August Non-Farm Payrolls Report Shows Big Weakness; Mortgage Rates Dropping

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

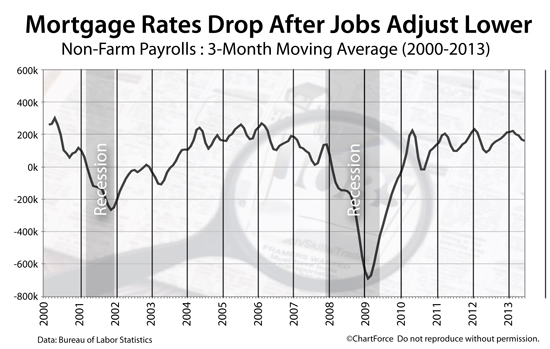

The August Non-Farm Payrolls report fell short of Wall Street expectations, showing just 169,000 net new jobs created last month, plus downward revisions to the prior two months of results. Analysts expected to see 177,000 jobs created last month.

The "miss" has sent mortgage rates of all types lower. Conforming, FHA, VA and USDA mortgage rates are dropping. Jumbo mortgage rates are falling, too.

Click here to see today's mortgage rates.

6.4 Million Jobs Created Since 2010

On the first Friday of each month, the government's Bureau of Labor Statistics releases its Non-Farm Payrolls report. The report details U.S. employment, sector-by-sector. The report also tallies the national Unemployment Rate.

In August, the U.S. economy added one-hundred-sixty-nine thousand net new jobs. This was a "miss" of eight thousand jobs. However, because the government also made downward revisions to its two most recent job reports, the net miss was even larger.

In re-evaluating data from June and July, the Bureau of Labor Statistics found that it had originally under-estimated job creation during those two months by seventy-four thousand.

Subtracting the revisions, we see new job creation of 97,000 jobs last month. Unemployment Rate dropped to 7.3%. It's now been 35 months since the jobs market showed a net monthly loss.

Mortgage bonds are rallying on the jobs market news. Mortgage rates are dropping.

Click here to see today's mortgage rates.

Jobs Affect Mortgage Rates

The monthly U.S. jobs report has a direct effect on mortgage rates. Since late-2012, around the time when the Federal Reserve linked its future stimulus plans to the Unemployment Rate, the correlation has been tight.

According to the Fed, as the jobs market goes, so goes the economy; and, as the economy goes, so goes Fed stimulus.

Fed stimulus -- namely the QE3 program -- have helped to suppress mortgage rates nationwide. The program was announced in September 2012 and, since that date, mortgage rates moved to all-time lows in a historical context. The removal of QE3 will give rates more room to rise. This why threats of a QE3 "taper" are met with sharply climbing mortgage rates.

It explains why mortgage rates rose more than 1 percentage point between May and early-July.

Since July, though, rates have been dropping.

Softer language from the Federal Reserve plus well-placed hints that the Fed's QE3 will outlast its original projections have made U.S. homes more affordable and refinances more possible. HARP mortgage volume is expected to rise, for example.

August's weaker-than-expected jobs report means that QE3's rate-suppressing effects may last longer than Wall Street had planned. This is good for near-term mortgage rates and give U.S. rate shoppers a second chance to lock something low.

See Today's Mortgage Rates

Mortgage rates have been easing since the start of last month. With relative weakness in jobs, that trend may continue. It's a boon to home buyers in search of low mortgage payments, and to refinancing homeowners in search of low rates.

Use today's jobs report to your advantage. Mortgage rates are down and appear ripe for a lock. Get started with a rate quote today.