What's with the Economy - Trouble Brewing?

by Girish Navare And Steve Picarillo | March 27, 2014

While the US economy continues to grow, the rate of growth is slowing. This troubling trend suggests that the US economy is, once again, at risk of slipping into recession.

This should not be a surprise given the historic patterns of economic cycles, the overall weakness blanketing much of the global economies and the escalating political conflicts abroad.

Nevertheless, for those who have yet to recover from the last recession, this is a dose of unwelcome and discouraging news. On a positive note though, absent an unexpected external event (i.e. non-economic), any recession is likely not to hit until late 2014 or early 2015.

The characteristics of a recession include a general slowdown in economic activity, a decline in business activity, a reduction in the amount of goods and services produced and sold. According to the National Bureau of Economic Research (the official authority of US recessions), there were 10 recessions between 1948 and 2011. The most recent recession began in December 2007 and ended in June 2009.

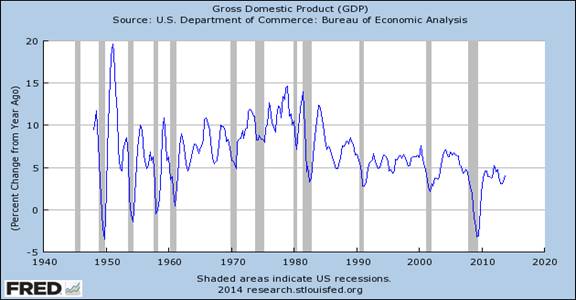

When looking back on business cycles since the Great Depression, a clear pattern emerges. Recessions typically occur every seven to 10 years. Although events, such as the 9/11 attacks or a shock to oil prices, as seen in the 1970s, can disrupt the “normal” business cycle. Given the timing in the cycle, by looking at Chart-1 below, based on calendar alone, a logical conclusion could be that the US is approaching another recession.

Chart 1

Since the end of the 2007 recession, the US economy has been on a roller coaster of highs and lows. The recovery has been tepid and, at times, tottering, fraught with starts and fits. The volatility of the Gross Domestic Product (GDP) and the common pattern of decline prior to, and of course, during a recession, are clear and rather repetitive.

Chart 2

Over the past year, growth of the “Leading Index” has been within the normal trend of this weak and lackluster recovery, however more recent data points negative, which causes pause. Importantly however, the weakness in the trend is not significant enough to predict a recession in the near-term. Accordingly, this data point suggests any recession is likely to be more than six months away.

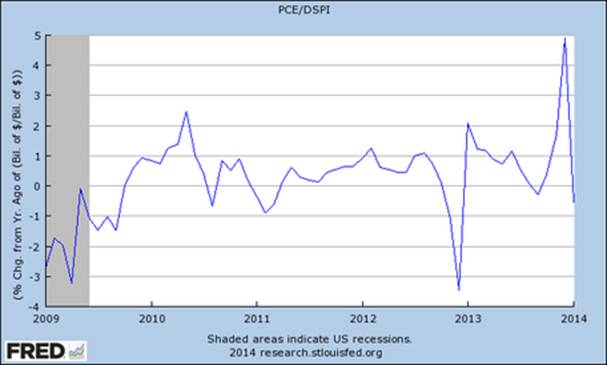

That said, there is significant data suggesting that there are clouds on the horizon. First, lets look at the growth of consumer spending to income. As Chart-3 demonstrates, consumers continue to spend, but they are spending less in relation to income. This may indicate that consumers are concerned about the security of their jobs and income, the overall economic environment, and value of their home — just to name a few.

Chart 3- Personal Expenses to Disposable Income

Another troubling trend is the trajectory and intensity of the downward trend of personal spending to income, after the year-end spike. While the severe weather that blanketed much of the US was certainly a driver behind this sudden drop, there are likely more deep-rooted economic causes. Moreover, a considerable amount of this spending will not be recouped, as such; this suggests lost dollars that will never flow through the economy. We are closely watching this ratio as it unfolds in the coming months.

One of the most widely recognized indicators of a recession is an increase in the unemployment rates. While employment data is useful in charting the depth of a recession, unemployment is less useful in predicting recessions, as it tends to peak well after the recession is over.

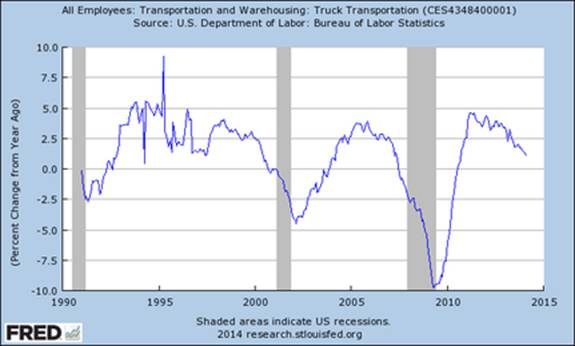

While civilian unemployment is considered a lagging indicator, the truck transportation and warehouse portion of employment, Chart-4, provides insight in forecasting impending recessions. Given the need for people to buy food and goods, transportation activity can be used as an economic indicator, given goods need to be moved well before the final retail sale occurs. Slowing employment in this sector suggest less goods are being shipped, indicating reduced demand for inventory, and as such, a slower business environment.

Chart 4

Transportation employment growth remains above the zero growth line, but the growth is decelerating and is approaching negative territory. This measurement of employment provided a six-month warning of an impending recession for the past two recessions. Given this, the trajectory of the transportation index suggests a recession may very well be on the horizon, but still more than six months away.

There are also numerous external factors such as the economic weakness in the Eurozone, the slowing economy in China, the Russian conflict, the unsettled Middle East and the constant threat of terrorism, all of which can impact the timing of the next recession. By their nature, these events are difficult, if not impossible, to predict and it is extremely difficult to fully estimate the overall impact of any such factor(s) on the economic environment in the US or across the globe.

The above are just a few signposts used to opine on and predict economic trends. There are countless other measures and indicators that may tell the same story or something totally different. The most certain prediction that one can make is that the next nine to 12 months will likely be more of the same — anemic economic growth, low levels of employment, highs and lows, and general apprehension.

After all the numbers are crunched, massaged, charted and presented, it may just fall back to historic trends, which tells us that recessions typically transpire every seven to 10 years, so the calendar suggests we are getting close. Time will tell.

Visit WeissWatchdog.com to access up to 10 financial strength and investment ratings. Just register — it’s free! Once you set up a watch list, Weiss will send you an alert whenever the rating for a company on your list changes.

When you need more than a letter grade... the Weiss one-page report will tell you what you need to know... about your bank, credit union or insurance company!

About the authors:

Girish Navare, bank and credit union analyst at Weiss Ratings, is a CFA charter holder with more than 15 years of financial industry experience in quantitative analysis and credit-risk management with various sized domestic and international banks and finance companies.

Steve Picarillo is an internationally known and respected financial executive, analyst and author. Steve has spent most of his career on “Wall Street” as a lead analyst covering large financial institutions in the US and in Europe. In addition to being an expert on global banking, credit ratings, banking regulations and compliance, Steve is a student of the global economic environment, a motivational speaker and an active philanthropist. Steve’s recent articles, full biography, CV and contact information can be found on www.stevepicarillo.com.

Copyright © Weiss Ratings. All rights reserved.

http://www.weissratings.com/news/articles/140327-whats-with-the-economy-trouble-brewing/