With Rates Unexpectedly Trending Lower, Fed Meeting Looms Large

For

the first time in two months, mortgage rates improved last week on a

week-over-week basis.

For

the first time in two months, mortgage rates improved last week on a

week-over-week basis.

The Fannie Mae 3.5% coupon improved +16/32.

Fannie Mae mortgage bonds are linked to conforming mortgage rates which means that mortgage applicants in search of a HARP 2.0 refinance or a 20% down conventional loan, as examples, should receive reduced mortgage rates from their lenders.

The Ginnie Mae 3.5% coupon improved even more, climbing +29/32.

Ginnie Mae bonds help set rates for FHA purchase loans, VA mortgages, and USDA home loans. Mortgage rates for these products improved last week overall, too -- much more than for conventional ones.

Click to see today's lower mortgage rates.

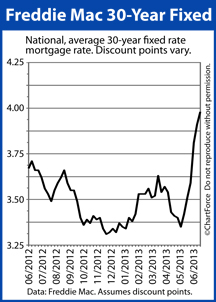

Freddie Mac : 30-Year Fixed Rises To 3.98%

Freddie Mac reported mortgage rates rising 0.07 percentage points to 3.98% this week, the highest reading in 62 weeks. The rate is available to borrowers willing to pay 0.7 discount points at closing.

Discount points are optional, one-time closing costs where 1 discount point is equal to one percent of your loan size. Paying discount points gets you access to lower mortgage rates than a lender would otherwise offer.

Applicants paying zero discount points, therefore, don't get Freddie Mac's 3.98% 30-year fixed. These homeowners and home buyers are currently experiencing rates in the low-to-mid 4s.

It's been a rough few weeks for rate shoppers.

Since dropping to a 3.35% in early-May, the average 30-year fixed rate mortgage rate nationwide has climbed 0.63 percentage points. This is the biggest one-month surge in mortgage rates since 2009 and the shift has pushed up the principal + interest payments on a new loan by 8%.

The good news is that rates may soon reverse lower.

Mortgage rates improved through the latter half of last week on a shift in market sentiment, and expectations for the Federal Reserve's next meeting, a two-day affair scheduled for June 18-19, 2013.

Click to see today's lower mortgage rates.

Mortgage Rates Expected To Drop This Week

After rising for six straight weeks, mortgage rates are in retreat. Mortgage bond pricing improved Tuesday, Wednesday, Thursday and Friday last week, dropping bond yields to a multi-week low.

Not surprisingly, mortgage rates are dropping for the same reasons they climbed -- expectations.

The recent mortgage rate run-up started May 2, the day after the Federal Open Market Committee (FOMC) adjourned from its third scheduled meeting of the year. In the group's post-meeting press release, the Fed said it may alter the pace of its open market bond purchases, a program commonly known as QE3.

Via QE3, the Federal Reserve creates demand for government-issued bonds, which helps to suppress yields and, therefore, mortgage rates. Currently, the Fed buys $85 billion in mortgage-backed and U.S. Treasury-issued bonds monthly.

Following the announcement that these purchases may "taper" or end entirely, Wall Street worried that QE3's closure was imminent. In response, it began to feverishly sell its mortgage-bond holdings, sending bond yields soaring and mortgage rates up.

Today, Wall Street's expectations are changing. The torrid pace at which mortgage bonds were sold has ended. Wall Street is now a net buyer of mortgage-backed securities so mortgage rates are moving lower.

Click to see today's lower mortgage rates.

Mortgage Rate Movers : Week Of June 17, 2013

After two weeks of relative calm, this week's economic calendar is a little more full. The highlight of the week is the Federal Open Market Committee's two-day meeting scheduled for Tuesday and Wednesday, but there are other market-movers in the schedule as well.

Here is a look at the week ahead :

- Monday : NAHB Housing Market Index

- Tuesday : Housing Starts; Consumer Price Index

- Wednesday : FOMC Meeting Adjourns

- Thursday : Initial Jobless Claims; Existing Home Sales

- Friday : None

There is a lot on this calendar for mortgage markets to digest. Rates are expected to trend lower into the FOMC meeting, but could move higher or lower at any time. The Federal Reserve adjourns at 2:00 PM ET Wednesday.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.