July Employment Report Pushes 30-Year Mortgage Rates Lower (FHA, VA, USDA & Conv.)

Current mortgage rates are dropping after the July Non-Farm Payrolls report release.

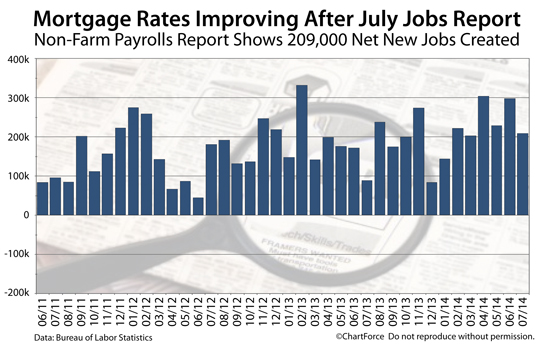

Two-hundred-nine thousand persons were added to U.S. payrolls last month, with a net fifteen-thousand person revision made to the releases of the two months prior. Total jobs created are mostly in-line with Wall Street's expectations for the report.

Mortgage interest rates are improving on the release. Rates remain near a 14-month low.

Mortgage Rates Lower After July Jobs Report

Once monthly, the Bureau of Labor Statistics releases its Non-Farm Payrolls report. More commonly known as the "jobs report", Non-Farm Payrolls details employment in the U.S. economy by sector, and demographic.

The release also includes workforce-related data including employment rates, workforce size, and the number of hours worked per week, on average.

According to the government, the U.S. economy added 209,000 net new jobs in July with nearly than one quarter of those jobs coming from professional and business services. Employment in retail stores added twenty-seven thousand jobs to the economy; and construction jobs grew by twenty-two thousand.

Employment in government, financial activities, and health care was little changed.

Despite net job gains, the U.S. Unemployment Rate rose one tick to 6.3% last month.

Prior to its release, analysts were unsure of what the July Non-Farm Payrolls report would show. Estimates ranged from 200,000 to 275,000 net new jobs created. The actual results were in-line, toward the lower-end of estimates.

Mortgage rates are improving after the report's release. Rates have returned to their lowest levels since mid-last year.

Click to see today's live mortgage rates.

The Future Of Federal Reserve Stimulus

The Non-Farm Payrolls report swings a big stick in mortgage markets. Job growth is linked to economic growth, and economic growth is linked to mortgage rates.

Since late-2012, however, the jobs report-mortgage rates connection has been even tighter. This is because of the Federal Reserve's current, third round of quantitative easing -- a stimulus program more commonly called "QE3".

Via QE3, the Fed purchases a fixed amount of Treasury and mortgage bonds monthly on the open market. The group's purchases drive up bond prices which, in turn, drives down rates.

The Federal Reserve believes low mortgage rates for the 30-year fixed and other other products are key to the U.S. labor market. Low rates boost homeownership which boosts consumer spending, construction jobs, and the health of tens of satellite sectors.

In other words, low mortgage rates creates jobs.

QE3 was announced in September 2012 with a size of $85 billion monthly -- $45 billion dedicated to Treasury bonds and $40 billion dedicated to mortgage bonds. Beginning in early-2014, a QE3 "taper" began.

At a pace of $10 billion monthly, the Fed has been reducing the size of its monthly purchases. QE3 will end in October 2014, given the current pace. Wall Street said this would lead to 5-handle mortgage rates.

So far, Wall Street has been wrong. Mortgage rates have dropped as QE3's size has reduced.

There are two main reasons why.

The first reason reason why mortgage interest rates are dropping as QE3 shrinks is that, as the Fed buys fewer mortgage-backed bonds, there are fewer mortgage-backed bonds available to buy. U.S. mortgage loan volume is fading, which has reduced the number of newly-issued mortgage-backed securities for sale.

The Fed is still purchasing a large percentage of the overall mortgage-bond issuance, which helps to keep mortgage-bond prices high. When mortgage bond prices rise, mortgage rates drops. It's how mortgage rates are made.

A second reason why mortgage rates are low is that there is economic uncertainty worldwide.

China's current growth may be unsustainable, the Eurozone is sputtering along, and there's concern for bank failures in Europe. Furthermore, there is a series of geopolitical unknowns including items from the Middle East, Russia and Ukraine, and Africa.

During periods such as this, "safe haven" buying picks up, which helps to lead mortgage rates lower.

Freddie Mac's weekly mortgage rate survey says the 30-year fixed averages 4.13 percent. Many consumers, though, report getting rate quotes in the 3s. Mortgage rates remain near 14-month lows.

Get Today's Mortgage Rates Now

Mortgage rates reacted positively to the July Non-Farm Payrolls report. With mortgage rates low, it's a good time to lock your mortgage rate; or consider the refinance of an existing loan.

Don't miss your chance to lock low rates. Compare today's live rates here, at no cost whatsoever. Rates are available online with no obligation and with no social security number required to get started.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Copyright Full Beaker, Inc. 2014

http://themortgagereports.com/16404/jobs-non-farm-payroll-mortgage-rates-fha-va-usda