U.S. Mortgage Rates Unchanged Since July; Purchasing Power And Refinance Opportunities Remains Strong

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

The effect of today's mortgage rates might be less than you think.

After a rapid rise though May and June, mortgage rates have held steady. The popular 30-year fixed rate has been mostly unchanged through July, August and September.

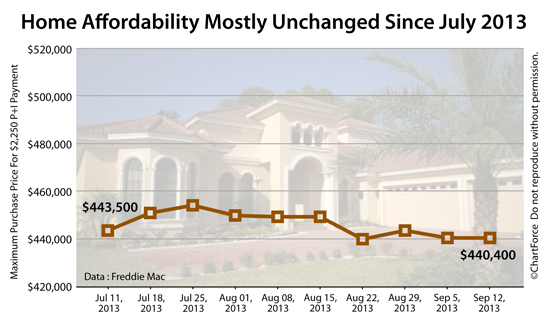

Home affordability is the same, and your maximum home purchase price is only marginally lower as compared to 10 weeks ago.

Click to get today's up-to-the-minute mortgage rates.

Mortgage Rates : Unchanged At 4.57%

According to Freddie Mac, a government-backed guarantor of U.S. mortgage bonds, the average conventional 30-year fixed rate mortgage rate was unchanged this week at 4.57%. The rate is available to borrowers willing to pay 0.8 discount points at the time of closing, where 1 point is equal to one percent of your loan size.

Discount points are akin to "prepaid mortgage interest". The more discount points you elect to pay, the lower your final mortgage rate can be. Borrowers willing to pay more than 0.8 discount points can get access to rates lower than 4.57%.

Borrowers unwilling to pay discount points should expect mortgage rates nearer to 4.75%.

Note that Freddie Mac's mortgage rate figures are based on survey data from more than 100 banks nationwide and represent a mortgage rate average. Your quoted rate may be slightly higher or lower depending on your loan's individual characteristics.

For example, if you're making a downpayment of 20 percent, you can expect lower rates than a borrower using the non-FHA 97% mortgage program. In addition, if your credit scores are above 740, you can expect a lower mortgage rate than if your credit scores are between 720-739.

Click here to learn how to keep your credit score high while shopping for a loan.

Mortgage Payments Flat For 9 Weeks

Mortgage rates are in a holding pattern. It's one which has lasted 9 weeks. This is common with mortgage rates which routinely experience "holding periods" of between six and twelve weeks. We've seen so far this year.

However, the current "hold" doesn't feel like one. Although mortgage rates have failed to make a meaningful break from 4.50% in either direction, U.S. buyers appear to believe that rates are rising, rising, rising.

They're not. Nine weeks ago, the average 30-year fixed rate mortgage rate was 4.51 percent. Today, that rate is 4.57 percent. The delta of these two rates fails to change the math of "Should I rent or should I buy?"

Home buyers wishing to limit their monthly mortgage payment to $2,250 per month see just a negligible difference in purchasing power.

- July 11, 2013 : Maximum home purchase price of $443,500

- September 12, 2013 : Maximum home purchase price of $440,400

The sense of rising rates among homeowners has slowed refinance activity, too -- especially among homeowners eligible for the Home Affordable Refinance Program (HARP). Millions of U.S. homeowners are HARP-eligible but few are even applying.

The typical HARP refinance lowers a homeowner's mortgage rate 1.8 percentage points, says Freddie Mac.

Click to get today's HARP 2.0 mortgage rates now.

Get Today's Live Mortgage Rates Now

Earlier this year, the Mortgage Bankers Association (MBA) predicted that mortgage rates would end the year at 4.4 percent. Based on current mortgage market activity, this could be an accurate mortgage rate prediction.

Mortgage rates have stopped climbing. Get a personalized mortgage rate for your situation and see what turns up. Rates are lower than you think.