New 30-Year Mortgage Rate Surprises Buyers, Jumps To 3.51%

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

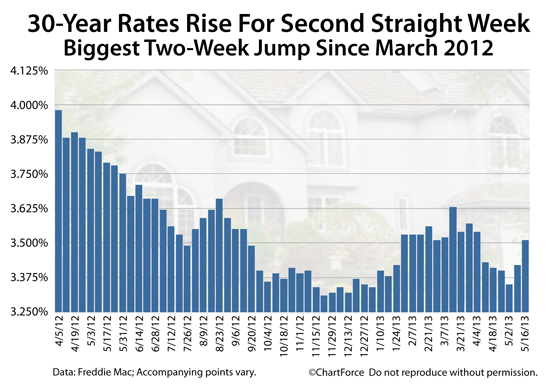

Halfway through May, the month's been tough on mortgage rates. After retreating in April toward the lifetime lows of late-2012, U.S. mortgage rates have reversed higher -- and sharply.

Conforming mortgage rates rose by more in the last two weeks than during any 14-day period in the period in the last 60 weeks.

30-year fixed rate mortgage rates have climbed to a seven-week high.

Click for a personalizes mortgage rate quote.

Freddie Mac : Mortgage Rates Leap To 3.51%

The average U.S. 30-year fixed rate mortgage rate rose 0.09 percentage points to 3.51 percent this week, according to Freddie Mac's weekly Primary Mortgage Market Survey (PMMS).

The jump marks the largest one-week increase in mortgage rates since March 2013.

Freddie Mac rates are available to prime borrowers willing to pay an average 0.7 discount points at closing, plus whatever closing costs typically accompany the loan. Freddie Mac defines "prime borrower" as someone with a 20 percent downpayment or equity ownership in a non-condo single-family residence; with FICO scores of 740 or better; and with ample verifiable income to create a debt-to-income ratio of 41% or lower.

It's not just the 30-year loan for which mortgage rates worsened this week. Rates on the 15-year fixed rate mortgage rose, too, surging 0.08 percentage points to 2.69%, on average, nationwide. This, too, was the largest one-week jump since March.

Although still low, all of April's mortgage rate improvements are lost.

Click for a personalized mortgage rate quote.

Mortgage Rates In A Post-QE3 World

Since the Federal Reserve launches its third round of quantitative easing (QE3) in September 2012, mortgage rates have been suppressed. The Fed's program buys $40 billion in mortgage-backed securities (MBS) monthly, creating new demand which helps to push mortgage bond prices up.

When bond prices rise, bond yields drop. It's a relationship which correlates with lower mortgage rates.

The launch of QE3 sparked the mortgage rate rally which defined the Q4 2012 market.

Lately, though, mortgage rates have climbed because the Fed is openly discussing its exit from QE3, and a reduction in MBS purchases. Without QE3, mortgage markets fear demand for mortgage-backed bond will sink sharply, which will lead to an abundance of supply.

A surplus of mortgage-backed bonds on the market with no buyers to buy them would lead bond price lower, which would lead bond yields up. This scenario correlates with higher mortgage rates. It's among the reasons mortgage rates are climbing.

Markets worry that the Fed will exit QE3 soon.

The Refinance Boom Continues

Despite recently-rising rising mortgage rates, the U.S Refinance Boom continues. Rates remain within 0.25 percentage points of all-time lows and mortgage lenders have made tens of "special" loan programs available to entire groups of mortgage applicants including first-time home buyers, underwater homeowners, and veterans of the military.

As one example of how today's low rates can help, the typical HARP refinance now saves homeowners 35% off their mortgage payment.

See what today's low rates can do for your monthly payments. See today's mortgage rates now.