With Mortgage Rates Near 2-Month Low, The Cost Of Homeownership Drops Nationwide

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

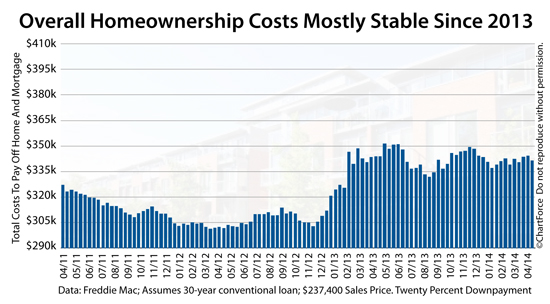

According to Freddie Mac's weekly survey of more than 100 U.S. banks, the average conforming 30-year fixed rate mortgage rate fell to 4.34% this week, and appear headed lower into next week, too.

Since the release of the March jobs report, rates have been in steady decline.

Because of lower mortgage rates, homeowners now pay less 7% interest to pay off their home loans as compared to January 1. There are opportunities for buyers and refinancing homeowners to save good money.

Click to get today's mortgage rates.

Lower Mortgage Rates Reduce Interest Payments

Mortgage payments to your bank are comprised of two parts -- a principal component and an interest component. Principal is the portion of your original loan which you repay to the bank. Interest is the fee you pay for borrowing those monies.

The amount of principal and interest including with each payment changes month-by-month. At the start, the principal portion is relatively small; growing larger with each month.

Interest works in reverse.

At the start of a loan, interest payments are relatively large, then decrease in size monthly. A homeowner's schedule of payments is known as an amortization (ah-mor-tih-ZHAY-shun) schedule. It's a model which favors the banks because interest payments are maximized during a loan's early years.

Few homeowners hold loans for a full 30 years anymore.

With current 30-year fixed rate mortgage rates at 4.34 percent, though, the "early year" interest payments aren't so high. The first payment of a new 30-year fixed rate mortgage is more than one-fifth principal.

As compared to five years ago, this is a large percentage of payment going to principal.

- Mid-2009 : First payment comprised of 15% principal, 85% interest

- Mid-2014 : First payment comprised of 22% principal, 78% interest

A loan from 2009 didn't reach 22% principal-per-payment until its 50th month. Today's loans get there in Month 1. This means that less money is spent on mortgage interest, and that home equity can build more quickly.

For homeowners using conventional loans with less than 20% down, or refinancing via HARP, then, refinancing to low rates can help get rid of PMI more quickly.

Homeowners with low rates save more money.

Click here to get today's mortgage rates.

Refinancing In 2014 : No Home Equity Required

With mortgage rates low and home values rising, literally, there are millions of U.S. homeowners eligible to refinance.

The best news is that you may not need home equity to do it.

With just modest credit scores and a verifiable income, homeowners can be mortgage-eligible via any one of five government agencies -- Fannie Mae, Freddie Mac, the FHA, the VA and the USDA. Each has a refinance program for homeowners with, or without, home equity.

For homeowners whose homes have lost value since purchase, some of these options include :

- Fannie Mae / Freddie Mac : HARP (also known as The Obama Refi)

- FHA : The FHA Streamline Refinance

- VA : The IRRRL program for veterans

- USDA : The USDA Streamline

For everyone else, "standard" refinance programs give access to great, low rates, too. You'll want to avoid high closing costs, however, if possible. Paying too much to refinance can reduce the benefits of refinancing at all.

Therefore, when you get a quote from a lender, ask for low- and no-closing cost mortgage options. Rates for such loans will be marginally higher than Freddie Mac's published rate of 4.34% , but the money saved in the long-run may be worth it.

See Today's Low Mortgage Rates Live

If you're a U.S. homeowner and have yet to refinance, see what today's low mortgage rates can do for your payments. You'll win monthly savings today, and gain long-term savings for your future.

Compare today's mortgage rates online at no cost and with no obligation. Rates are available in an instant and your social security number is not required to get started.