When Mortgage Rates Rise 1%, Your Purchasing Power Falls By 10.75%

Mortgage rates have run higher this month, climbing 0.750 percentage points or higher for a conventional loan, and even higher for FHA and VA mortgages. Not since 2009 have mortgage rates moved this much, this quickly.

Rising rates have foiled FHA-backed homeowners attempting to squeeze in a refinance ahead of the agency's new rules for MIP. It's also harmed home buyers hoping to stretch their mortgage-money dollar.

Home affordability has taken a hit since May 1.

Mortgage Rates Drive Home Affordability

"How much home can I afford?" It's among the most common questions asked by a home buyer and the starting point for nearly every home search in the country.

Home affordability questions help buyers in two ways :

- They place boundaries on a home search

- They establish a price range for homes you can actually afford to buy

Unfortunately, though, asking a question such as "how much home can I afford?" puts undue focus on a home's particular "purchase price".

Home affordability is not about a home's "sticker price" -- it's about the home's monthly carrying cost. There's the home's real estate tax bill, for example, to consider; and the home's cost to insure. And, of course, there's the mortgage.

The mortgage payment due to your lender is based on how much you borrow, for how long your loan lasts (e.g.; 30 years, 15 years), and your loan's given mortgage rate. The higher your rate, the higher your payment and, as mortgage rates climb, the monthly costs of home ownership jumps.

Mortgage rates have jumped in May.

Click for a personalized mortgage rate quote.

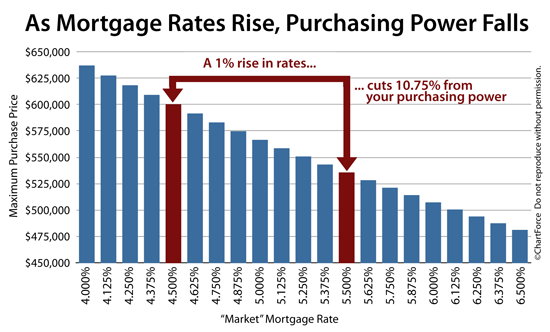

1% Rate Change = 10.75% Purchasing Power Change

Changing mortgage rates do more to influence home affordability than changing home prices.

If that seems strange to you, think back to the last two years. Quarter-after-quarter, home affordability stuck near all-time highs even as home values have recovered from "the bottom". Home affordability didn't improve because home prices were lower -- it improved because mortgage rates were.

Each time rates ticked lower, a buyer's purchasing power increased, all the way through the all-time lows set last November. When mortgage rates reached 3.31%, affordability peaked.

Lately, however, the trend has reversed. Mortgage rates are pushing 4 percent and the answer to "how much home can I afford" has changed.

Take, for example, the hypothetical home buyer in Washington, D.C. who was pre-approved in November 2012 for a maximum $600,000 home, assuming 20 percent down. While he's been shopping, U.S. mortgage rates have been rising.

Unfortunately,with each 0.125 percentage point increase to rates, his maximum purchase price has dropped $8,100.

Today, the same buyer can afford a home for $551,400.

Rising mortgage rates and rising home prices are harming today's affordability.

With Changing Rates, Get Re-Pre-Approved

Mortgage rates are markedly higher as compared to just 4 weeks ago. Today's home buyers -- pre-approved or not -- should consider a re-pre-approval; a re-verification of terms and a re-qualification for a mortgage.

What you can afford today is different from what you could afford May 1. Mortgage rates are rising and purchasing power is waning. See how today's rates fit your housing budget.

Click for a personalized mortgage rate quote.

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.