China’s Tricky Balancing Act

by Girish Navare and Steve Picarillo | May 7, 2014

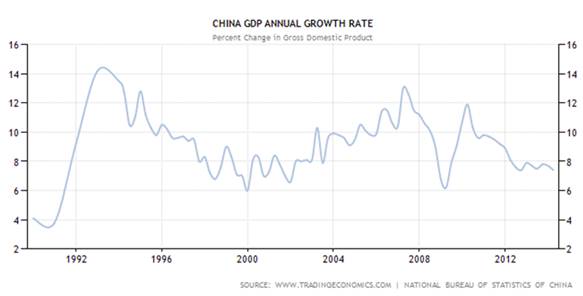

As the fastest growing major economy in the world, China is walking a shaky tightrope trying to balance economic reform and growth. Its Gross Domestic Product (GDP) growth is down, flirting with the "status quo," and barely keeping pace with population growth. As the country continues to shift its economy from debt-driven manufacturing to an economy driven by consumption, time continues to provide headwinds.

Indeed, more time is needed to convert China’s reform scheme into policy. Moreover, as the government pulls back on credit, it must avoid triggering a recession. As such, the Chinese government faces many challenges to achieve economic growth, job creation and income generation sufficient to fuel a consumption-based economy.

So, the question remains: Will China keep its economy rolling?

For the first quarter of 2014, China's economy expanded by 7.4 percent. While this is better than many expected, it is a clear slowdown from the 7.7 percent growth experienced in the fourth quarter of 2013. More notably, this is much lower than the 10+/- percent growth rate the country has experienced over the past 10+ years. So, the reduced GDP growth is cause for economists, analysts, business and investors to take note.

In addition, recent data indicates that China’s manufacturing and industrial sectors are also weak. This intensifies discomfort given that the Chinese economy has been historically reliant, arguably overly reliant, on manufacturing and industrial sectors.

Given the size and scale of its economy, China's growth is watched closely around the globe. It is watched even more closely by regional economies likely to be impacted by a slowdown, especially those that export commodities and industrial components to the country.

China’s planned reforms are far reaching and have the potential to transform the economy. Intended to enhance overall prosperity by boosting private consumption, making growth more sustainable, implementation will be key. But, for now, the fallout is a slowing economy.

While the near-term impact of a temporarily slowing economy on the rest of Asia is expected to be minor, most economies in the region are ultimately expecting to benefit from rising consumption in China.

To negate the concerns of a slowdown, and address economic imbalance, the Chinese government has enacted measures to boost activity and give the economy a jolt. The government recently announced a mini stimulus package, extending a tax break to small and medium-size companies. The government also announced its ramp-up of spending on its railway infrastructure.

Further, Mainland China took steps to open up its capital markets, announcing a partnership with Hong Kong that allows cross-border stock investments. This pilot program is scheduled to begin in about six months. The government aim is to increase investments and trade to boost manufacturing and industry, rounding out its domestic service sector.

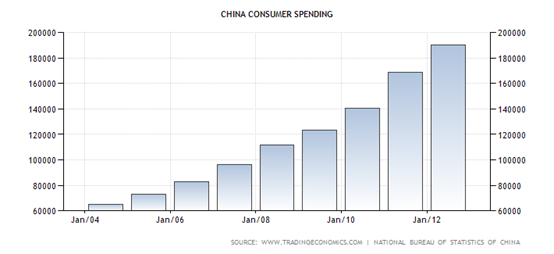

While the government’s reforms, set in 2013, have boosted sentiment, progress on economic rebalancing remains incomplete as investment, rather than consumption, continues to be the major growth driver. However, there are mounting signs that consumption will play a larger role in the economy and efforts to cool down credit growth, raise the cost of capital, and dampen investment growth will continue. But, in the medium term, anticipated productivity gains should boost growth, raising household income.

As a result, private consumption (as a share of GDP) would likely inch up, reaching nearly 37.5 percent of GDP, 4 percentage points above the baseline, supporting domestic and external rebalancing and making growth more sustainable.

The Chinese government is quick to point out that the first-quarter’s GDP growth rate was within its expected range given its economic transformation efforts. China points to income as the real measure of growth. In this view, rural income grew by 10.1 percent from a year ago, while urban income increased 7.2 percent. This contributed to increased retail sales, which grew by 12.2 percent, indicating growing consumption.

And, to give credit where credit is due, new loans fell 19 percent from a year ago, while money supply expanded at the lowest pace on record indicating that the growth in retail sales was not fueled by debt. This is certainly a good sign for China’s reform agenda. So, by China’s income gauge, the economy is doing better, not worse than last year.

Still, there is no overlooking the dampening industrial output at 8 percent, the slowest pace since the 2009 global recession. Moreover, the potential fallout from restrained credit and higher cost of credit on real estate remains a reality. Given that real estate represents some 16 percent of China's economy, a crunch, reminiscent of Ireland and Spain, would stress the banking system through higher credit losses. Similar historical patterns across the globe make it clear that maintaining the balance of credit availability and real estate activity will be difficult.

Going forward, GDP growth is expected to slowly decelerate to a more sustainable 7.5 percent in 2014 and 7.3 percent in 2015. But China must create 7 million jobs a year to handle new graduates and another 10 million to accommodate the migrants moving to cities as part of the government's urbanization drive. As such the projected GDP rate is just slightly more than required for China to maintain the current status quo. Leaving China with the continuing challenge of developing its services sector to create jobs and increase incomes. How China maintains the requisite growth, with reduced credit and likely higher interest rates, while implementing policy changes to reshape the economy for the long-term will remain a closely watched balancing act.

So, while it’s hard to foresee how China will evolve economically in the near term, commitment to progress makes the outlook for long-term growth very promising. Despite the challenges, many companies are positioning to grow along with China. And the reward for those that shift with the changes could be the big growth they lust for.

As the Chinese government and Chinese consumers continue to push for more access to the global marketplace and enhanced prosperity, it’s a good time to look at the Weiss Investment Ratings for a few companies that are well-engaged in China’s economy.

See Weiss Investment Ratings for Select Companies Engaged in China Business

See China Banks: Big Assets, Big Buildings

About the authors:

Girish Navare, bank and credit union analyst at Weiss Ratings, is a CFA charter holder with more than 15 years of financial industry experience in quantitative analysis and credit-risk management with various sized domestic and international banks and finance companies.Steve Picarillo is an internationally known and respected financial executive, analyst and author. Steve has spent most of his career on “Wall Street” as a lead analyst covering large financial institutions in the US and in Europe. In addition to being an expert on global banking, credit ratings, banking regulations, and compliance, Steve is a student of the global economic environment, a motivational speaker and an active philanthropist. Steve’s recent articles, full biography, CV and contact information can be found on www.stevepicarillo.com.

Copyright © Weiss Ratings. All rights reserved.

http://weissratings.com/news/articles/140512-china-tricky-balancing-act/