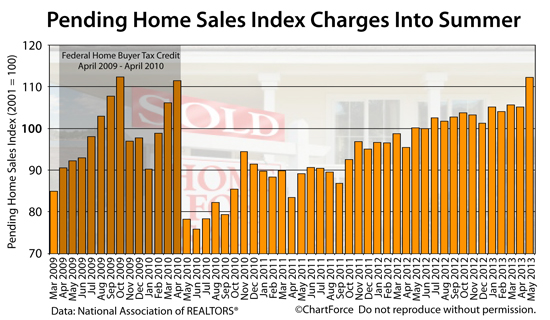

U.S. Housing Updates : The Pending Home Sales Index Blows Past Its 2010 “Tax Stimulus” High-Water Mark

The pace of U.S. home sales continues to hasten.

In May, for the thirteenth consecutive month, the Pending Home Sales Index (PHSI) surpassed its 100-value benchmark. Posting 112.3, the monthly metric from the National Association of REALTORS® shows a consistent and expanding U.S. housing market recovery which will likely to last through the end of 2013, and into early-2014, at least.

Buying a home this year? Expect higher prices ahead.

Pending Home Sales Index : Peak Since October 2009

The Pending Home Sales Index is published monthly by the National Association of REALTORS®. It measures the number of homes which have gone into contract nationwide, but have not yet sold.

Data shows that 80 percent of "pending" homes go to closing within 60 days of contract. The majority of the remaining twenty percent go to settlement within months 3 and 4.

Each home "closed" is eventually included in NAR's Existing Home Sales report. It's this inclusion which makes the Pending Home Sales Index so valuable. The Pending Home Sales Index, by nature, is a forward-looking housing market indicator.

The May 2013 Pending Home Sales Index shows strength in all 4 U.S. regions, led by California, Washington, Oregon and the other western states.

- Northeast Region : No change from the month prior

- Midwest Region : +10% from the month prior

- South Region : +3% from the month prior

- West Region : +16% from the month prior

The Pending Home Sales Index is now at its highest point since October 2009 -- beating even the $8,000-tax-credit-fueled months of early-2010. And, when the Pending Home Sales Index rises, Existing Home Sales tend to follow.

Click here to see today's mortgage rates.

Home Buyers Try To Beat Rising U.S. Home Prices

The Pending Home Sales Index set a multi-year in May. Most notable, though, is that the index scored north of 100. The "100" reading is important because of how the Pending Home Sales Index is scored.

Here's why readings over 100 matter to buyers.

When the National Association of REALTORS® built the index in 2001, it was built to be a relative housing market index as opposed to an absolute one. As an example of an absolute housing market index, consider the Existing Home Sales. It's a reading that's measured in raw numbers, and seasonally-adjusted to help with comparisons.

By contrast, though, the Pending Home Sales Index is relative index; one whose readings are baselined to the housing market as it existed in 2001. Pending Home Sales Index prints are always relative to that year's market. Therefore, when the PHSI beats 100, it suggests that the housing market is "better" than it was in 2001.

The Pending Home Sales Index has been over 100 for more than one year. This is because home buyers are buying at the fastest pace since last decade, and it's contributing to a national shortage in available housing.

The jumbo housing market is faring especially well with broad gains in the market for homes over $500,000.

If 2001 is considered a good year for housing, 2013 is shaping up to to be a great year. Through 5 months this year, the Pending Home Sales Index averages 106.5.

How Much Home Can You Afford?

It's a terrific time to be a U.S. home buyer. Despite rising prices, homes remain affordable because of relatively low mortgage rates and aggressively low- and no-downpayment mortgage programs.

Take a look at the FHA's 3.5% downpayment mortgage program and at the 100% financing options via the VA and USDA. Each are in high-demand. Even jumbo mortgage buyers are exploiting the 10% downpayment program for loans over $625,500.

See how much home you can afford. Get started with a rate quote online -- no social security number required.

Click here to get today's mortgage rates.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.