Kamakura Reports Drop in Corporate Credit Quality in October

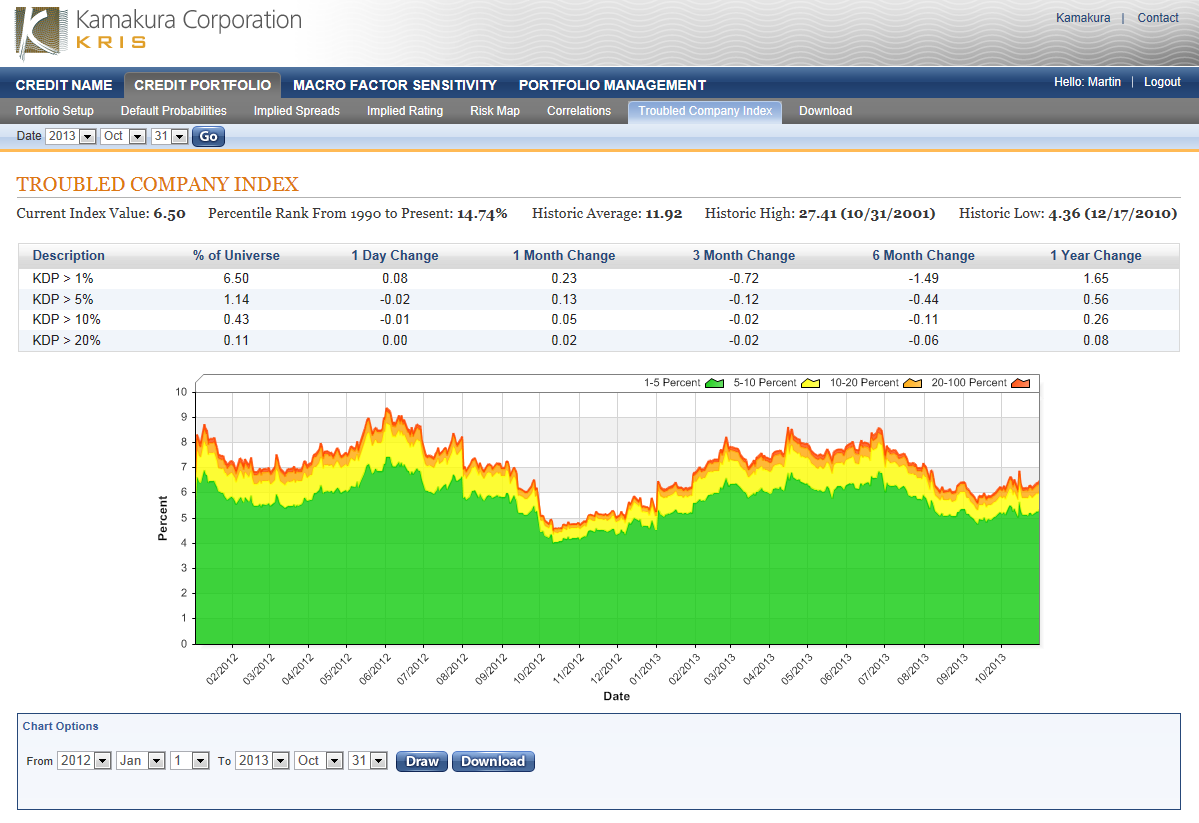

Kamakura Corporation reported Friday that the Kamakura troubled company index ended the month of October at 6.50%, an increase of 0.23% since last month. The index reflects the percentage of the Kamakura 35,000 public firm universe that has a default probability over 1.00%. An increase in the index reflects declining credit quality.

As of October 31, the percentage of the global corporate universe with default probabilities between 1% and 5% was 5.36%, up 0.10% from last month. The percentage of the universe with default probabilities between 5% and 10% was 0.71%, up 0.08% from last month while the percentage between 10% and 20% was 0.32%, up 0.03%. The percentage of companies with default probabilities over 20% was 0.11%, up 0.02% from last month. The index hit an intra-month high of 6.89% on October 15th, while the intra-month low of 6.15% was on October 4th. The magnitude of change in the index during the month was 74 basis points compared to 79 basis points last month.

At 6.50%, the troubled company index is at the 85th percentile of historical credit quality (with 100 being best all time) over the period from January, 1990 to the present. Mirabela Nickel LTD once again had the world’s highest one-month default risk among rated companies at 52.12%. Mirabela is an Australian company whose primary asset is a nickel mine in Brazil. Mirabela failed to make an interest payment that was scheduled to be paid on October 15, 2013 and is now operating within a 30-day grace period under the terms of the note. Mirabela has been on our list of riskiest firms for some time once again providing users of Kamakura’s default probability service with advance warning of financial distress. Among the ten riskiest firms in October, seven were European firms and one each from Australia, China and Saudi Arabia.

Martin Zorn, President and COO for Kamakura Corporation, said Friday, “Overall credit conditions remain stable and generally very good. Europe continued to be the primary area of credit worries again in October. Looking at the default probabilities of the companies in the High Yield Index show that most of the risk is concentrated the natural resource and communications sectors. Starting this month we will release a mid-month update on the risk within the high yield sector.”

The Kamakura troubled company index measures the percentage of more than 35,000 public firms in 45 countries that have annualized 1 month default risk over one percent. The average index value since January, 1990 is 11.94%. Since November, 2010, the Kamakura index has used the annualized one month default probability produced by the KRIS version 5.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors. The version 5.0 model was estimated over the period from 1990 to 2008, and includes the insights of the worst part of the recent credit crisis. The countries currently covered by the index include Australia, Austria, Bahrain, Belgium, Brazil, Canada, China, Denmark, Egypt, Finland, France, Germany, Greece, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kuwait, Luxemburg, Malaysia, Mexico, the Netherlands, New Zealand, Norway, Oman, Poland, Portugal, Qatar, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, United Arab Emirates, United Kingdom, the United States, and Vietnam.

![]()

To subscribe or visit go to: http://www.riskcenter.com

www.riskcenter.com/articles/story/view_story?story=99916020