Emerging CSP markets: More than meets the eye

Long before the legislative changes in Spain and the termination of loan guarantees in the United States, several emerging CSP markets had stepped into the limelight.

These potential solar hotspots are increasingly attracting CSP players from across the global supply chain. But in weighing up the options for entering these markets, can the announced CSP targets and high solar resources be sufficient for decision making?

CSP markets to watch

An accelerated geographic shift has been taking place in the global CSP market over the past 12 months. While Spain’s removal of feed-in-tariffs is forcing CSP stakeholders to redefine their business strategies and identify new areas of investment, the termination of the loan-guarantee program in the United States means that developers must find other sources to raise project finance.

At the same time, high-DNI countries across South America, Southern Africa, Asia the Middle East and North Africa are actively pursuing or preparing CSP tenders to meet ambitious renewable energy targets. According to the results of the CSP Today Markets Survey July 2013, whose participants include CSP component suppliers, developers, consultants, government bodies, and EPC firms, CSP companies are currently generating most of their revenue from the USA and Spain.

In the next 10 years, however, CSP revenue is expected to be drawn from China, South Africa, Saudi Arabia, UAE, Chile, India, and the USA, according to the survey, to which a total of 243 experts contributed.

These emerging CSP hotspots are all witnessing first-time government support for renewable energy, mainly driven by burgeoning energy demand, the desire to save domestic energy resources and the need to achieve energy independence. As a result, permitting procedures in these countries are easing up, local supply chains are developing, and financing is becoming more accessible.

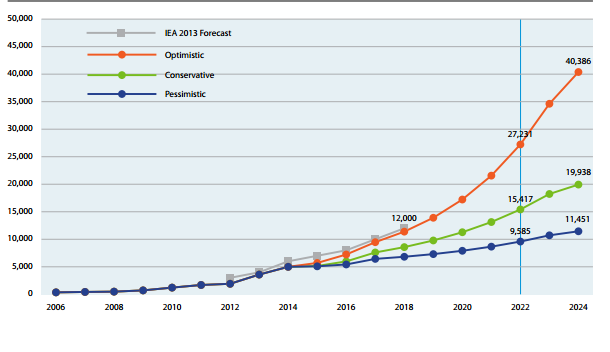

With a prospective capacity amongst new markets of between 11.5 GW and 40 GW by 2024, as forecasted by the CSP Today Markets Report 2014, and an average year-on-year added capacity ranging from 12% to 26%, the industry is poised for tremendous growth across the world. However, when deciding which direction to take, several factors must be taken into consideration.

Figure 1: CSP Market Capacity Forecast Until 2024 (MW)

(Source: CSP Today Markets Report 2014)

Influential factors

As described in the CSP Markets Report, a number of critical metrics should be evaluated when comparing different CSP markets. One of these is the technical potential of a market, which is not only defined by the available solar resource but also by other factors, such as water availability, environmental restrictions, lands’ slopes and grid connectivity.

By combining these factors, along with the estimated CSP potential, in terms of installed capacity and energy generation, as well as the announced and under-development capacities, markets such as the United States, Saudi Arabia, Chile, Morocco, and South Arabia stood out in the report’s technical potential ranking. These locations are known to have the world’s highest DNI levels, but they also suffer water scarcity; thus dry cooling and robotic cleaning systems represent more feasible options for such markets.

In Chile, South Africa, Morocco, and China, the limited grid capacity and lack of adequate transmission lines are serious issues that can hinder the development of solar power plants if not tackled. And while countries like the United States, Morocco, South Africa, and China have sufficient land for projects, in the UAE, land is rare and expensive.

Similarly, the ease of financing CSP projects in a given country is of paramount importance to market entrants, especially under today’s global economic situation. This includes credit access, investor protection, restrictive labour regulations, tax rates and inflation.

In Chile and the UAE, for example, financing challenges remain as CSP projects are still perceived as high-risk investments, and in Saudi Arabia, clear funding arrangements will be required to achieve the ambitious target set by the government. On the other hand, Morocco and South Africa are seeing greater funding support from financing institutions.

Proving commitment to CSP

For a country to be attractive to CSP investors, having real and solid targets proves its commitment to establishing a local CSP industry. Such markets are where CSP players are more interested in investing; where they can find a continued pipeline of projects that compensates investment costs, rather than in places with just a couple of potential projects and no further activity expected. Consequently, the CSP capacities announced by different governments are vital metrics in assessing the commercial potential of a market.

Six of the eight markets analysed in the CSP Markets Report have announced ambitious renewable energy or CSP targets with varying timelines. South Africa aims to deploy 1.2 GW by 2030; Saudi Arabia 25 GW by 2032; Morocco 2 GW of solar by 2020; India 1.08 GW by 2015; China 3 GW by 2020; and Chile is targeting 20% of energy to come from renewables by 2025 – with the first CSP tender released in February 2013 and supported with a government subsidy of up to US $20 million.

Renewable energy support is another important aspect that should not be overlooked when making investment decisions in CSP. This specifically applies to emerging markets, which are still at the early stages of the learning curve, and where there is a need for some type of support to boost development.

“Several parameters are essential in forming a country-specific renewable energy support metric, from regulatory policies, to fiscal incentives, to public financing,” states the CSP Markets Report 2014.

Government support for CSP development has been already demonstrated through initiatives such as SunShot in the United States and the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) under development in South Africa.

Permitting and bureaucracy are not usually among the main factors that are evaluated when comparing markets, yet in some countries, the complex, lengthy and costly permitting process required by local authorities could become a discouraging hurdle for CSP investors.

Conversely, a straightforward permitting process facilitates market entry; hence this is one of the influential factors on an investment decision. According to the CSP Markets Report, obtaining approvals in the U.S. South Africa, India, and China is still regarded as a complex and lengthy procedure.

Equally important when assessing the true potential of a new CSP market is evaluating the country’s industrial network. In Saudi Arabia, for example, a CSP manufacturing capacity has yet to develop, although there are several locally-based EPC companies with relevant experience – both local and multinational – which are outlined in the CSP Markets Report. Generally, CSP companies will be much more competitive if they team up with entities within Saudi Arabia.

China, as another example, offers the opportunity to develop CSP technology, and taking advantage of its economies of scale could lead to cheaper equipment and a lower LCOE. South Africa, India and Morocco were also found to have strong manufacturing capacities – with the latter having existing industries for metal structures.

“Although under the current globalized economy, importing components and services from all over the world does not represent a major issue, the availability of a local industry and engineering services can be a good way to reduce costs and make CSP projects more competitive,” the CSP Markets Report highlights. In fact, several governments, such as in India and South Africa, have made local content a prerequisite. Those who haven’t made it compulsory have still emphasized the importance of localization.

Finally, a country’s political stability and economic environment, as well as the strength of its local energy sector in terms of energy consumption, demand and overall security are crucial to enabling CSP development in the short and long run.

All the above criteria were extensively assessed in the CSP Markets Report 2014, together with the opinions of 243 CSP experts, revealing a market forecast up to 2020, based on optimistic, conservative and pessimistic scenarios.

© CSP Today

http://social.csptoday.com/markets/emerging-csp-markets-more-meets-eye