Mortgage Rate Predictions And Analysis : What Should You Expect From Mortgage Rates This Week?

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Mortgage rates improved last week, marking the first time rates have dropped on a week-over-week basis since October.

In the holiday-shortened week, the Fannie Mae (FNMA) 3.5% coupon climbed 23/32 between Monday and Friday, which moved conventional mortgage rates lower by approximately 0.250 percentage points.

Conventional mortgage loans include the "standard" 30-year fixed rate mortgage from Fannie Mae and Freddie Mac, as well as speciality mortgage programs such as the HARP 2.0 refinance.

Furthermore, Ginnie Mae (GNMA) 3.5% coupons improved last week, too, moving +31/32. The move reduced mortgage rates for GNMA-dependent products, a group which includes FHA mortgages, VA mortgages, and USDA mortgages.

Looking ahead to this week, mortgage rates may drop again.

Click to skip to today's live mortgage rates.

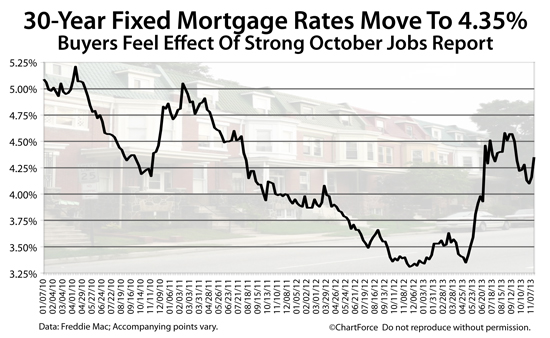

Freddie Mac : 30-Year Fixed At 4.35%

Mortgage rates made small improvements each day last week, and pricing was at its best headed into the weekend. However, according to Freddie Mac's weekly Primary Mortgage Market Survey (PMMS), mortgage rates rose from the week prior.

The reason behind the discrepancy is a difference in "survey period".

Freddie Mac's mortgage rate survey period doesn't correspond to an actual calendar week; rather, it overlaps weeks, running from Wednesday to Wednesday.

Last week's Freddie Mac rate was higher because its survey period included Friday, November 8. This is the date on which the October Non-Farm Payrolls report was released and the report was unexpectedly strong. Mortgage rates spiked that day, worsening by as much as 0.375 percentage points.

As a result, the most recent Freddie Mac survey shows 30-year mortgage rates up 0.19 percentage points this week to 4.35% nationwide. It shows the 15-year fixed rate mortgage up 0.08 percentage points to 3.35%.

Both rates are multi-week highs and both were reported with an accompanying 0.7 discount points due at closing. This means that, in order to lock the published rate, mortgage applicants should expect to pay 0.7% of their loan size as discount points due at closing.

Discount points remain optional, however.

Borrowers opting to pay zero discount points at closing can expect their locked mortgage rate to be slightly above the published Freddie Mac rate. Similarly, borrowers opting to pay more than 0.7 discount points can expect their mortgage rates to be slightly below Freddie Mac's rates.

Click to get mortgage rates with various "discount point" options.

What's Next For U.S. Mortgage Rates

This week, mortgage rates may continue to drop.

For the second straight week, there is little on the economic calendar to affect mortgage rates. However, there is an abundance of Federal Reserve members slated to speak publicly.

This could be good news for rate shoppers, depending on the message the Fed speakers deliver to markets.

The calendar for the week ahead includes :

- Monday : Boston Federal Reserve President Eric Rosengren speaks; Homebuilder Confidence Survey; New York Federal Reserve President William Dudley speaks; Philadelphia Federal Reserve President Charles Plosser speaks; Minneapolis Federal Reserve President Narayana Kocherlakota speaks

- Tuesday : Chicago Federal Reserve President Charles Evans speaks; Federal Reserve Chairman Ben Bernanke speaks

- Wednesday : Consumer Price Index; Retail Sales; Existing Home Sales; New York Federal Reserve President William Dudley speaks; St. Louis Federal Reserve President James Bullard speaks; FOMC Minutes

- Thursday : St. Louis Federal Reserve President James Bullard speaks; Jobless Claims; Producer Price Index; Federal Reserve Governor Jerome Powell speaks; Richmond Federal Reserve President Jeffrey Lacker speaks

- Friday : Kansas City Federal Reserve President Esther George speaks; Federal Reserve Governor Daniel Tarullo speaks

Wednesday will likely be the most important day for rates this week because Retail Sales measures consumer spending, and consumer spending comprises the majority of the U.S. economy.

Last month, excluding auto sales, retail receipts were weak. Another month of slow growth could drag down mortgage rates because it may signify a weakening economy. Conversely, if Retail Sales beats expectations, mortgage rates could rise.

The FOMC Minutes will also be a market-mover.

See Today's Live Mortgage Rates

Mortgage rates remain historically low nationwide. Purchasing power is high and refinancing opportunities are abundant. If you haven't seen today's live mortgage rates and compared them to your loan, you may be missing an opportunity.

Get today's live mortgage rates now. Rates are available at no cost and with no obligation. Plus, this may be as low as mortgage rates get.