30-Year Mortgage Rates Now Linked To U.S. Jobs Report

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

The housing market and the U.S. economy are closely linked to national employment. Whether correlation or causation, as the jobs market has improved since 2010, the U.S. housing market has reversed its slide and the economy appears poised for a strong 2013 and 2014.

The relationship between jobs and housing is one which not only foreshadows an expanding housing market through the rest of the year, but also one which may also push mortgage rates higher.

Today's low mortgage rates may be as good as it gets -- especially with the latest jobs report due for release Friday morning.

Click here to get today's mortgage rates.

The Jobs Market : 5.5 Million Jobs Added Since 2010

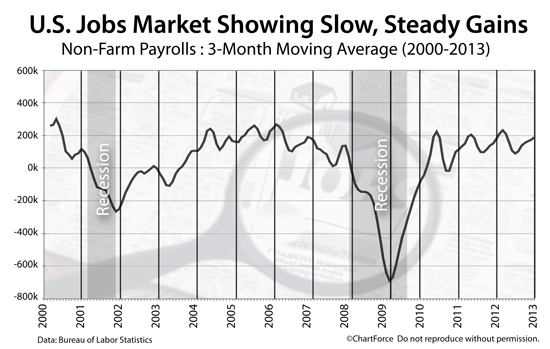

On the first Friday of each month, the Bureau of Labor Statistics publishes its Non-Farm Payrolls report. Most commonly known as "the jobs report", Non-Farm Payrolls highlights employment changes across 10 private sectors including insurance and finance; and also includes government hiring statistics.

The Non-Farms Payrolls report shows which economic sectors are expanding and which are contracting.

Lately, most sectors are expanding.

Between 2008-2009, the U.S. economy fell into recession, highlighted by the failure of Lehman Brothers; the near-collapse of mortgage lending; and the movement of Fannie Mae and Freddie Mac into conservatorship by the Federal Home Finance Agency (FHFA). The U.S. economy shed 7.4 million jobs during that period.

Since 2010, however, more than 5 million jobs have been added back -- a near three-fourths recovery in terms of employed persons. Furthermore, more than half of those jobs have been created since October 2011, which marks the same month as the housing market's bottom.

As jobs have gone, so has gone the housing market. It news which puts today's home buyers on notice.

Click here to get today's mortgage rates.

Job Growth Can Add To Homeowner Ranks

Job growth benefits the economy and housing in two ways. The first is economic; the second is psychological.

The economic link between jobs and housing is straight-forward. A person with a full-time job earns a periodic paycheck and a "periodic paycheck" is required to get a mortgage approval. Note that you must only be on the job for one day, though. With just one day of work, you'll get mortgage-approved.

In this way, a recently unemployed person who has since found full-time work, or a household that's relocating on an offer letter, is instantly mortgage-eligible -- both for refinancing via the FHA Streamline Refinance program or via HARP 2, for example; or for purchase of a new home.

More people earning paychecks, therefore, can unlock pent-up demand for housing and -- all things equal -- growing demand leads home prices higher. We're seeing this relationship in action right now. Home supplies are dwindling as buyer demand rises to multi-year highs.

Home builders, for example, report the highest levels of buyer foot traffic since 2006.

The psychological link between jobs and housing is a little less clear. It's not just unemployed Americans that don't search for new homes, for instance. Neither does a person who's scared and uncertain. When people worry for their job, or when they expect to take a pay cut, they're much less likely join the national buyer pool.

Fearing for your job stops the home buying process almost as effectively as not having a job at all. In a recovering economy, therefore, as the ranks of the employed increase, so does the potential number of home buyers nationwide.

Jobs are a key link in the housing market's turnaround.

Click here to get today's mortgage rates.

Friday's Jobs Report Will Shift Mortgage Rates

Last month, the economy added 88,000 jobs. This month, it's expected to add 153,000. And, although the economy has yet to replace all of the jobs lost last decade, the U.S. workforce has expanded over 29 straight months and the Unemployment Rate has dropped nearly one percentage point in one year.

With every newly-added, tax-paying worker, the U.S. economy gets a boost. It's more disposable income per household; more revenue earned for governments as taxes; and more confidence among homeowners to "make a switch". It's yet another reason to be optimistic for the 2013 and 2014 housing market.

For mortgage rates, though, the news may be not so good. A healthy economy promotes stock market growth, which often comes at the expense of bonds, including the mortgage-backed kind. When bonds sell off, mortgage rates rise.

Today, mortgage rates remain low. And homes are relatively inexpensive. The same may not be said 6 months from now. If you're planning to buy a home, therefore, consider moving up your time frame. See how much home you can afford. Start with a mortgage rate quote today.