Mortgage Rates Unexpectedly Rise

Should You Lock With Your Lender ASAP?

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

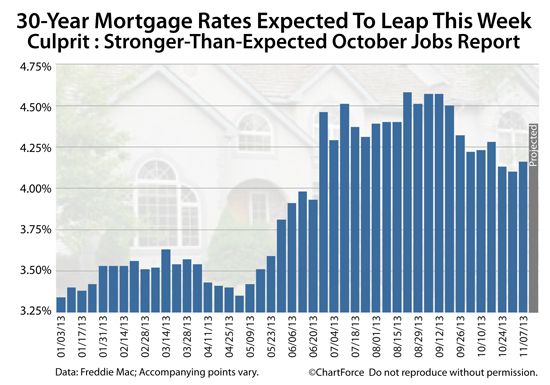

Mortgage bonds worsened last week after Friday's October Non-Farm Payrolls report showed U.S. labor markets performing better than Wall Street expected.

The data sparked a full-scale mortgage market selloff. By the week's end, mortgage rates had surged to a 9-week high and momentum appears to be pulling rates north.

For this week's buyers and mortgage rate shoppers, it may be time to lock something in.

Click here to get an instant, personalized rate quote.

Mortgage Rates Worsen By 1 Point Or More

Wall Street dumped its mortgage bonds last week. Mortgage rates climbed.

The Fannie Mae (FNMA) 3.5% 30-year coupon fell -1 13/32 between Monday and Friday, which was its worst one-week move in more than a quarter. Fannie Mae bonds are used to make conforming mortgage rates so it follows that conforming mortgage rates rose.

30-year fixed rate mortgage rates moved higher by as much as +0.50 percentage points between Monday and Friday across the full suite of conforming loan programs.

Rates rose for "prime" borrowers making a purchase; for condo owners refinancing a rental; and, for underwater homeowners using HARP 2.0, as examples.

Some borrowers absorbed last week's worsening a different way. Rather than taking the half-point hit to their rate, they opted to pay additional discount points instead.

Conforming pricing worsened by approximately 1.25 discount points.

Mortgage rates rose for FHA, VA, and USDA loans last week, too. This was because the 30-year Ginnie Mae (GNMA) 3.5% coupon dropped -1 15/32. Ginnie Mae bonds are linked with FHA, VA and USDA loans and their worsening led to a half-point increase in all three loan types.

Buyer purchasing power dropped six percent.

Click here to get an instant, personalized rate quote.

Does The Jobs Report Force The End Of QE3?

The entirety of last week's mortgage rate run can be linked to the October Non-Farm Payrolls report. The report showed 204,000 net new jobs created in October, plus a +60,000 revision to the results of the two months prior.

The print exceeded even the most optimistic Wall Street projections. Consensus opinion called for one-hundred-forty thousand net new jobs last month, with the high-end prediction running one-hundred-sixty-eight thousand.

Accounting for revisions, October's Non-Farm Payrolls exceeded Wall Street estimates by more than 50%. The result may affect more than just labor markets.

Currently, the Federal Reserve is buying $40 billion worth of mortgage-backed bonds monthly in a program known as "QE3". The program began in September 2012 and was launched by the Fed with no specific end date.

QE3 will end, the Fed subjectively said, when the market no longer needs it and, with every "strong" jobs report, the end of QE3 comes nearer.

QE3 works by creating artificial demand for mortgage bonds which drives up prices for whichever bonds the Federal Reserve chooses to buy. As prices rise, mortgage rates drop.

Because QE3 exists, U.S. mortgage rates are lower than they otherwise would be. Similarly, without QE3, U.S. mortgage rates would be higher than they are today. This is why the October jobs report did such a number on last week's rates.

The strength of the October Non-Farm Payrolls report has Wall Street wondering whether the Fed will soon end its rate-suppressing program. After all, the Fed has said that the future of QE3 is "data-dependent" and, right now, the data looks fairly strong.

Mortgage rates should continue to rise, therefore, until the economy lays an egg or until a member of the Federal Reserve specifically states that QE3 will last into 2014.

Mortgage Rates : What's Ahead For This Week

There is little economic data set for release in this holiday-shortened week so mortgage markets are expected move on last week's momentum, and in response to geopolitical events from abroad.

The biggest events on the U.S. calendar are prepared speeches from five Federal Reserve members, including one from Federal Reserve Chairman Ben Bernanke.

Wall Street will be listening to the Fed speeches, searching for clues about whether QE3 will continue indefinitely, or whether the program is headed for a "taper". Rates are expected to move sharply should the Fed provide specific, clear direction.

You may not want to wait for that. Mortgage rates -- although rising -- remain low and ripe for locking. See how today's mortgage rates fit your budget. Get started with a quote today.