HARP 2.0 : Fewer Loans Made For “Severely Underwater” Homeowners

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

One year ago, the Home Affordable Refinance Program (HARP) opened up for U.S. homeowners whose mortgages are "severely underwater".

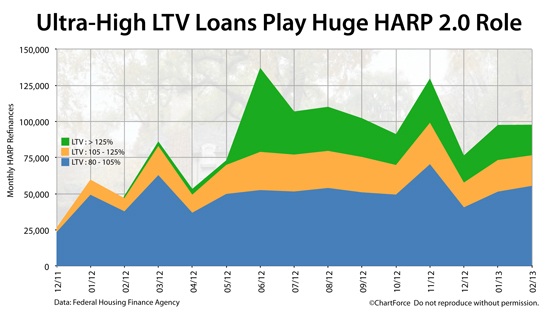

HARP loans for ultra-high LTVs -- defined as loans for which the loan-to-value (LTV) exceeds 125% -- now account for more than one-fifth of all HARP refinances completed nationwide.

Get a personalized HARP rate quote for your home.

HARP : Refinancing For Underwater Homeowners

HARP is an acronym. It stands for Home Affordable Refinance Program. Sometimes called the "Obama Refi", it was launched in 2009 as part of that year's economic stimulus program.

At the time, mortgage rates had been dropping sharply -- but home values had been, too. In places like Los Angeles, California; Miami, Florida; and Phoenix, Arizona, homeowners were watching 30-year fixed rate mortgage rates fall into the 4s but there was, literally, nothing they could do to take advantage.

There were no mortgage programs for homeowners with no home equity.

So, the government promoted the idea that if these homeowners could just get access to refinance; to lower their monthly mortgage payments, it would increase the national household cashflow, which would increase consumer spending, which would help to push the U.S. economy forward.

HARP was launched to meet this goal.

The HARP program told banks to treat home equity differently. It instructed them to ignore a homeowner's home equity percentage so long as that homeowner had a loan-to-value (LTV) of 125% or less, and history of on-time mortgage payment.

Get a personalized HARP rate quote for your home.

HARP 2 : Removing 125% LTV Restrictions

When HARP was first launched, it was expected to reach 7 million U.S. homeowners. After two years, however, government data showed that the program had failed to reach even one million households.

There were two main reasons for the shortfall, it was determined.

First, the government was asking banks to underwrite more HARP loans, but also holding them responsible for due diligence errors made on the originally-underwritten home loan.

For example, if Wells Fargo was giving a HARP loan to an existing Bank of America customer, Wells Fargo would be accountable to Bank of America's original home loan approval plus any errors, omissions, or traces of fraud therein.

Banks don't like rules like that.

In response to the explicit liability for another bank's loans, many HARP participants chose to limit program access to their existing customers base only. This came to be known as "same-servicer" HARP loans.

The second reason -- as it turned out -- was HARP's cap at 125% LTV. The figure proved to be too limiting. Homeowners in hard-hit states such as Nevada and Florida found themselves in a much more negative position than 125% LTV. Some carried LTVs as high as 300 percent.

So, in November 2011, as an effort to make HARP "better", the government re-released the Home Affordable Refinance Program as HARP 2.0.

The main changes for HARP 2.0 were two-fold :

- Indemnify new mortgage lender from errors made by original mortgage lender

- Remove the loan-to-value restrictions so 125% LTV was no longer a limit

Because of these changes, today's U.S. homeowners can get unlimited LTV on their home loans, and can use any HARP-participating lender. The program tripled its closing rate in 2012, and is on pace to close nearly 1.2 million loans in 2013.

Get a personalized HARP rate quote for your home.

HARP For LTVs Over 125% Lose Market Share

Fannie Mae and Freddie Mac launched HARP 2.0 in November 2011. The program was not widely-adopted until March 2012. It took 90 days for banks to close HARP loans at that time. This is why June 2012 remains the peak month for ultra-high LTV HARP loans.

Since that June 2012 peak, however, ultra-high LTV HARP loans have lost market share, slipping from 42.4 percent of all HARP loans to 21.6 percent in February 2013.

Ultra-high LTV Home Affordable Refinance Program closing, month-by-month :

- March 2012 : 3.7% of all HARP refinances were for LTVs over 125%

- April 2012 : 7.5% of all HARP refinances were for LTVs over 125%

- May 2012 : 4.4% of all HARP refinances were for LTVs over 125%

- June 2012 : 42.4% of all HARP refinances were for LTVs over 125%

- July 2012 : 27.9% of all HARP refinances were for LTVs over 125%

- August 2012 : 27.7% of all HARP refinances were for LTVs over 125%

- September 2012 : 26.2% of all HARP refinances were for LTVs over 125%

- October 2012 : 23.4% of all HARP refinances were for LTVs over 125%

- November 2012 : 23.6% of all HARP refinances were for LTVs over 125%

- December 2012 : 24.5% of all HARP refinances were for LTVs over 125%

- January 2013 : 24.9% of all HARP refinances were for LTVs over 125%

- February 2013 : 21.6% of all HARP refinances were for LTVs over 125%

HARP volume for loans north of 125 percent remains strong today, but it's well off its peak of 2012. This is largely the result of rising home prices which has reduced the need for a severely-underwater mortgage refinance option.

The HARP program is good through December 31, 2015 -- but will we even need it?

Get HARP Mortgage Rates

The HARP mortgage program terminates more than 2 years from today. There's no rush to refinance. However, with mortgage rates near all-time lows, today's market conditions are favorable for underwater and ultra-high LTV homeowners.

The typical HARP homeowner saves more than 35% on their mortgage payment monthly. See how HARP can help you. Get started with a rate quote. It's fast and free.