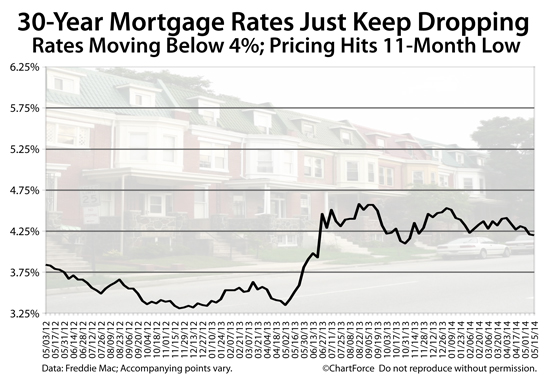

30-Year Fixed Mortgage Rates Drop Again This Week; Trek Toward 4.00% Continues

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

It's another week of falling mortgage rates.

The average conventional 30-year fixed-rate mortgage rate eased 0.01 percentage points this week to reach 4.20 percent -- its lowest reported point in 27 weeks. However, many U.S. consumers have been reporting mortgage rates in the 3s.

For active home buyers and refinancing households, it's a terrific time to compare today's rates. Pricing is the best it's been this year.

30-Year Fixed Rate Mortgage Rate Now 4.20%

According to Freddie Mac's weekly Primary Mortgage Market Survey (PMMS), conventional 30-year fixed-rate mortgage rate and the conventional 15-year fixed-rate mortgage rate both improved again last week.

The 30-year fixed rate mortgage rate has dropped in 5 of the last six weeks and both rates are at their lowest levels of the year.

Freddie Mac shows the 30-year rate at 4.20%, on average, nationwide; and, the 15-year rate at 3.29%. However, mortgage rates today are actually lower than what Freddie Mac is reporting. This is because survey responses are typically received during the first part of the week and rates made big gains Wednesday and Thursday morning -- after Freddie Mac's survey had closed.

Today's mortgage rates are lower than they've been in 11 months.

Note that the Freddie Mac survey shows mortgage rates offered to "prime" borrowers, which is defined as persons with a high credit score, verifiable income, low debt-to-income ratio, and a twenty percent downpayment. It also assumes that borrowers will pay discount points at closing.

Discount points are a one-time closing cost and, for tax purposes, are considered prepaid interest. For some homeowners, discount points are tax-deductible.

The cost of one discount point is equal to one percent of your loan size such that paying a discount point on a $100,000 loan costs $1,000. Discount points can be paid with cash, or, when refinancing a loan, can be added to your overall loan size.

Freddie Mac's survey reports that borrowers are paying an average 0.6 discount points to lock this week's 30-year fixed mortgage rate. Loans at the 2014 conforming loan limit of $625,500, then, in places like Alexandria City, Virginia; Rockville, Maryland; and Newport Beach, California, are subject to $3.753 in discount points.

15-year mortgage rates at 3.29% also require 0.6 discount points paid at closing.

Click for a personalized mortgage rate.

Conforming 15-Year Mortgage Rate Falls To 3.29%

As mortgage rates drop, home buyers can buy homes more affordably. Purchasing power has increased more than four percent already this year. In addition, falling rates open refinance opportunities for existing U.S. homeowners.

Freddie Mac's weekly mortgage rate survey showed the following average mortgage rates nationwide :

- 30-year fixed rate mortgage : 4.20% with 0.6 discount points

- 15-year fixed rate mortgage : 3.29% with 0.6 discount points

- 5-year adjustable rate mortgage : 3.01% with 0.4 discount points

Note that the Freddie Mac-published mortgage rates apply to conforming mortgages only. Mortgage rates for FHA mortgages, VA mortgages, USDA loans, and jumbo loans are governed by different mortgage market mechanisms.

However, rates for these products are similarly low.

Homeowners with existing FHA and VA home loans report refinance rates below four percent with either limited costs, or no closing costs due. USDA rates are also low.

Furthermore, not everyone will get access to the Freddie Mac-surveyed rates shown above. Mortgage applicants with lower credit scores, for example, or home buyers of a condominium may receive rate quotes at a slightly higher rate.

The same is true for homeowners refinancing via the "Obama Refi", which helps homeowners whose homes have lost value to refinance at today's market rates. Some may receive slightly higher mortgage rates than what Freddie Mac has published for the week.

© Full Beaker, Inc. 2014

http://themortgagereports.com/14938/mortgage-rates-freddie-mac-lock-refinance