Kamakura Reports Drop in Corporate Credit Quality in June

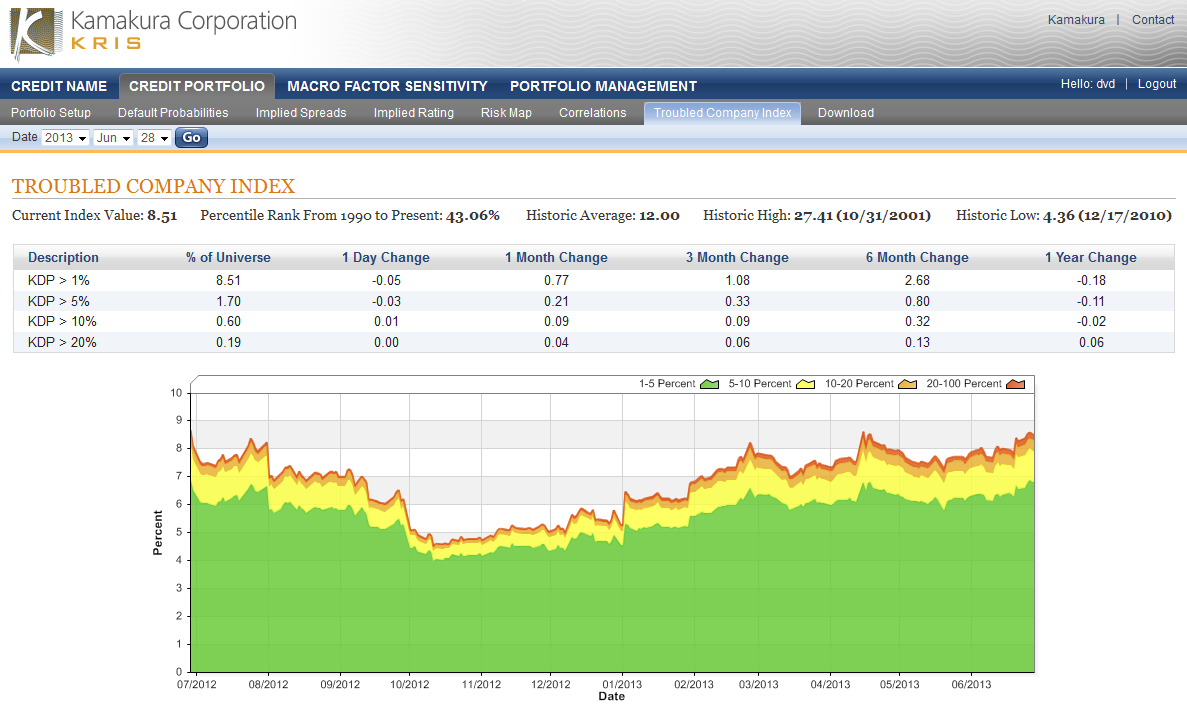

Kamakura Corporation reported Tuesday that the Kamakura troubled company index ended the month of June at 8.51%, an increase of 0.63% since the end of May. The index reflects the percentage of the Kamakura 32,000 public firm universe that has a default probability over 1.00%. An increase in the index reflects deteriorating credit quality.

As of June 30, the percentage of the global corporate universe with default probabilities between 1% and 5% was 6.81%, up 0.50% from last month. The percentage of the universe with default probabilities between 5% and 10% was 1.10%, while the percentage between 10% and 20% was 0.41%. The percentage of companies with default probabilities over 20% was 0.19%, up 0.02% from last month.

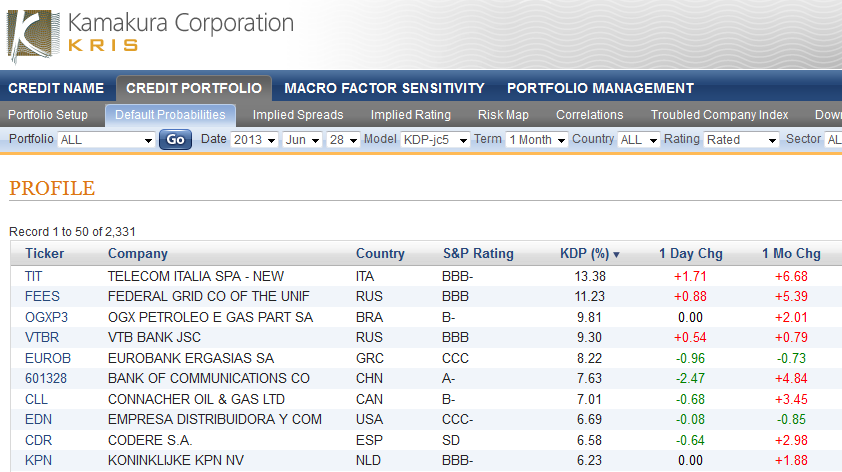

At 8.51%, the troubled company index is at the 57th percentile of historical credit quality (with 100 being best all time) over the period from January, 1990 to the present. That is a drop of 6 percentage points from last month. Telecom Italia had the world’s highest one-month default risk among rated companies, at 13.38%. Among the ten riskiest firms in June, six were European firms; two were from South America and one each from Canada and China.

Martin Zorn, Chief Administrative Officer for Kamakura Corporation, said Tuesday, “Europe continued to be the primary area of credit worries again in June, with on-going problems in the banking and telecommunications sectors. Rising interest rates in the United States are having a broad impact on the U.S. financial sector and we expect that trend to continue.”

![]()

To subscribe or visit go to: http://www.riskcenter.com

http://riskcenter.com/articles/story/view_story?story=99915558