Why U.S. Banks May Raise Mortgage Rates Just 24 Hours From Now

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

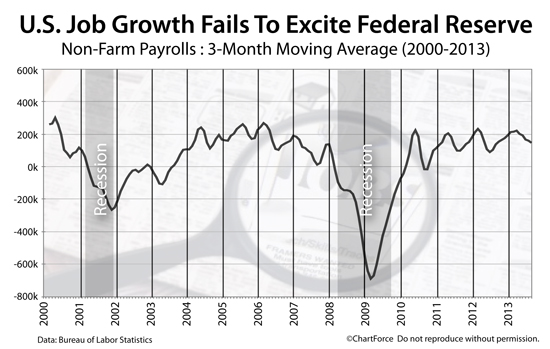

On the first Friday of each month, the Bureau of Labor Statistics publishes its Non-Farm Payrolls report. Most commonly known as "the jobs report", Non-Farm Payrolls highlights employment changes across 10 private sectors including insurance and finance; and also includes government hiring statistics.

It's a report closely watched by Wall Street, and one which directly affects the U.S. mortgage market. This is because the U.S. labor market is now linked to the future of the Federal Reserve's QE3 program.

October Non-Farm Payrolls will be released Friday morning. Consider locking your floating mortgage rate before that release occurs.

Click for today's pre-jobs report mortgage rates.

The Jobs Market : 6.6 Million Jobs Added Since 2010

The Non-Farms Payrolls report is a broad look at the U.S. labor market. By industry, it shows which economic areas are expanding, and which areas are contracting. It also shows the national labor participation rates and the overall U.S. unemployment rate.

The government's Non-Farm Payrolls report release is a monthly Wall Street highlight. Jobs growth is paramount to economic growth, and economic growth drives investment strategy.

Recently, though, the importance of the jobs report has been magnified. This is because the Federal Reserve is "data-dependent" and the future of its stimulus programs depends of the strength of U.S. labor.

One such program is QE3 -- the Fed program through which the central banker suppresses U.S. mortgage rates.

With mortgage rates low, the Fed reasons, the housing market gets a boost which, in turn, helps to support U.S. jobs in construction, retail, and banking among other sectors. Low rates spur refinances as well. This increases household savings and may contribute to consumer spending.

Skip to today's live mortgage rates.

Consumer spending comprises more than two-thirds of the U.S. economy and the Fed is keen to see employment return to levels considered "stable".

Between 2008-2009, the U.S. economy fell into recession, highlighted by the failure of Lehman Brothers; the near-collapse of mortgage lending; and the movement of Fannie Mae and Freddie Mac into conservatorship by the Federal Home Finance Agency (FHFA).

The U.S. economy shed 7.4 million jobs during that period.

Since 2010, however, 6.6 million jobs of those lost jobs have been added back -- an 89-percent recovery in terms of employed persons. The jobs created during this time may not be of equal pay or stature as compared to those lost, but more employed persons is a new positive.

As jobs go, so goes QE3. It news which puts today's home buyers on notice.

If job growth is shown to be strong for October, the Fed may move to end QE3 quicker-than-expected which would move mortgage rates up, similar to what happened between May and June of this year.

At the time, a strengthening economy led Wall Street to believe QE3 would soon end. In response, mortgage rates made their fastest 2-month gain since the super-charged inflation days of 1981. The same could happen Friday.

If the jobs report is strong, rates could add as much as 0.25 percentage points overnight. An added risk is that Wall Street estimates for the October Non-Farm Payrolls report carves a monstrous range.

Analysts calls are for as many as 168,000 net new jobs created and as few as -300,000.

Click for today's pre-jobs report mortgage rates.

Job Growth Can Crowd The Housing Market

Job growth benefits the economy and the broader U.S. housing market. The link is fairly straight-forward.

A person with a full-time job earns a periodic paycheck and a "periodic paycheck" is required to get a mortgage approval. With even just one day on your new job, you can get mortgage-approved so long as your debt-to-income ratio meets lender requirements.

In this way, a recently unemployed person who has recently gone back to work, or a household that's relocating on an offer letter, is instantly mortgage-eligible -- both for refinancing via the FHA Streamline Refinance program or via any number of eligible programs for underwater homeowners, for example; or for purchase of a new home.

When more people earn paychecks, it can unlock pent-up demand for housing and, all things equal, when demand grows, home prices move higher.

We're seeing this relationship in action right now. With buyer demand at multi-year highs, home prices are higher.

Home builders report the highest levels of buyer foot traffic since 2006 and home supplies are firmly beneath 6.0 months -- the benchmark divider between "buyer's market" and "seller's market".

Home prices have climbed more than 8 percent in the last twelve months, with luxury home sales over $1,000,000 leading the charge. Housing has trickled up and its dragging up prices.

Should mortgage rates rise Friday, home affordability would just sink some more.

Friday's Jobs Report Will Shift Mortgage Rates

In September 2013, the economy added 148,000 net new jobs. Last month, with the effects of the 16-day government shutdown in play, that figure is expected to drop to just 120,000.

It would mark the second-lowest reading in a year and that's one reason why an unexpectedly strong reading will cause mortgage rates to rise.

There is little room for rates to fall unless job creation goes negative. More likely is that rates will climb beginning Friday morning.

Today may be the last chance for weeks to lock an ultra-low mortgage rates. Get an instant rate quote now. It's fast, it's free, and there's no obligation whatsoever.