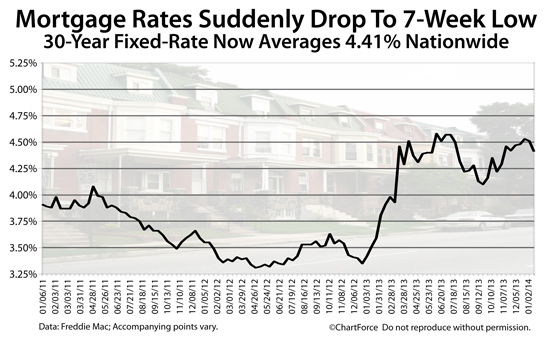

30-Year Mortgage Rates Fall To 4.41% After Biggest 1-Week Drop In Two Months

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Mortgage rates dropped big last week, according to Freddie Mac's weekly Primary Mortgage Market Survey (PMMS).

The average conforming 30-year fixed rate mortgage rate fell 0.10

percentage points last week to 4.41%, on average, lowering the

benchmark rate to a multi-month low.

Have you seen today's mortgage rates?

Click for an instant mortgage rate quote.

30-Year Fixed Rate Mortgage Rate : 4.41%

Each week, government-backed Freddie Mac conducts a mortgage rate survey of 125 banks nationwide. The survey asks banks reply with their "going" mortgage rate for a prime mortgage borrower, including the number of accompanying discount points required to lock that rate.

A prime borrower, as defined by Freddie Mac, is one with ample home equity or downpayment, high credit scores, and documented income which meets or exceeds mortgage underwriting standards.

HARP mortgages are not considered "prime", nor are VA loans or FHA loans which are backed by the Department of Veterans Affairs and the Federal Housing Administration, respectively.

Freddie Mac's weekly survey shows the average 30-year fixed rate mortgage rate at 4.41%. This is the lowest that mortgage rates have been since mid-November.

In order to get Freddie Mac's 4.41% mortgage rate, borrowers should expect to pay 0.7 discount points, on average; or $700 in closing costs for every $100,000 borrowed.

This means that borrowers whose loans are at the maximum 2014 conforming loan limit of $625,500 in areas such as Loudoun County, Virginia; Potomac, Maryland; and Orange County, California, can get the Freddie Mac rate for a one-time cost of $4,379.

The 15-year fixed rate mortgage rate also improved last week, shedding 0.11 basis points to move to 3.45% for borrowers willing to pay 0.7 discount points at closing. This, too, is a multi-month best.

Click for a personalized mortgage rate quote.

Where Are Mortgage Rates Lowest? California.

Mortgage rates made big gains last week, but they fell unevenly from region-to-region. Depending on the state in which your home is located, you'll see different mortgage rates quoted from your lender.

Today's cheapest "rate-and-fee" combinations are being offered to mortgage applicants in the West Region, an area which includes California, Oregon, Washington, Nevada and Arizona.

Mortgage rates in the West Region average 4.38% with an accompanying 0.7 discount points.

By contrast, the most "expensive" mortgages are going to applicants the Southwest Region, an area which includes New Mexico and Oklahoma; and the Southeast Region which includes Florida and Georgia.

By region, Freddie Mac reports :

- Northeast Region : 4.39% with 0.8 discount points

- West Region : 4.38% with 0.7 discount points

- Southeast Region : 4.42% with 0.5 discount points

- North Central Region : 4.45% with 0.7 discount points

- Southwest Region : 4.47% with 0.6 discount points

Note that discount points are tax-deductible for some home buyers and refinancing households; and that discount points are optional. Mortgage applicants may choose to pay zero discount points, if that's preferred, in exchange for a slightly higher mortgage rate.

In general, loans with no points are priced no more than a quarter-percentage point higher.

A Good Day To Lock Your Mortgage Rate

Freddie Mac shows the average 30-year fixed rate conventional mortgage rate lower this week -- again. It's the second straight week mortgage rates have dropped, but this may be the best that rates get in 2014. Market analysts predict rates will rise up to one percentage point before the year is over.

Today's low rates are ready to be locked. See how much money you can save as compared to even last week. Get a live rate quote online, with no cost and no obligation to proceed.