Mortgage Rates Slip To New, Lifetime-Lows After May 2013 FOMC Statement

Mortgage rates are dropping as the Federal Open Market Committee (FOMC) adjourns from its third meeting of the 2013.

In its post-meeting press release, the Fed described the U.S. economy as expanding "at a moderate pace" over the past six weeks, buoyed by strengthening housing and labor markets.

Mortgage markets are gaining on the news. Conforming and FHA mortgage rates have dropped to lifetime-low levels.

Click for a personalized mortgage rate.

Near-Unanimous Vote : No Change In Rates

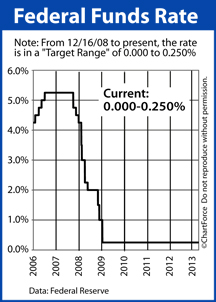

Wednesday, the Federal Open Market Committee (FOMC) voted 9-1 to leave its benchmark Fed Funds Rate unchanged at its current range near 0.000%.

It marks the 35th consecutive FOMC meeting at which the Fed Funds Rate was held near-zero. When the Fed Funds Rate is low, it reduces borrowing costs for businesses and consumers.

Low borrowing costs stimulate spending and, by extension, the U.S. economy.

The Federal Reserve statement contained few changes from the Fed's last meeting, in March 2013.

- On housing : The sector has "strengthened further"

- On household spending : Spending has advanced

- On employment : There is "improvement", but the unemployment rate "remains elevated"

Furthermore, the Fed again noted that inflation rates are running below the group's 2% target rate, and that inflation pressures are expected to remain low in the medium-term.

Low inflation rates are a bonus for today's home buyers and refinancing households. Inflation is linked to rising mortgage rates.

Click for a personalized mortgage rate.

The Fed's QE3 Program May (Or May Not) Continue

Also for the second straight time, the FOMC statement featured language describing how, and when, the FOMC may start to raise the Fed Funds Rate.

So long as the U.S. jobless rate remains above 6.5%, the statement reads, the Fed Funds Rate is likely to remain near zero percent. According to economists, this range won't likely be reached until 2015 or later.

The Fed Funds Rate is linked to Prime Rate, which is the basis for credit card rates and home equity lines of credits. Consumer rates, then, will be low for at least another two years.

However, the Fed retains the right to raise the Fed Funds Rate sooner. Should labor markets exhibit unexpected strength; or, should inflation pressures mount, the Fed may act sooner.

It may also end its third round of quantitative easing (QE3).

The Fed launched QE3 in September 2012. Via the program, the Fed purchases $40 billion of mortgage-backed bonds monthly in the open market. The excess demand keeps a lid on MBS pricing, which helps to suppress mortgage rates.

It's no coincidence, in other words, that the start of QE3 last September coincided with the Fall 2012 mortgage rate plunge. Now, however, the Fed has said that it will monitor "economic and financial developments" and may "increase or reduce the pace of its purchases".

A weakening economy will likely increase the Fed's ongoing purchases, which would be good for mortgage rates. For a strengthening economy, the result would be the reverse.

Click for a personalized mortgage rate.

Get A Personalized Mortgage Rate Quote

Mortgage rates are roughly -0.125% lower as compared to the start of April and there are few reasons for rates to be headed higher. The early-year pressure on rates subsided in late-March when banking and economic issues surfaced in the Eurozone. In addition, aside from the housing market, U.S. economic conditions have proved slightly weaker-than-projected.

If you're floating a mortgage rate, though, or wondering if today is a good day to lock a loan, consider asking for a lender commitment. Rates may drop through May but, then again, maybe they won't. And rates look great today.

Click for a personalized mortgage rate.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.