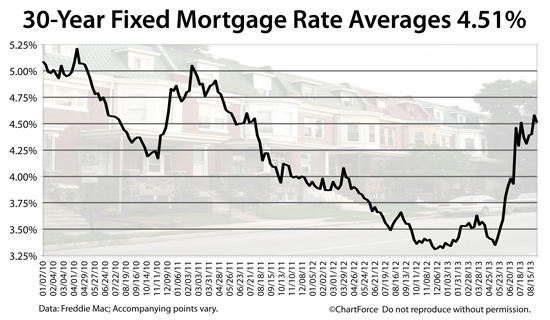

30-Year Fixed Rate Mortgage Rates Fall To 4.51%; Refinance Chances Resurface

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Mortgage rates are dropping.

According to Freddie Mac's weekly Primary Mortgage Market Survey (PMMS), the conforming 30-year fixed rate mortgage rate fell 0.07 percentage points last week to 4.51%, on average, nationwide. Rates for the 15-year fixed rate mortgage fell, too, last week, shedding 0.06 percentage points to 3.54 percent.

The spread between the two rates remains near an all-time high.

Click to skip to today's live mortgage rates.

30-Year Fixed Rate Mortgage Rate : 4.51%

Each week, government-backed Freddie Mac conducts a mortgage rate survey of 125 banks nationwide. The survey asks banks reply with their "going" mortgage rate for a prime mortgage borrower, including the number of accompanying discount points required to lock that rate.

A prime borrower, as defined by Freddie Mac, is one with ample home equity or downpayment, high credit scores, and documented income which meets or exceeds mortgage underwriting standards. HARP mortgages are often priced differently. VA loans and FHA mortgages priced separately.

Click here for today's HARP and VA mortgage rates.

Freddie Mac's survey shows the average 30-year fixed rate mortgage rate down 7 basis points last week. In addition, it shows banks charging fewer discount points to lock a low rate.

The cost to lock a 4.51% 30-year fixed is down to 0.7 discount points, on average, down from one-tenth of a percentage point from the week prior. 0.7 discount points adds $700 per $100,000 borrowed.

For mortgages at the U.S. conforming loan limit of $417,000, 0.7 discount points will add a one-time $2,919 cost due at closing, along with whatever state, lender, and government closing costs apply to your loan.

Loans in high-cost areas including Loudoun County, Virginia; Potomac, Maryland; and Orange County, California, made at \ the maximum $625,500 loan size carry a one-time cost of $4,379.

Don't forget, though -- discount points are optional. Loans with "no points" are available anytime.

Click for today's mortgage rates with 0 points.

Lowest Mortgage Rates In California, Washington

Mortgage rates fell last week, but fell unevenly from region-to-region. Depending on where you live, you're seeing different mortgage rates from your lender.

Last week's average mortgage rates by region were :

- Northeast Region : 4.53% with 0.7 discount points

- West Region : 4.49% with 0.7 discount points

- Southeast Region : 4.53% with 0.7 discount points

- North Central Region : 4.50% with 0.7 discount points

- Southwest Region : 4.54% with 0.6 discount points

This breakdown indicates that today's cheapest "rate-and-fee" combinations are being offered to buyers and refinancing households in the North Central Region (Illinois, Wisconsin, Minnesota Michigan, and Ohio), and in the West Region (California, Oregon, Washington, Nevada and Arizona).

By contrast, the most "expensive" mortgages are going to applicants the Southwest Region, an area which includes New Mexico and Oklahoma.

Lock Your Mortgage Rate Today

Freddie Mac published the 30-year fixed rate mortgage rate at 4.51% this week. That doesn't mean everyone will get this rate (or even want it). Loans without discount points, for example, are linked to higher mortgage rates.

In addition, buyers using a 3 percent downpayment program and investors with more than 4 properties financed can expect a higher rate, too. As compared to last week, however, rates are lower across the board.

Get a real-time quote today. It's fast, it's free, and no social security is required.