The Refinance Boom Reboots As Mortgage Rates Dip Below 4.5% Nationwide

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Today's home buyers and refinancing households have reason to celebrate.

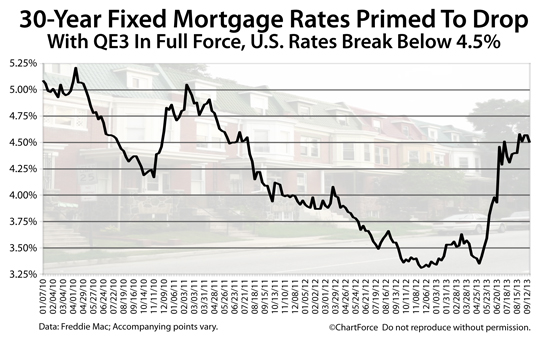

After 10 weeks of no change, the market's mortgage rate momentum is shifting. Conventional 30-year fixed rate mortgage rates have failed to climb since July and they now appear to be headed lower through the rest of September.

The Federal Reserve gave a boost to low rates after its September 2013 meeting but there are other factors at play, too. It's a good day to look at today's mortgage rates.

Click here for accurate, real-time mortgage rates.

30-Year Fixed Falls Below 4.50%

According to Freddie Mac, the average conventional 30-year fixed rate mortgage rate fell to 4.50% this week, a 0.07 percentage point drop from the week prior. The rate is available to mortgage applicants willing to pay 0.7 discount points at the time of closing.

A discount point is an up-front fee which lowers your mortgage rate. 1 discount point costs one percent of your loan size such that a loan with 1 point made at the Loudoun County, Virginia conforming loan limit of $625,500 with carry a cost of $6,250.

Discount points are optional. You can also use discount points in reverse.

The Freddie Mac figures are based on actual mortgage rates available from 125 surveyed banks nationwide during the course of the week. However, because the majority of survey respondents get back with Freddie Mac by Tuesday afternoon; and, because the survey isn't published until Thursday, the survey fails to capture whatever happens in the markets on a Wednesday.

This week, Wednesday was a great day for rate.

On Wednesday, the Federal Open Market Committee (FOMC) adjourned from its sixth meeting of the year, opting to leave the Fed Funds rate in its current range near zero percent and to leave its third round of quantitative easing (QE3) at its full strength.

Wall Street had expected the Fed to reduce the size of its stimulus effective immediately. The group's "no change" message sent mortgage rates plummeting. Pricing improved by an entire discount point that day.

A mortgage rate which cost 1 discount point Tuesday required no discount points Wednesday. Freddie Mac's survey failed to capture that change, which is why we know that mortgage rates are now below 4.50% nationwide, on average.

Click here for accurate, real-time mortgage rates.

Mortgage Rates Lowest In California; Highest In Texas

Mortgage rates are dropping but, like everything in real estate, pricing varies by location. Freddie Mac's weekly survey tracks regional mortgage rate pricing and this week's results show wide differences in rate depending on where you live.

Homeowners in the West Region, for example, which encompasses California, Arizona, Nevada, Oregon, Washington, Utah, Idaho, Montana, Hawaii, Alaska and Guam, are getting access to the lowest mortgage rates nationwide.

Homeowners in the Southwest Region, however, a region which includes Texas, Louisiana, New Mexico, Oklahoma, Arkansas, Missouri, Kansas, Colorado, Nebraska and Wyoming, are getting the least low mortgage rates.

Broken-down by region, here are Freddie Mac's surveyed mortgage rates :

- Northeast Region : 4.52% with 0.8 discount points, on average

- Southeast Region : 4.52% with 0.6 discount points, on average

- North Central Region : 4.50% with 0.6 discount points, on average

- Southwest Region : 4.56% with 0.6 discount points, on average

- West Region : 4.46% with 0.7 discount points, on average

Note that these rates are for conventional 30-year fixed rate mortgages for prime mortgage borrowers. A "prime" mortgage borrower is one with ample equity, high credit scores and acceptable debt-to-income levels.

Click here for accurate, regional mortgage rates.

U.S. Government May Lead Rates Under 4 Percent

This week's rapid drop in mortgage rates may be the start of a longer-term trend. Rates may sink through the rest of 2013, a move which would make homes more affordable for today's first-time and repeat buyers; and which would open refinancing opportunities for certain FHA-backed homeowners.

Falling rates would also give refinancing options to U.S. homeowners who purchased their home between June-August 2013, while mortgage rates were peaking. Saving one-half percent or more on your mortgage can make a huge long-term difference to your total mortgage interest paid.

For now, rates are Federal Reserve-influenced.

The Federal Reserve is currently purchasing $40 billion of mortgage-backed securities (MBS) on the open market, a stimulus program known as QE3. With QE3 in effect, the Fed is creating "bonus" demand for MBS which helps to hold MBS prices high.

Mortgage-backed securities are the basis for U.S. mortgage rates. When prices rise in the MBS market, mortgage rates drop, and this is how the Federal Reserve keeps mortgage rates in check. It doesn't "fix" mortgage rates or "set" them, even -- it provides demand for them which helps to keep mortgage rates suppressed.

The longer QE3 lasts, the longer mortgage rates are expected to stay low.

Rates may also get a boost from the looming Debt Ceiling Debate. Each of the last two times that Congress debated the Debt Ceiling (and took the deadline to the brink), mortgage rates dropped. This is because Debt Ceiling uncertainty creates Wall Street uncertainty and when Wall Street is uncertain, it tends to move assets from risky plays to "safe" ones.

Mortgage bonds are among the safest places to park money. As demand for safe assets increase, U.S. mortgage rates will likely move lower.

Take A Look At Today's Low Rates

Mortgage rates look terrific. The Federal Reserve has pledged to keep QE3 in place for another six weeks and Congress appears headed for a third drawn-out Debt Ceiling debate. Both events give downward pressure to U.S. rates.

However, both events could resolve quickly, too. QE3 could end without warning and Capitol Hill could reach debt ceiling agreement. Both events would move mortgage rates up -- likely in a hurry.

Therefore, don't wait for mortgage rates to drop. Take advantage of what the market gives today. Take a look at today's mortgage rates and see for what you'll qualify. Rates are available online and they're free with no obligation.