U.S. Housing Market Recovering, Values Approach Pre-Crash Levels

The U.S. housing market turned in a strong first quarter.

According to the Home Price Index, a monthly housing metric from the Federal Home Finance Agency (FHFA), U.S. property values climbed by close to two percent between January and March of this year, marking the seventh consecutive quarter of growth.

As compared to one year ago, home values are higher by 7 percent nationwide. Today's home buyers are finding it harder to find a bargain.

Click for today's live mortgage rates.

Home Price Index : 14 Straight Months Of Gains

The Home Price Index is a government-published home-valuation tracker. It tracks the change in a given home's value between subsequent sales, using data supplied to Fannie Mae and Freddie Mac in the mortgage approval process.

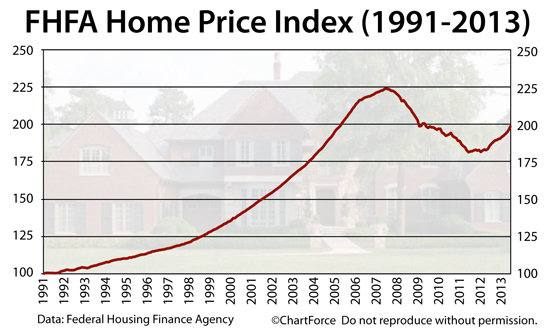

There is no "scale" for the HPI, per se. Rather, the index is benchmarked to a value of 100, which is meant to represent the U.S. housing market as it existed in 1991.

In March 2013 -- for the first time since February 2009 -- the Home Price Index topped 199. More important, though, is that the Home Price Index has climbed for 14 straight months, which suggests that the U.S. housing recovery is a little more permanent than economists originally believed.

Home values are rising in most U.S. markets and, although uneven, the gains appear sustainable. Buyer demand is strong, seller supply is scarce, and mortgage rates -- although rising -- remain favorable.

Ask any home buyer -- it's tougher to find great, cheap homes today as compared to just last year.

Click for today's live mortgage rates.

Pacific Region Gains Most, Led By California

The FHFA's Purchase-Only Home Price Index rose 1.9 percent during the first three months of this year, and has posted a 6.7% improvement since March 2013. We are nearly 18 months off the bottoms of October 2011, and the national valuation index has climbed to its highest point in 4 years.

However, like everything in real estate, we can't forget that home values are a local phenomenon. National indices such as the Home Price Index and the Case-Shiller Index, as another example, fail to capture specific buyer/seller activity in any given market; blanketing the nation with just a single housing "number" instead.

Even on a regional basis, valuation gains can vary.

The Pacific Region, for example, which includes California and Washington, showed large gains since last year. By contrast, the Middle Atlantic Region did not. A sampling of the annual Home PriceIndex data from the FHFA's 9 U.S. regions includes :

- Pacific : +16.1% (Hawaii, Alaska, Washington, Oregon, California)

- Mountain : +14.4% (Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona)

- Middle Atlantic : +2.2% (New York, New Jersey, Pennsylvania)

- East North Central : +4.7% (Michigan, Wisconsin, Illinois, Indiana, Ohio)

- South Atlantic : 7.5% (Delaware, Maryland, District of Columbia, Virginia, West Virginia, North Carolina, South Carolina, Georgia, Florida)

In addition, the West South Central Region gained +5.8% over the past year. The region includes Oklahoma, Arkansas, Texas, Louisiana.

Click for today's live mortgage rates.

How Much Home Can You Afford

Looking back, we see that home prices rose through all of 2012, and have started 2013 in-kind. Low mortgage rates, rising U.S. rents, and pent-up demand have combined to fuel the housing market's recovery, and momentum is expected to carry in to 2014, at least.

For today's buyers it's important to know your options, and to know how much home you can afford. A good place to start is with a monthly budget. Know your affordability limits and use today's mortgage rates to finish out your math.

Rates are free and can be found online. Click here to get today's mortgage rates.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.