HARP 3.0 Could Help The U.S. Government Reach Its 7 Million Household Target Figure

For the first time since last decade, mortgage rates are rising through the summer.

Since May, the average 30-year fixed rate mortgage rate has increased more than a percentage point, reducing the number of refinance opportunities nationwide. However, interest in the Home Affordable Refinance Program (HARP) remains strong.

U.S. homeowners closed on more HARP loans in April than during any month so far this year. Yet, should the much-anticipated HARP 3.0 program pass Congress soon, the April closed loan tally will likely appear meager.

There is pent-up demand for HARP 3.0 nationwide.

Jump to today's HARP mortgage rates.

What Is The HARP Home Loan Program?

HARP is an acronym. It stands for Home Affordable Refinance Program. It's a government-backed mortgage refinance program first released in March 2009 and meant to U.S. homeowners get access to the low mortgage rates of the day.

The stated goal of the Home Affordable Refinance Program program was two-fold.

First, the government aimed to help the average U.S. homeowner save $3,000 annually via refinance. Second, the government aimed to reach seven million U.S. households.

If consumers could reduce their housing payments by $21 billion each year, the government reasoned, some of that saved money would work its way back into the U.S. economy which would help combat the burgeoning economic pullback.

Via HARP, homeowners whose homes had lost equity since the date of purchase were eligible for refinance despite having little or no home equity left. This was a big deal in 2009. Homes in many metropolitan areas were losing ten percent or more of their value each year.

Within 12 months of its launch, it was clear that the HARP program had achieved its first goal -- eligible homeowners were saving large amounts of money on their mortgage. However, the program was falling short of its second goal.

By mid-2011, the Home Affordable Refinance Program had failed to reach even one million U.S. households. So, to help put the program within reach of more people, the government made aggressive changes to how the Home Affordable Refinance Program program worked.

Among the program's updates :

- Remove loan-to-value limitations; allow unlimited LTV for HARP loans

- Remove specific lender liabilities on a HARP-refinanced loans

By November 2012, the program dubbed "HARP 2.0" was available to millions more U.S. homeowners. The pace of refinancing tripled. Homeowners saved even more than the government's vaunted $3,000 target figure. The typical HARP homeowner saved 35 percent monthly.

This year, HARP loans are on pace to top 1 million closings. However, that tally may jump if HARP 3.0 passes Congress as expected.

HARP Helping "Severely Underwater" Homeowners

As part of HARP 2.0, program guidelines allowed for an unlimited loan-to-value (LTV). It's no surprise, then, that one-in-four HARP home loans feature an LTV over 125%.

There are other interesting refinance patterns among the Home Affordable Refinance Program closings, too. For example, in April, nearly 1-in-5 homeowners opted for a 15-year fixed rate or 20-year fixed rate HARP loan -- both of which can replace lost home equity more quickly than a comparable 30-year loan.

There were other notable data points, too :

- 23% of all April's U.S. refinance activity was Home Affordable Refinance Program-related.

- Nearly half of all Home Affordable Refinance Program loans have an LTV over 105%.

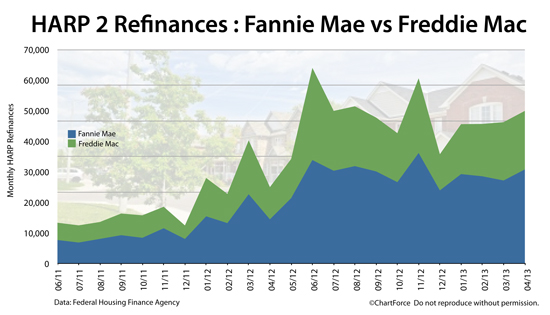

- Fannie Mae securitizes 62% of all Home Affordable Refinance Program home loans. Freddie Mac handles 38%.

Furthermore, HARP loans remain concentrated by state. Nevada, Arizona and Florida account for a disproportionate number of high-LTV HARP loans. Prior to HARP 2.0, these refinance opportunities did not exist.

If HARP 3.0 passes Congress this year, the distribution of HARP home loans will spread geographically. It's unclear which states may benefit the most.

Click here to see today's HARP mortgage rates.

Are You HARP-Eligible? Automate The Process.

Home Affordable Refinance Program (HARP) has reached 37 percent of its original intended market, and the government recently extended the program's end-date by two years to December 31, 2015. There's no promise that HARP 3 will pass, but rumors of its passage grow louder each month.

See how the HARP program can help you save money. Confirm your eligibility and see for what rates you qualify. The process is fast, free, and its online.

Click here for more HARP-related information.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.