Report : U.S. Mortgage Rates Jump, Rise To 5-Week High

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

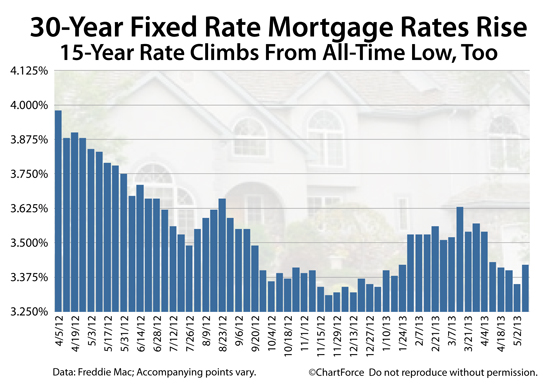

Mortgage rates ended their multi-month winning streak last week, finally rising after 6 weeks of improvement. The average 30-year fixed rate mortgage rate is now 3.42% nationwide, on average.

This is the highest average mortgage rate since mid-April.

Click to get personalized mortgage rates for today.

Why Freddie Mac Rates Appear "Lower" Than Bankrate

Each week, Freddie Mac issues its Primary Mortgage Market Survey (PMMS) -- the results of a questionnaire sent to as many as 125 U.S. lenders. The survey asks the nation's lenders to report on the "going rate" of a prime residential mortgage for several common loan products.

The surveyed products include the 30-year fixed rate mortgage, the 15-year fixed rate mortgage, the 5/1 adjustable-rate mortgage, and the 1/1 adjustable-rate mortgage.

According to Freddie Mac's weekly survey, this week, the average 30-year fixed rate mortgage rate rise 0.07 percentage points to 3.42% nationwide. The rate is available to homeowners willing to pay 0.7 discount points at closing, plus a normal set of closing costs.

Discount points are a one-time cost which the IRS will often treat as "prepaid mortgage interest". And, in exchange for paying such mortgage interest up-front, mortgage lenders grant mortgage applicants access lower mortgage rates.

In general, 1 discount point will lower your mortgage rate by 0.25 percentage points. However, this is less of a "rule" and more of a vague correlation. And, Freddie Mac's use of discount points in its survey is one reason why "Freddie Mac Rates" are often so much lower than the rates you see published elsewhere on the internet; and from other local banks.

Freddie Mac rates are typically quoted with the highest number of discount points.

Consider three commonly-cited mortgage rate surveys :

- Freddie Mac Survey : 3.42% mortgage rate + 0.70 discount points + closing costs

- Mortgage Bankers Association Survey : 3.59% mortgage rate + 0.33 discount points

- Bankrate.com Survey : 3.60% mortgage rate + 0.31 discount points + closing costs

In general, these three surveys are showing the same mortgage rate for prime U.S. borrowers. When you pay more points, you get lower mortgage rates.

Click to get personalized mortgage rates for today.

Freddie Mac : 3.42% 30-Year Fixed rate Mortgage

This week, Freddie Mac reports the 30-year fixed at 3.42%, its highest point since mid-April. Rates require 0.7 discount points paid at closing.

A borrower in Lower Merion, Pennsylvania, therefore, borrowing at the local conforming loan limit of $417,000, should expect discount points totaling $2,919 to be paid at closing, in addition to whatever "typical" closing costs are associated with the home loan.

The same applicant borrowing at the Los Angeles, California jumbo loan limit of $625,500 would pay $4,379 in discount points.

Luckily, as with many closing costs, mortgage applicants may often opt to "roll" required discount points into a loan balance. Discount points may also be waived in full.

Mortgage applicants paying no discount points should expect slightly higher mortgage rates -- as we saw in the Bankrate.com example above -- and applicants opting for a zero-closing cost mortgage should mortgage rates roughly 0.25 percentage points higher than a comparable "no points" loan.

Ask your lender for its zero-closing cost mortgage rates.

15-Year Fixed Rate Mortgage Rate Falls To 2.65%

Freddie Mac's weekly mortgage rate survey showed the following national numbers :

- 30-year fixed rate mortgage : 3.42% with 0.7 discount points

- 15-year fixed rate mortgage : 2.61% with 0.7 discount points

- 5-year adjustable rate mortgage : 2.58% with 0.5 discount points

Note that your quoted mortgage rate may be also be higher or lower depending your loan's unique characteristics which may include loan-to-value; FICO score; property type; and whether you have a second mortgage such as a HELOC in place.

Furthermore, special mortgage types such loans for real estate investors with 5-10 properties financed, or refinancing homeowners using HARP may receive slightly higher mortgage rates than the cited, national average.

Lastly, F`reddie Mac's survey applies to conforming loans only. FHA and VA mortgage rates follow different pricing models.