening opportunities via Fannie Mae- and Freddie Mac- programs such as Conventional 97 and HARP 2.0; and, via other government-backed programs including the FHA Streamline Refinance and the bevy of VA loans available via the Department of Veterans Affairs.

Furthermore, the outlook remains strong for today's rate shoppers -- at least through July 31, anyway. This is the date the Federal Reserve adjourns from its scheduled, 2-day meeting. Its post-meeting statement is expected to move markets.

Remember back to May 1. That was the day the Fed announced it would re-evaluate QE3, the central bank's mortgage-rate suppressing program. Predictably, rates surged on the news, ending the longest bull-run in mortgage rates since the early-1980s.

The Fed's remarks after its July 31 meeting could have a similar effect.

If the Fed says full-strength stimulus is still required to aid the U.S. economy, mortgage rates will continue their recent march lower toward 4 percent. In time, rates may even drop into the 3s -- especially should the economy shows signs of slowing through the third and fourth quarters.

Click here for up-to-date U.S. mortgage rates.

Freddie Mac : Rates Are Best Since Start Of July

Each week, Freddie Mac asks 125 banks nationwide about their "going rate" for a prime mortgage borrower with 20% downpayment and excellent credit. The results are compiled as the Primary Mortgage Market Survey (PMMS), a weekly pulse of U.S. mortgage rates.

This week's survey puts the average 30-year fixed rate mortgage at 4.31% nationwide for borrowers willing to pay 0.8 discount points. Discount points are optional closing costs and are expressed as a percentage of your total loan size.

1 discount point on a loan at the national conforming loan limit of $417,000 costs $4,170. Loans with 1 point made for $625,500 in such high-cost areas as Loudoun County, Virginia; San Jose, California; and New York, New York would carry an additional cost of $6,250.

Freddie Mac's complete mortgage rate breakdown for the week showed :

- 5-Year Adjustable-Rate Mortgage : 4.31 with 0.8 discount points

- 15-Year Fixed-Rate Mortgage : 3.39 with 0.8 discount points

- 30-year Fixed-Rate Mortgage : 3.16 with 0.7 discount points

Borrowers preferring to pay zero discount points should expect slightly higher rates that the Freddie Mac "with points" figure, as should mortgage applicants preferring zero-closing-cost mortgages.

Click for today's zero-closing-cost mortgage rates.

See Today's Low Mortgage Rates Here

For U.S. home buyers and would-be refinancing households, this week's improving market presents a second opportunity to lock in low rates. There are millions of U.S. households still eligible for the HARP refinance program, and the typical HARP homeowner saves 20% or more on his mortgage.

See today's live mortgage rates. Rates are available online at no cost and with zero obligation.

Click for today's live mortgage rates.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.