How The HARP Mortgage Changed The Way U.S. Homeowners Refinance

The traditional home refinance has changed.

The result of extra-forgiving loan programs including HARP 2.0, the VA-to-VA refinance, and the FHA Streamline Refinance, today's underwater homeowners are getting access to low rates which would have been unavailable just a few years ago.

And, yet, there are millions more households which could potentially join the boom. FHA loan requirements have been loosened, mortgage rates keep dropping, and more than 667,000 U.S. homeowners are "in the money" for a Home Affordable Refinance Program (HARP) refinance.

It's easier than ever for an underwater homeowner to refinance its mortgage.

Get today's mortgage rates now.

HARP Refinance : Mortgages For Underwater Homeowners

Since 2009, millions of U.S. households have refinanced despite having little or no home equity. Some have refinanced via the VA Streamline Refinance and others via the FHA Streamline Refinance. Both programs, not coincidentally, waive home appraisals.

More than 3.1 million others have refinanced via the Home Affordable Refinance Program.

Sometimes called the "Obama Refi", the HARP loan refinances homes for homeowners with lost home equity. Via HARP, there are few verifications beyond proof of a good mortgage payment history dating back 12 months.

HARP got its start in 2009.

At the time, the U.S. economy was sinking and mortgage rates had fallen to an all-time low. Unfortunately, home values were dropping, too, so few homeowners were eligible to refinance without taking on private mortgage insurance (PMI).

For most homeowners, the additional monthly costs of PMI wiped out the benefits of refinancing to a new, low rate.

Yet, given current interest rates, the typical homeowner stood to save $3,000 annually. The government recognized this, and knew that an extra $3,000 in disposable income would help reduce the instances of foreclosure, would boost consumer spending, and would help stave off recession.

To help make these refinances possible, then, the government created the Home Affordable Refinance Program (HARP).

The main draw of the government's HARP mortgage program was that it allowed homeowners whose loan-to-value exceeded 80% to refinance without an increase in their current private mortgage insurance coverage. This meant that homeowners who had originally made a 20% downpayment -- but now had little or no equity -- were eligible to refinance without needing PMI at all.

Prior to HARP, underwater homeowners were required to do a "cash-in" refinance to refi without needing PMI. Post-HARP, the cash-in mortgage was nearly made extinct.

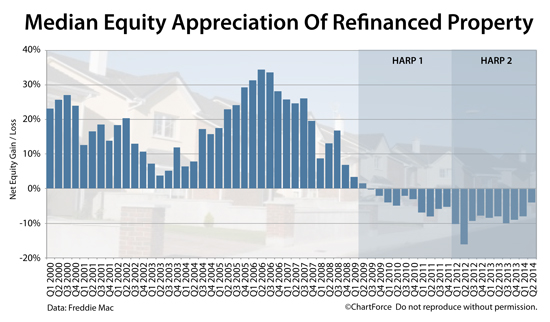

Between April and June 2014, Freddie Mac data shows the median appreciation of a refinanced home was -4%, marking the 20th straight quarter during which lenders refinanced an "underwater mortgage" more often than a home with existing home equity.

Not surprisingly, this 20-quarter streak began around the same month that the government launched its Home Affordable Refinance Program (HARP), a component of the the 2009 Making Home Affordable program.

Are you HARP-eligible? Get today's mortgage rates.

HARP 2.0 : More Options For "Underwater Mortgages"

HARP was successful early on, but the program was reaching too few U.S. households, the government felt. The government had aimed to help 7 million households. After two years, however, HARP hadn't reached even one million homes.

So, to boost HARP closings, in late-2011, the government loosened the programs requirements and relaunched the Obama Refi as HARP 2.0.

"The President waives refi requirements", said headlines.

The biggest difference between the original HARP and HARP 2 was that HARP 2 allowed for unlimited loan-to-value on a refinanced home. No matter how far underwater you were with your home and your loan, with HARP 2.0, refinancing was possible

The release of unlimited LTV was a boon to HARP refinancing in places such as Phoenix, Arizona; Orange County, California; and Las Vegas, Nevada -- three areas in which homes values had plunged between 2007-2009. Homeowners in these areas were typically severely underwater and, today, HARP accounts for more than one-quarter of all refinances in Georgia, Florida, and Ohio.

HARP 2 has changed how refinancing is done.

Cash-in refinances are more rare today. Underwater refinances are common. Just look at how underwater mortgages have affected the median home appreciation of all refinanced loans via Freddie Mac since 2011.

- HARP 1.0 : Median refinanced home appreciation of -3%

- HARP 2.0 : Median refinanced home appreciation of -9%

If not for sharply rising home values over the last 12 months, the difference would be even more stark.

The Home Affordable Refinance Program is scheduled to terminate December 31, 2015.

Are you HARP-eligible? Get today's mortgage rates.

HARP Mortgage Rates Drop To 60-Week Low

Today's mortgage rates are the lowest they've been since June 2013, and low rates have put the HARP loan within reach for more than 667,000 U.S. households.

The government refers to these homeowners as being "in the money" and it has published a state-by-state list of eligible homeowners. Perhaps you're among them.

The government defines "in the money" homeowners as those with loan balances of at least $50,000; with remaining loan terms of at least 10 years; and, with current mortgage rates which are at least 150 basis points (1.5%) above today's market rate.

Many of these homeowners will save 30% or more on their mortgage each month. It's an amount which far exceeds the government's initial estimate of three-thousand-dollars-per-year per household.

Via HARP, some households save $8,000 or more each year.

If your current loan is HARP-eligible, then, it's sensible to compare your current mortgage rate against today's HARP pricing. Lenders will quote you rates with no obligation to proceed and typically won't require your social security number or a credit check to get started.

Check Your HARP Mortgage Eligibility

Hundreds of thousands of U.S. homeowners are immediately HARP-eligible. Maybe you are one of them. With mortgage rates low, it's time to explore what kind of money you can save.

The Home Affordable Refinance Program offers low mortgage rates, simple underwriting standards, and a fast closing. See what the HARP mortgage can do for you. Get started with a quote today.

Explore your HARP options now.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Copyright Full Beaker, Inc. 2014

http://themortgagereports.com/16481/harp-refinance-mortgage-rate-home-equity

Try the Mortgage Payment

Calculator

Try the Mortgage Payment

Calculator