The pending closure of the Vermont Yankee Nuclear Power Station is the latest in a string of planned plant retirements that many industry analysts say forecast a shrinking role for nuclear in the nation’s energy mix.

Vermont Yankee, which began operating in 1972, is the fifth reactor in the country to be scheduled for closure over the past year, dealing another blow to industry hopes of a nuclear renaissance. While four new reactors are scheduled to come online over the next several years, analysts expect more nuclear plants to shut down, unable to compete economically with natural gas and, increasingly, renewable sources such as wind and solar.

“The economic pressures that have made Vermont Yankee not worth maintaining for the company are affecting all merchant nuclear plants,” said Ezra Hausman, vice president at Synapse Energy Economics Inc., a research and consulting firm in Cambridge. “Any company that has its own money on the line is taking a hard look at any investments” in nuclear power.

Entergy Corp., the Louisiana company that owns Vermont Yankee, said on Tuesday that it would shut down the 41-year-old plant next year because of increased operating costs and falling profits. As with other closed or closing nuclear plants, Vermont Yankee fell victim to a combination of age, low natural gas prices, and declining demand for electricity, analysts said.

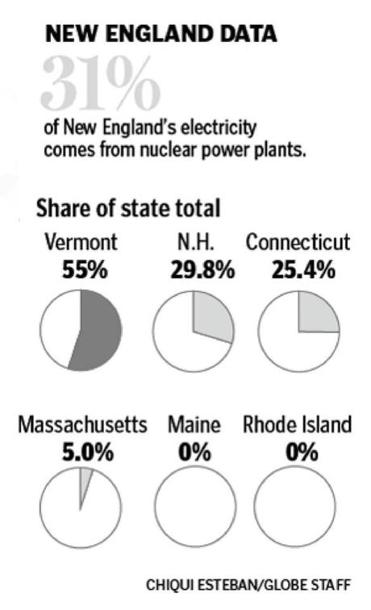

Nuclear power today accounts for about 20 percent of the US electricity supply, and 31 percent of New England’s. As recently as five years ago, when crude oil prices were soaring to record highs and new laws and regulations aimed at slowing climate change seemed imminent, some analysts and industry officials predicted a comeback for emission-free nuclear power.

Nuclear power accounts for

But legislation that would have taxed carbon dioxide and other greenhouse gases that contribute to climate change has stalled. Meanwhile, the controversial drilling technology known as fracking has opened new reserves of fossil fuels and driven natural gas prices down.

Michael Haggarty, a senior vice president at Moody’s Investors Service, an economic forecasting firm in West Chester, Pa., said he expects to see two or three more nuclear plants retired in the near future as low natural gas prices squeeze the competitiveness of such facilities in deregulated wholesale electricity markets.

“Low natural gas prices have been a fundamental game-changer for the sector,” Haggarty said.

And while Entergy, which also owns Pilgrim Nuclear Power Station, said it plans to keep that plant open and operating, Haggarty said the Plymouth facility could face a similar fate as Vermont Yankee, in large part because it exists in the same competitive electricity market.

“It’s roughly the same size as Vermont Yankee; it’s in the New England power markets,” Haggarty said of Pilgrim and its chances for closure. “Just from those similarities you have to mention it.”

For the last 30 years, nuclear power has acted as a baseload resource in New England, meaning it produces electricity day in and day out, said Gordon van Welie, chief executive of ISO New England, the region’s grid operator. The loss of a 650-megawatt plant like Vermont Yankee means a portion of that power now has to come from elsewhere — likely from natural gas-fired plants.

That’s a concern for van Welie, who has repeatedly cautioned that the region is becoming too dependent on natural gas. The fuel already accounts for more than 50 percent of New England’s net electricity generation.

“Natural gas is also putting coal and oil units out of business as well, so I think the bigger question for us as a region is where our replacement energy is going to come from,” van Welie said. “It’s not a bad thing to be dependent on natural gas as long as you have adequate supply of natural gas when you need it. “

But that is becoming a problem in New England, where pipelines are operating at or near capacity, said van Welie.

During an extended cold snap last winter, for example, wholesale natural gas prices spiked here because overtaxed pipelines could not provide adequate supply to meet the surging demand.

Nuclear power was once viewed as the energy of the future, but public opposition over safety concerns, huge costs, and the difficulties of disposing of radioactive waste led to a diminished role. The last new US commercial reactor was built in 1996.

Few analysts see nuclear returning as a major power source.

“We have resources that we can use to meet our need for electricity, and those resources are less costly than building nukes,” said Mark Cooper, a senior research fellow for economic analysis at Vermont Law School who is considered an expert on nuclear reactor financing.

“If nuclear power could compete, it would. It can’t. For the foreseeable future, nuclear is uneconomic.”