|

| Source: LCD |

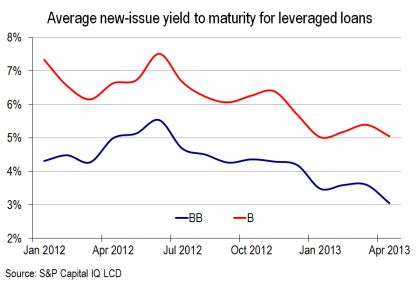

Existing loans are being "repriced" (converted) into debt with lower rates and looser covenants.

LCD: - Falling new-issue spreads spurred a new round of opportunistic deal flow. In April, issuers cuts spreads on $36.7 billion of institutional loans, up from $24.7 billion in March. In all, issuers have now repriced $155.7 billion of loans, or 28% of the S&P/LSTA Index, by 115 bps on average.

And a great deal of this demand is coming from shadow

banking - Business Development Corporations (BDCs), CLOs,

and even credit hedge funds (see

story). How can US chartered banks (under regulatory

pressure) possibly compete when credit for large and

mid-market firms is so readily available and so cheap? One

way is to expand lending into smaller business space, where

sanity still prevails with respect to rates and leverage

levels. And that's exactly what banks have been doing. The

latest data from the Fed shows banks easing on underwriting

standards for small company loans...

|

|

| Source: FRB ("C&I" stands for commercial & industrial - meaning corporate as opposed to retail loans) |

... and tightening spreads.

|

|

| Source: FRB |

While this development is great news for small businesses and the US economy as a whole, it shows that credit may be approaching frothy levels. All this new liquidity from the Fed has to end up somewhere.

![]()

To subscribe or visit go to: http://www.riskcenter.com

http://riskcenter.com/articles/story/view_story?story=99915345