Itís The Best Feature Of The HARP 2.0 Mortgage But Few Homeowners Even Want It Anymore

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

U.S. home prices are climbing, up more than 12 percent since last year. And, as home values rise, the increase is diminishing the value of this year's most popular mortgage refinance program -- the HARP 2 mortgage.

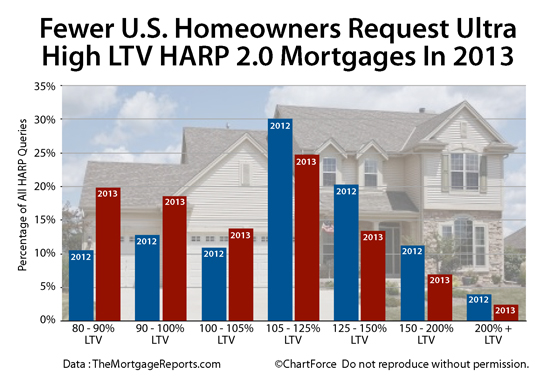

Fewer U.S. homeowners are requesting the "ultra-high" LTV mortgages which the HARP 2 program allows. Through the first 10 months of 2013, the majority of HARP queries asked for loan-to-value (LTV) of 105% or less.

It's a dramatic shift from just two years ago when 7 in 10 HARP queries requested an LTV of 105 percent or more. The shift may boost that chance that a third version of HARP -- HARP 3.0 -- is released for U.S. homeowners later this year.

Click for today's live HARP mortgage rates.

HARP : Mortgages For Underwater Homeowners

HARP stands for Home Affordable Refinance Program. It's the government's refinance program for underwater U.S. homeowners.

HARP was first launched in 2009 as part of a broader economic stimulus program. Dubbed "The Obama Refi", it promised homeowners $3,000 in annual savings, on average; the result of refinancing loans to lower mortgage rates.

In 2009, mortgage rates had dropped below 5 percent for the first time in history.

As part of the HARP program, lenders were instructed to refinance homes without respect to that home's value, so long as the loan size divided by the home's valuation remained at 125% or less. Via the Home Affordable Refinance Program, private mortgage insurance (PMI) coverage on a home was to remain as-is; and, closing costs were to remain limited.

Even if you lost your 20% downpayment to the housing market, you could refinance via the Home Affordable Refinance Program without incurring PMI.

In its first 3 years, there were more than 1 million HARP mortgage closings as the program helped U.S. households, U.S. banks, and gave a boost to the broader U.S. economy. As a result of HARP's success, in late-2011. the government expanded the program to help reach even more U.S. homeowners. The new iteration of HARP was quickly assigned the nickname "HARP 2.0".

In design, HARP 2.0 was nearly identical to HARP 1. There was one notable exception, however. HARP 2.0 waived the 125% LTV restriction of its predecessor, allowing for unlimited LTV.

Skip to today's live HARP mortgage rates.

HARP 2.0 : Closings Soar With Unlimited LTV

HARP 2.0 was announced in late-2011 and made widely available by March 2012.

The program removed the loan-to-value limitations of the original Home Affordable Refinance Program (which was huge for U.S. homeowners), while also introducing rules which simplified the process of refinancing from an "old" lender to a new one.

For example, under HARP 1, it was a challenge for refinancing homeowners to refinance a loan from Bank of America to Wells Fargo, for example; or from Chase Mortgage to Citi. With HARP 2, cross-lender hurdles were removed.

Not surprisingly, HARP 2 outperformed its predecessor handily.

Whereas HARP 1 closed one million loans in its first 3 years of existence, HARP 2 closed 1 million loans in just its first 12 months, a large percentage, of course, of which were the ultra-high LTV loans not possible via the original Obama Refi.

This was especially true in states such as Nevada and Florida where home values had dropped the most toward the end of last decade. In these hard-hit states, the Home Affordable Refinance Program loans dominated refinance activity, accounting for more than half of all closings statewide.

HARP 3.0 : Focus On Non-Fannie Mae / Non-Freddie Mac Mortgages?

Through 2013, though, the need for ultra-high LTV loans has waned.

Home values are rising in many U.S. cities as the housing market expands. There are far fewer requests for HARP 2 loans as compared to a similar period last year.

This website has fielded thousands of HARP mortgage queries since HARP 2 launched. The difference between the query traits of last year and this year is stark. Through October 2013, LTV requests are overwhelmingly lower as compared to 2012.

In 2013, as compared to the year prior, half as many homeowners ask for HARP over 125%.

And, as LTVs for HARP loans fall, the program's reach is becoming limited. There were fewer HARP 2.0 loans closed in August 2013 than during any month since the program's massive overhaul.

For this reason, the Home Affordable Refinance Program may soon morph again. HARP 3 boost the number of HARP-eligible households and provide relief to millions of additional U.S. households.

Fannie Mae and Freddie Mac are already making a move in this direction. In mid-October, both groups changed the HARP program's eligibility start date. More changes could be coming.

Potential HARP modifications include extending the Home Affordable Refinance Program to mortgages not backed by Fannie Mae or Freddie Mac; changing the HARP mortgage eligibility cutoff date sometime into 2011; and, allowing homeowners who have used the HARP program once to "re-HARP".

Refinancing an existing HARP mortgage would re-open the program to more than 2.8 million households nationwide.

There is no timetable for when HARP 3.0 will be official. Some, however, believe HARP 3.0 will happen soon.

Verify Your HARP Mortgage Eligibility

Homeowners refinancing via HARP save big money. At today's low rates, the typical HARP homeowner now saves 30 percent on his mortgage payment. Those savings multiply over 30 years into something huge.

Check your Home Affordable Refinance Program eligibility online and get started with a free rate quote. It's fast, it's free and there's no obligation whatsoever. See how much money a HARP mortgage can save you.