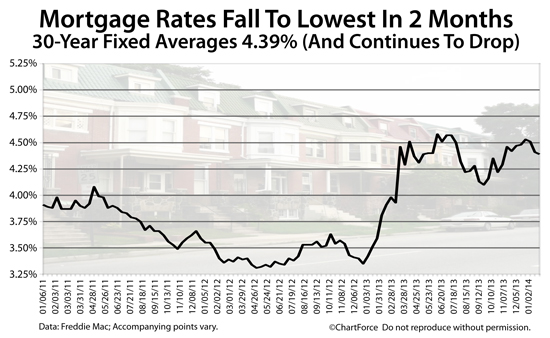

30-Year Mortgage Rates Defy Experts, Fall For Third Straight Week To Reach 4.39%

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Mortgage rates have dropped for the third straight week, and the momentum lower is picking up. Purchasing power among buyers has grown since the start of the year, and refinance opportunities for existing U.S. homeowners are re-opening.

Reconsider your current rate. The market's trending better and there's money you can save.

Click for an instant, live rate quote.

30-Year Fixed Rate : Falling 3 Weeks In A Row

According to Freddie Mac's Primary Mortgage Market Survey (PMMS), the average 30-year fixed-rate mortgage rate fell 0.02 percentage points this week to reach 4.39%.

The rate is available to borrowers willing to pay 0.7 discount points at closing plus a full set of closing costs.

The 15-year fixed rate mortgage rate fell, too, easing 0.01 percentage point to 3.44%.

Rates are based on a weekly survey of more than 100 U.S. banks. The survey asks banks to submit to Freddie Mac their "going rate" for a prime borrower where "prime borrower" has strict definition.

A prime borrower is one with a credit score of 740 or higher; with a purchase downpayment of twenty percent or more; with a debt-to-income ratio which meets mortgage guidelines; and with ample reserves to support a mortgage approval.

Furthermore, loans for prime borrowers are loans made against single-family residences which includes detached homes, certain town homes and attached properties, and condos which meet minimum eligibility standards.

The Freddie Mac survey does not account for loans backed by the FHA or VA, nor does it account for No-Money-Down USDA loans in suburban and rural areas.

Since reaching a multi-year high of 4.57% in September, mortgage rates have finally made a sustained run lower. For the first time in more than a quarter, mortgage rates have dropped through three straight weeks, and today's rates are the lowest of the year.

Click to get a live mortgage rate quote.

Low Mortgage Rates Boost Household Savings

At 4.39%, today's 30-year fixed rate mortgage is cheap. The benchmark rate has averaged over 8% since the 1970s, and borrowers pay far fewer discount points than ever before.

Furthermore, millions of U.S. homeowners are paying more than today's going rate.

Only since the start of this decade have sub-5 percent mortgage rates been common. That means that every homeowner whose mortgage pre-dates 2010 could potentially save money via a refinance.

Savvy homeowners are figuring this out. They're refinancing their homes, getting mortgage rates in the 4s, and booking huge monthly savings on their respective mortgages.

Consider this : Recent Freddie Mac data shows that the median age of a refinanced mortgage was 6.7 years in last year's third quarter, which means that the typical U.S. homeowner lowered their mortgage rate via refinance by 1.82 percentage points.

The typical homeowner is savings 26.1% per month.

And, for homeowners using HARP to refinance, the savings are even larger.

Today's typical HARP household saves close to one-third monthly. That's a big number and millions of HARP-eligible households have yet to refinance. And we're not talking HARP 3, either -- this is just for HARP 2.0.

HARP 3 would be the third iteration of the popular Home Affordable Refinance Program, the market stimulus program meant to give underwater homeowners access to today's low mortgage rates. The revamped program, which has not been released, could put today's low mortgage rates within reach for an estimated 4 million additional U.S. households.

Get Today's Live Mortgage Rates

Mortgage rates are dropping. It's a good time to refinancing, or even stretch your purchase dollar. With mortgage rates at a 2-month low, the potential for savings is large.

Mortgage lenders want to make loans and you could be eligible for ultra-low rates. Get a personalized mortgage rate online and see for yourself.

It's fast, it's free and there's no obligation whatsoever.