Lower FICO Scores Now Allowed: Mortgage Lenders Change Credit Score Standards

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Borrowers with low credit scores are having an easier time getting approved for a mortgage.

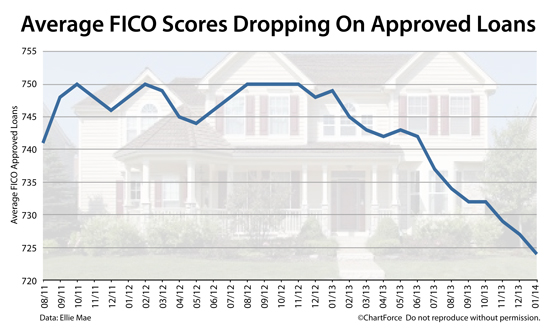

According to the January 2014 Ellie Mae Origination Insight Report, the average FICO of an approved mortgage fell to 724 -- the lowest average credit score for approved loans since the mortgage origination software company first launched its monthly analysis more than two years ago.

It's another sign of the mortgage market's thaw.

Click here to get an instant mortgage rate quote.

Average FICO Drops

The average FICO score on a closed mortgage fell three points in January 2014 from the month prior, registering 724 nationwide.

It's the third straight month in which the average FICO of a closed mortgage dropped, and marks a monstrous 25-point reduction as compared to the year prior.

Today's borrowers are finding it easier to get approved with less-than-perfect credit.

The move toward lower FICO scores has been a gradual one. Late last decade, the mortgage market reacted to a rash of defaults and foreclosures. Lenders tightened guidelines, limiting the number of Americans who could get access to a home loan.

The cycle became self-reinforcing.

As loans were denied, the housing market seized. Buyers couldn't buy, few could refinance, and the number of distressed properties in the 50 united states ballooned levels unmatched in history.

Programs such as the FHA Streamline Refinance, the VA Streamline Refinance and the HARP refinance gave certain underwater homeowners the means to refinance to lower payments, "out of trouble". For everyone else, the outlook was bleak.

Mortgage standards toughened as lenders sought to reduce risk. High-LTV loans were removed for mortgage menus; home equity lines of credit (HELOC) went scarce; income and asset requirements increased for borrowers of all types.

FICO score minimums climbed, too.

By way of definition, "FICO score" is another way of saying "credit score". The FICO model, first developed by the Fair Isaac Company, has been in use for decades. It's meant to predict the likelihood of a person going delinquent on a mortgage.

High FICO scores correlate with a low default probability and low FICO scores correlate with a high default probability.

However, the credit scoring model is imperfect. When consumers exist in a world with multiple "external threats" including weak labor markets, soft housing, and an economy in recession, credit scores may understate any one person's risk of default.

Similarly, when labor market improve, home values rise, and the economy begins to expands, credit scores may overstate a person's risk of default. Lenders know this.

It's easier to get a loan with low FICO scores today.

Click here to get a live mortgage rate quote.

FHA Mortgages Let More People In

A rise in the number of closed FHA loans is among the reasons why Ellie Mae reports falling average credit scores on closed loans.

In January, FHA loans accounted for 21% of all closed mortgages, marking the highest reading for the low-downpayment program since April 2013. Not coincidentally, that was a month during which the Federal Housing Administration raised its mortgage insurance premiums (MIP) for U.S. borrowers.

This time, demand for FHA loans did not rise because of rising MIP. It rose because the FHA is filling a marketplace void.

As an agency, the FHA doesn't actually make loans. Instead, it insures loans made by U.S. lenders which conform to its standards.

In order to qualify for FHA backing, lenders must ensure that a loan meets or exceeds the FHA's minimum credit quality standards. These standards rage over hundreds of traits including borrower income and assets; subject property characteristics; and the requested mortgage loan size.

FHA loans must also meet minimum FICO standards.

According to today's FHA guidelines, the FHA will insure loans for borrowers with a 580 FICO score; with some granted exception down to a FICO of 500. However, lenders have recently applied investor overlays to this particular standard.

Instead of accepting the FHA's stated minimum credit score of 580, lenders have limited FHA loan access to borrowers whose FICOs are 640 or better. This is within a bank's right and the policy has kept FHA loans at bay for large segments of the U.S. population.

That is, until recently.

Since the start of the year, at least one major mortgage lender has lowered its minimum FHA credit score to 600; and, many smaller mortgage banks have followed the lead. You no longer need a 640 FICO to get an FHA mortgage.

The average FICO score of an approved loan is down 25 points in 12 months.

Get A Live Mortgage Rate Quote Now

For borrowers with low credit scores, it's a good time to be shopping for a mortgage rate. Lenders are loosening their standards and mortgage rates have dropped to multi-month lows.

If you've been turned down for a mortgage in the past because of your low credit score, it's time to apply again. Rates are available online at no cost and with no obligation, and no social security number is not required to get started.