New Home Sales Drop Despite Falling Mortgage Rates; National Supply Reaches 6.0 Months

Sales of new homes slipped to a 4-month low in July, despite the lowest mortgage rates more than a year.

According to the U.S. Department of Housing and Urban Development (HUD), 412,000 new homes were sold on a seasonally-adjusted, annualized basis in July; and the national supply of new homes for sale reached a multi-year high.

Despite weaker-than-expected numbers, the average sale price of a new home is up 3 percent from last year and demand for new homes remains strong.

Mortgage rates are at their lowest levels of the last 14 months. Purchasing power is up 8% from the start of the year.

Click to get today's live mortgage rates.

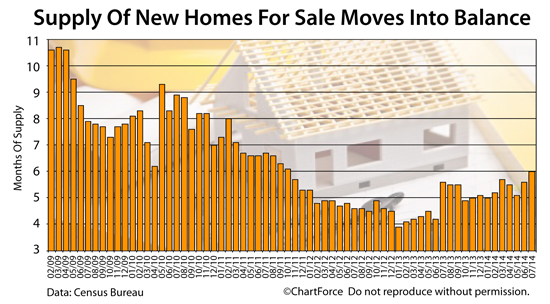

New Home Supply Reaches 6.0 Months

The number of new homes sold fell by ten thousand units in July 2014, moving to 412,000 units on a seasonally-adjusted, annualized basis.

This figure was below Wall Street's expectations, but the government also reported a net 33,000 upward revision to the results from April, May, and June.

The July New Home Sales data was inline with consensus opinion. However, different from prior months, the mix of July's New Home Sales skewed toward buyers of luxury homes.

- 14% of homes sold were sold at prices of $500,000 or more

- 8% of homes were sold at prices of $150,000 or less

In addition, the national New Home Supply increased 0.4 months to 6.0 months as the number of homes for sale topped 200,000 for the first time in several years. At the current pace of sales nationwide, all new homes for sale would be "sold out" in six months exactly.

This 6-month marker is an important one -- six months of supply is the purported housing balance point between a buyer's market and a seller's market.

When home supply exceeds six months, buyers tend to gain negotiation leverage over sellers. Conversely, when home supply falls below six months, sellers tend to have control.

July ended a 32-month streak in which New Home Supply favored sellers over buyers. Home prices were up markedly during that time, rising by as much as 25% in some markets.

Current Mortgage Rates Boost Buyer Purchasing Power

As home prices have climbed this year, mortgage rates have dropped. 30-year mortgage rates have been on steady decline en route to the lowest rates of 2014 and the best rates since June of last year.

Assuming a purchase price of $300,000, today's homeowners with a VA mortgage rate of 3.50% can expect to pay $1,347 monthly to their lender -- $177 less as compared to eight months ago.

Savings are similarly large with other low- and no-downpayment mortgage options including the FHA mortgage, which requires just 3.5% down; the USDA loan, which requires nothing down; and, conventional financing via Fannie Mae and Freddie Mac with as little as 5% down.

Of all the low-downpayment programs, though, the FHA-backed loan has the most traction. Recently, several large U.S. lenders relaxed their FHA minimum credit score requirements, lowering minimum FICO scores to 580, which has spiked FHA loan applications.

An estimated 14% of the U.S. population carries credit scores between 580-640.

Another reason why FHA loans have been popular is because FHA loans are "assumable". This means that a homeowner can transfer a home's existing mortgage to the "next" homeowners when the home is eventually sold -- whenever that may be.

With today's mortgage rates sinking to the 3s, the FHA's assumable feature can be an attractive selling point -- especially if mortgage rates return toward historical norms within the next half-decade.

Buying A New Home? "Deals" Are Disappearing

For today's new home buyers, there's a window to find great deals. Mortgage rates are low, housing supply has moved into balance, and purchasing power has been extended.

See today's live mortgage rates now. Mortgage rates are available online at no cost, with no social security number required to get started, with no obligation to proceed.

Get today's mortgage rates here.

Copyright Full Beaker, Inc. 2014

http://themortgagereports.com/16542/new-home-sales-supply-mortgage-rates-builders