US Now Most Attractive Market for Renewable Energy, Finds Ernst & Young

Chris Meehan

May 31, 2013

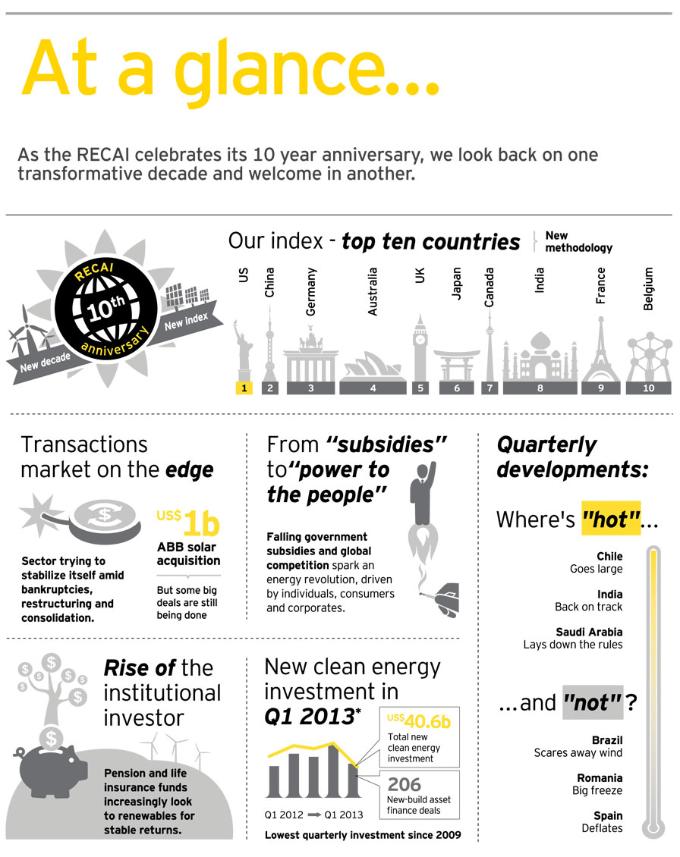

Ernst & Young’s (EY’s) 10th annual Renewable Energy Country Attractiveness Index finds that the US is again the most attractive place in world for renewable energy, supplanting China, which held the top spot in the previous index. The annual report ranks 40 of the most active countries for renewables based on a number of factors, including incentives, opportunities for projects and more.

The London-headquartered, international accounting firm says that the global investment in clean energy grew to $269 billion in 2012, a five-fold increase from 2004, the first full year of EY’s renewable energy index. It also shows that the sector has moved from the fringes and is now more mainstream. “The sector now competes for investment with more traditional energy sources,” EY contends in the report. It adds that solar, biomass boilers and mini wind turbines are allowing people to produce their own electricity. “Changing the way businesses and consumers think about energy.”

In this 10th anniversary index EY also changed its rating system to reflect changes in the renewables world. “Market fundamentals, such as energy demand growth, security of energy supply and the affordability of renewable energy (relative to other sources), feature as some of the most prominent drivers of renewable energy growth today," explains Ben Warren, EY’s environmental finance and global cleantech transactions leader. "Our revised methodology allows us to analyze each market’s investment attractiveness much more effectively by considering these factors and weighting them accordingly.”

Achieving an overall score of 71.6 on the index, the US attained the top spot on the index, beating both China and Germany, which received scores of 70.7 and 67.6, respectively. The US achieved the score on factors including its economy’s “macro stability”, ease of doing business and the bankability of renewables.

Key factors included Obama’s support for more renewables and a permanent extension of the Production Tax Credit (PTC). For instance, in his 2012 State of the Union Speech he called for the US to double renewable energy generation by 2020 while reducing oil imports to half of 2008’s levels. That’s in addition to his call for a $2 billion Energy Security Trust, to support clean energy research initiatives, the report says. “He also called for the Department of the Interior to improve its permitting process for clean energy projects.”

While Obama called for a permanent extension of the PTC, there are doubts that it will happen. “While the high cost will probably decrease the likelihood of Congress permanently extending the tax credit…its inclusion in the budget is a strong signal of Obama’s intention to retain the PTC beyond the current December 2013 expiration date,” EY contends.

Renewables in the US are being driven by more than Obama. The report observes that “big business” is increasingly supporting renewables. Referring to a Business Roundtable report, business leaders in the country want a smooth transition to unsubsidized renewable energy competitiveness via mechanisms like extending but reducing and ultimately eliminating the PTC over time, which EY notes that even the American Wind Energy Industry Association supports. That business report also called on Congress to extend master limited partnerships (MLPs) to renewable energy projects making it easier for institutions and the public to invest in them. Such legislation has been introduced in Congress.

While China was formerly the top country for renewables, according to EY, “high barriers to entry for external investors realign China into second place.” Still the country’s GDP growth, increasing energy demand, and strategic importance of the renewable energy to local economies in China make it a good market for renewable energy investment.

Other emerging markets for renewable include South America and Asia Pacific, including Japan and Australia. “Chile’s project pipeline includes 300MW-400MW concentrated solar power (CSP) plants, while Peru has entered the index for the first time due to good resources and a strong investment climate. However, new policy measures and tender cancelations in Brazil are likely to temper the rapid growth seen in the region over the last 18 months,” the report finds. Additionally, “High levels of project activity and investment interest in Japan and Australia give the Asia Pacific region a stronger presence at the top of the index.”

“With the shift in the democratization of the energy sector and the increasing power of the customer, the future of renewable energy in the energy mix is bright,” Warren concludes.

The original article was posted on the SolarReviews blog.

© Copyright 1999-2013 RenewableEnergyWorld.com - All rights reserved.

http://www.renewableenergyworld.com

© Copyright 1999-2013 RenewableEnergyWorld.com - All rights reserved.

http://www.renewableenergyworld.com