What is Fed Tapering?

Tapering is a term given to an expected series of

upcoming actions on the part of the Federal Reserve to pull back new

infusions of cash into the U.S. economy. Ever since the credit

crisis and subsequent Great Recession, the Fed has been injecting

liquidity into the banking system to stimulate the economy and keep

interest rates low. At some point, when the economy shows enough

signs of improvement, the Fed will need to begin slowing the rate at

which it buys assets and pumps up markets. Investors and other

financial observers fear that as the Fed begins this tapering

process (tapering off the buying of assets to inject liquidity into

the economy) markets and the economy may suffer.

The Fed is currently purchasing $85 billion in bonds and mortgage-backed securities every month. The Fed is purchasing longer term assets in order to put downward pressure on long-term interest rates. By increasing the cash reserves of banks through large scale asset purchases, the Fed is also making it easier for banks to lend and lowering the cost of borrowing.

Any pullback from the monthly $85 billion in asset purchases will signal the start of Fed tapering.

What Every Investor Needs to Know

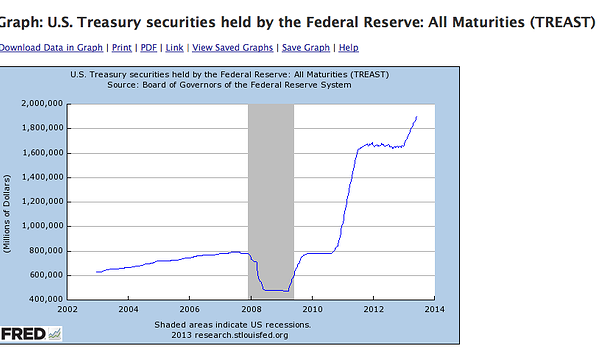

The Fed's current balance sheet stands at $3.1 trillion, or about 20% of U.S. GDP. This is a much larger balance sheet than the Fed carried prior to the 2008-09 credit crisis. The Fed's balance sheet is also risky, because it is comprised largely of long-term bonds and mortgage-backed securities, as opposed to short-term assets. How will the Fed reduce the balance sheet to a more normal size and what impacts will this reduction have on the typical investor?

Will Fed tapering put the brakes on the struggling economy by removing the support of artificially low interest rates? Will tapering be handled with such finesse that rising interest rates will have minimal effects? Should tapering take place at all? These are questions that cast growing shadows across the financial horizon as the 2008 financial debacle and Fed rescue program reach a possible turning point. Moreover, what can befuddled investors do to be in the best position when and if monetary policy changes course? These are questions we explore in Fed Tapering Survival Guide.

© 2013 by FedTapering.com