Kamakura Reports Improvement in Corporate Credit Quality in September

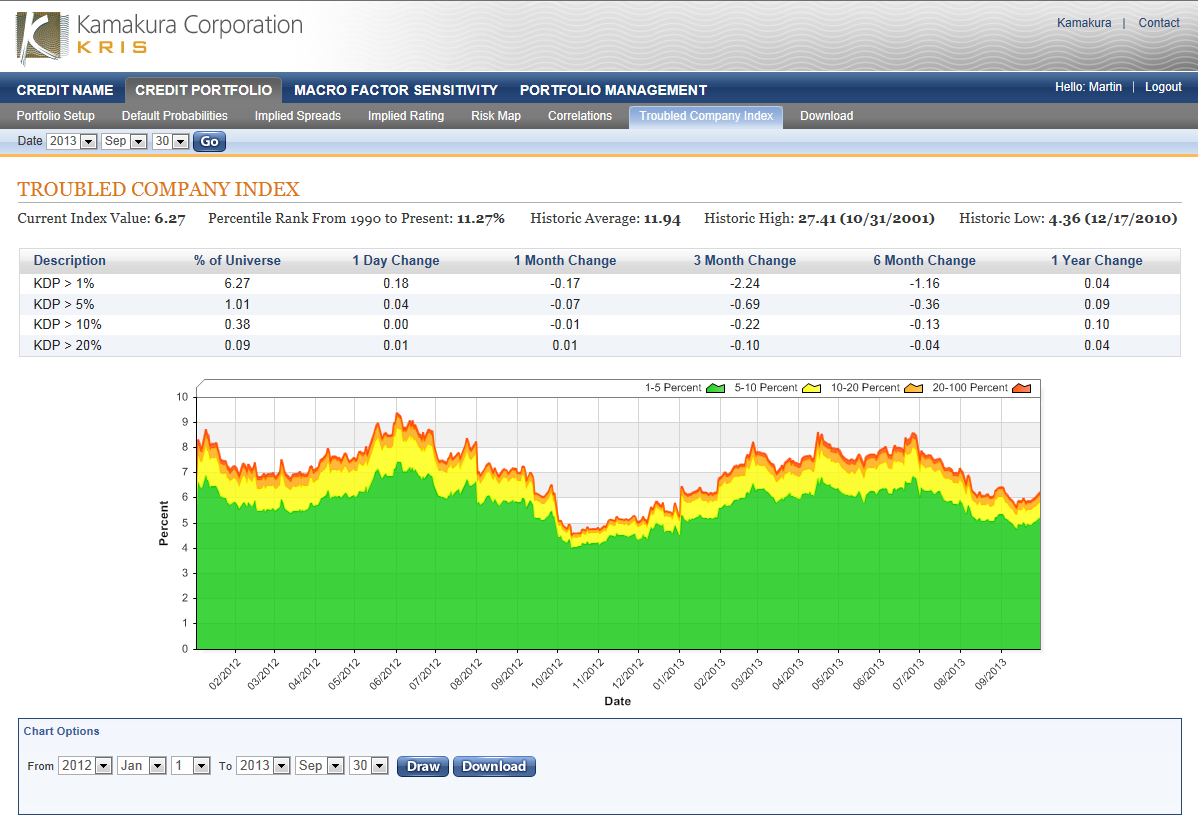

Kamakura Corporation reported Tuesday that the Kamakura troubled company index ended the month of September at 6.27%, a decrease of 0.17% since last month. The index reflects the percentage of the Kamakura 35,000 public firm universe that has a default probability over 1.00%. A decrease in the index reflects improving credit quality.

As of September 30, the percentage of the global corporate universe

with default probabilities between 1% and 5% was 5.26%, down 0.10%

from last month. The percentage of the universe with default

probabilities between 5% and 10% was 0.63%, down 0.06% from last

month while the percentage between 10% and 20% was 0.29%, down

0.02%. The percentage of companies with default probabilities over

20% was 0.09%, up 0.01% from last month. The index hit an

intra-month high of 6.44% on September 2nd, while the

intra-month low of 5.65% was on September 12th. The

magnitude of change in the index during the month was 79 basis

points compared to 103 basis points last month.

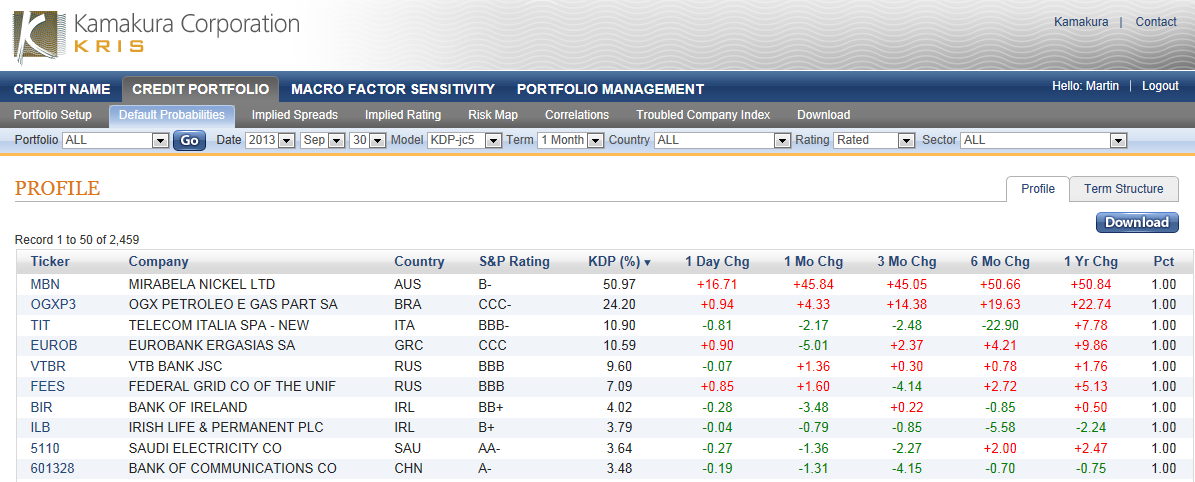

At 6.27%, the troubled company index is at the 89th percentile of historical credit quality (with 100 being best all time) over the period from January, 1990 to the present. Mirabela Nickel LTD had the world’s highest one-month default risk among rated companies at 50.97%. While Mirabela is an Australian company its primary asset is a nickel mine in Brazil. Among the ten riskiest firms in September, six were European firms and one each from Australia, Brazil, China and Saudi Arabia.

Martin Zorn, President and COO for Kamakura Corporation, said Tuesday, “The markets have moved passed the “taper” worries and are now focused on “shutdown” and “debt ceiling” concerns. Credit spreads are moving in line with the broad market sentiment while the overall troubled company index is very benign from a historical basis. This is the very time that astute risk managers need to be vigilant against complacency and also focus carefully on company specific risk.”

![]()

To subscribe or visit go to: http://www.riskcenter.com

http://riskcenter.com/articles/story/view_story?story=99915902