Mortgage Rates Preview : Will The Fed Extend QE3 And Will HARP 3 Pass Congress?

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Mortgage markets improved last week as weaker-than-expected economic data helped to lower U.S. mortgage rates. It's a break for home buyers and would-be refinancing households.

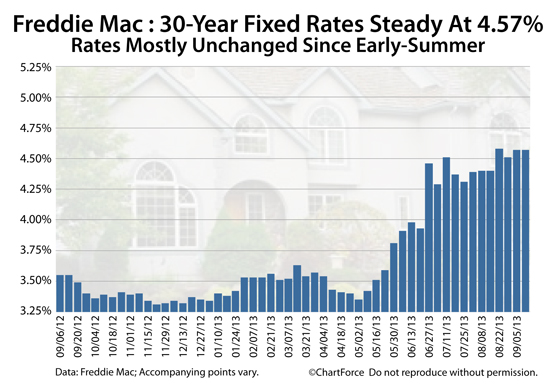

Since reaching 4.5% ten weeks ago, mortgage rates have mostly idled. Purchasing power remains strong and millions of U.S. households are still refinance-eligible.

This week, mortgage rates won't likely rise. It's a good time to look at locking something in.

Click here for a no-obligation rate quote.

FHA, VA, Conventional Mortgage Rates Drop

As compared to one week ago, mortgage rates are better across all government-backed loan types. Mortgage rates moved lower for FHA loans, VA loans, conventional loans, and USDA ones.

Rates for these four loan types are based on the price of mortgage-backed securities (MBS) which are bonds backed by homeowners' mortgage payments.

The price of a Fannie Mae 4.5% coupon improved 38.5 basis points last week. This reduced the number of discount points a buyer would pay at closing by the same, or gave mortgage applicants the ability to lock rates 0.125 percentage points lower as compared to the week prior.

Pricing for FHA and VA bonds improved, too. The Ginnie Mae 4.5% coupon climbed 68 basis points, which reduced the rates for FHA loans and VA loans by 0.250 percentage points.

USDA mortgage rates fell by a similar amount.

The only mortgage rates which did not drop last week were jumbo mortgage rates. Jumbo mortgages are loans which exceed local loan size limits. For conventional loans, this amount is $625,500 at maximum. For FHA loans, it's $729,750.

Click here for a no-obligation rate quote.

This Week : Will Mortgage Rates Drop Big?

For watchers of the U.S. mortgage market, this week is the most eventful in months.

Along with a bevy of housing and economic data, the Federal Open Market Committee (FOMC) meets for the sixth time this year. The FOMC is the sub-group within the Federal Reserve which votes upon U.S. monetary policy.

The FOMC is expected to vote to keep the Fed Funds Rate in its current range near 0.000% but may elect to begin tapering the Federal Reserve's QE3 program, which started one year ago last week.

Via QE3, the central banker purchases $40 billion of mortgage-backed securities on the open market monthly, creating excess demand which holds bond prices high. The Fed's stimulus is directly responsible for last year's lowest mortgage rates in history.

In May 2013, the Fed said it would begin considering whether to increase or decrease the pace of its purchases based on U.S. economic growth. That statement sparked a massive MBS sell-off which pushed rates from 3.5% to the current range near 4.5%.

However, the economy has shown little spark since that date. Job growth is slower-than-expected nationwide; housing data has somewhat cooled; and, consumer spending has failed to keep up. The economy is expanding, but not by enough to warrant a "full taper", some believe.

How the Federal Reserve handles QE3 will be the big news this week, and make the largest impact on U.S. mortgage rates. The week's complete schedule looks like this :

- Monday : Empire State Manufacturing Survey

- Tuesday : Homebuilder Confidence Survey; Consumer Price Index (CPI)

- Wednesday : FOMC adjourns; Federal Reserve forecasts released; Housing Starts

- Thursday : Initial Jobless Claims; Existing Home Sales

- Friday : None

It's also noteworthy that five Federal Reserve members have scheduled speeches between Thursday and Friday. Expect these speeches to affect mortgage rates because each speaker is expected to put their personal spin on "what the Fed should do next".

Click here for a no-obligation rate quote.

Will HARP 3 Pass This Week?

U.S. homeowners also wonder if this week is the week Congress passes HARP 3.

Also known as #MyRefi and "A Better Bargain For U.S. Homeowners", HARP 3 would be the third iteration of the popular Home Affordable Refinance Program which was first launched in early-2009. More than 2.7 million U.S. homeowners have used HARP to refinance to lower mortgage rates since the program's inception.

It's unknown what will be different with HARP 3, but there is speculation that any, or all, of the following enhancements could be added when HARP is revamped for the public :

- HARP 3 may allow the "Re-HARP" of an existing HARP refinance

- HARP 3 may allow non-Fannie Mae and non-Freddie Mac mortgages

- HARP 3 may change the program cut-off date to include more homeowners

- HARP 3 may allow larger loan sizes of up $729,750

HARP 3.0 is currently in committee in Congress and may pass this week, or next week, or not at all. Millions of homeowners may be instantly refinance-eligible should HARP 3.0 pass.

Take A Look At Today's Mortgage Rates

Mortgage rates are low and it's a good time to see for what you'll qualify. Homeowners looking to refinance have a second chance to realize monthly savings and today's home buyers can use low rates to expand their purchasing power.

See today's mortgage and how they'll fit your budget. Rates are available at no cost and with no obligation.