|

|

| Source: ISI Group |

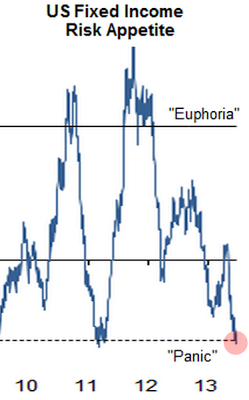

Some insist that this is more of a "rotation" than a panic. A possible way to settle the argument is by looking at the Credit Suisse Risk Appetite Index. One of its components is the Fixed Income Risk Appetite sub-index, which in fact just entered the "panic" mode for the first time since 2011.

|

| Source: Credit Suisse |

However, those who prefer the contrarian view of the markets will appreciate the following quote.

Credit Suisse: - A break into "panic" territory has historically been a strong signal for a turning point in the bond market, indicating that the market has become very oversold in the short run. Since the start of the index in 1995, there have been seven such signals. Six out of seven times that translated into longer-dated US bonds outperforming bills over a period of 3-6 months. In recent years, panic deeps have on average become shorter and shallower, resulting in even stronger signals.

The fundamental explanation here is that a sudden rate shock we've had can't be great for the economy. And any visible sign of renewed US economic weakness could delay the Fed's "taper", creating a bid for bonds.

![]()

To subscribe or visit go to: http://www.riskcenter.com

http://riskcenter.com/articles/story/view_story?story=99915534