As Mortgage Rates Drop For 4th Straight Week, A Second Chance For Buyers And Refinancing Households

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

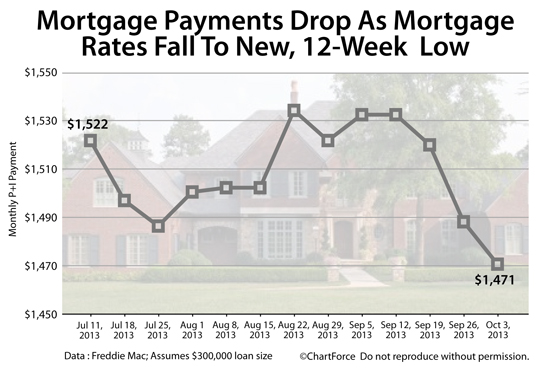

Mortgage rates have dropped to a 12-week low, re-igniting the national Refinance Boom and helping to make homes more affordable for today's U.S. home buyers.

The average conventional 30-year fixed-rate mortgage rate is now 4.22% nationwide. FHA and VA mortgage rates have made similar improvements.

Click to get your personalized rate quote now.

Mortgage Rates : Lowest Rates Since June

According to mortgage-backer Freddie Mac, 30-year fixed rate mortgage rates shed another 0.10 percentage points this week nationwide. The "going rate" for a 30-year fixed is now 4.22 percent nationwide for prime borrowers willing to pay 0.7 discount points at closing.

A "prime" borrower is defined as one with high credit scores, verifiable income, and a downpayment of twenty percent or more on a purchase. Rates for prime borrowers seeking a HARP refinance, or a loan against a condominium, for example, should expect slightly higher rates.

Rates for the 15-year fixed rate mortgage are similarly improved.

As compared to the week prior, the average 15-year fixed rate mortgage rate fell 0.08 percentage points. Since peaking in September, rates for 15-year loans have moved to 3.29% nationwide -- a 30 basis point improvement.

The 15-year and 30-year fixed rate mortgage rate are at their lowest recorded levels since late-June, a span of 12 weeks.

Get a personalized mortgage rate quote right here.

Will Mortgage Rates Fall Below 4%?

After peaking in late-July, this year's mortgage rates have dropped. Several factors have driven the multi-month slide, and some may continue to push rates lower through the rest of 2013.

Then again, today could be the lowest that mortgage rates go, so let's take a look at what's moving mortgage rates lower.

QE3 Will Hold Mortgage Rates Down

First, there's QE3, the Federal Reserve's economic stimulus program which works by suppressing U.S. mortgage rates nationwide. Via QE3, the Fed buys $40 billion in mortgage-backed securities monthly. The bond buys raise demand for mortgage-backed bonds which, in turns, raises bond prices.

High bond prices correlate to low mortgage rates. This is how QE3 helps to keep mortgage rates low.

Earlier this year, the Fed suggested that an improving economy would lead to a QE3 "taper". That is, a gradual reduction in the QE3 program's size. The news was a catalyst for rising rates through May and June of this year.

Now, however, with the economy beginning to slow, the Fed has defied Wall Street expectations. The taper has yet to start and analysts are unsure of when it will. In response, mortgage rates have dropped.

Until the economy showed marked improvement, QE3 may remain at full strength.

Congressional Wrangling Will Hold Mortgage Rates Down

Government activity is another factor in this week's low mortgage rate print. The current government shutdown has affected U.S. businesses and consumers, which will ultimately affect our nation's economic output.

A slowing economy can sometimes push investors into "safe haven" buying. Safe haven buying is when investor seek less risky investments during a period of economic or political uncertainty. Stock markets lose and bond markets gain.

Mortgage bonds benefit during periods of safe haven buying, up until the point when they don't. For U.S. bonds, this point will be October 17, 2013 -- the date on which the U.S. Treasury will reach its debt limit.

As October 17 nears, expectations of a U.S. debt default are expected to move mortgage rates higher.

Slow Job Growth Will Hold Mortgage Rates Down

The U.S. labor market will also affect the future of mortgage rates. This is because job growth is linked to consumer confidence, home sales, retail sales and, therefore, economic output.

Plus, because the Federal Reserve is watching employment rates as a key economic indicator, and because inflation is running well below the Fed's two percent target, labor market weakness may help extend QE3 into 2014.

The U.S. economy has added 6.4 million jobs since 2010 and the Unemployment Rate has dropped from ten percent to 7.3%. However, the jobs being created are not of equal type-and-pay as those which were lost last decade; and the falling Unemployment Rate is as much the result of discouraged workers leaving the workforce as actual job growth.

Without a bona fide labor market turnaround, mortgage rates are likely to drop.

Get An Instant Mortgage Rate Quote

Mortgage rates are dropping and this is your second chance to refinance. Rates have returned to mid-June levels and mortgage payments are more affordable than during any time this summer.

Don't miss your second chance to refinance. Rates may drop to 4% but what if they don't? This will be your last chance to capture this year's all-time low mortgage rate for your monthly household budget.

Get today's live mortgage rates now. Quotes are personalized, free, and there's no obligation whatsoever.