Fewer HARP Mortgages Closed, But HARP Remains A Huge Part Of Today’s Refinance Market

Mortgage rates and markets change constantly. Stay 100% current by taking The Mortgage Reports by email each day. Click here to get free email alerts, or subscribe to the RSS feed in your browser.

Fewer than 27,000 HARP 2.0 loans closed in February 2014, the lowest one-month tally in more than two years.

Fewer HARP closings doesn't mean that the refinance program for underwater homeowners is less valuable, however. In some states, HARP mortgages still account for more that one-third of all refinance activity; and more than 3 million HARP loans have closed nationwide.

The Home Affordable Refinance Program remains an important part of today's U.S. mortgage market.

Click to get today's HARP mortgage rates.

Qualification Standards For HARP

The Home Affordable Refinance Program (HARP) is a government refinance program meant to help homeowners whose homes have lost value since purchase.

HARP was initially launched in 2009 as part of the Making Home Affordable initiative, a program which also launched the Home Affordable Modification Program, better known as HAMP.

The primary difference between the HARP and HAMP programs is that the Home Affordable Refinance Program is meant for homeowners who are current on their respective mortgages. HAMP is for homeowners facing foreclosure, or whom are otherwise delinquent on their home loan.

HARP is often called the "Obama Refi", and it's backed via Fannie Mae and Freddie Mac exclusively. HARP's Fannie Mae version is called "Refi Plus". Freddie Mac's version is called the "Relief Refinance". These are brand names of the same mortgage product.

The qualification standards for the Home Affordable Refinance Program are low :

- Your loan must have been securitized by Fannie Mae or Freddie Mac

- Your loan must have a note date of no later than May 31, 2009

- You may not have previously used the HARP program to refinance

In addition, your mortgage payment history must be perfect for the last 6 months with no more than one late payment in the last 12 months.

Click here to compare today's rates.

HARP 2.0 : Underwater Homeowners Get Relief

When the Home Affordable Refinance Program was first launched in 2009, it was built to reach more than 7 million U.S. households. Through its first three years, however, the program fell well short of that goal.

Between 2009-2011, there were fewer than 1 million closings nationwide.

To help HARP reach more households, then, in late-2011, the government re-wrote the program and re-tooled it. Changes were centered on two main ideas. First, make HARP more compelling to lenders so they'd make more loans; and, second, lower HARP qualification standards for U.S. homeowners.

For banks, the government removed particular underwriting liabilities which, under the original Home Affordable Refinance Program, had made lenders wary of refinancing another bank's loan. This change made cross-servicing refinances possible.

A homeowner with a Bank of America loan could now do a HARP refinance with Wells Fargo, for example. This wasn't so simple under HARP 1.

The second change in the Home Affordable Refinance Program targeted homeowners.

Under HARP 2.0, homeowners were given to permission to refinance irrespective of their home's equity. In the prior version of HARP, loan-to-value was limited to 125 percent. Today, HARP allows an unlimited LTV.

If your loan size is within the local conforming loan limit, you can use HARP.

Click here to get HARP mortgage rates.

Georgia, Florida, Ohio Top HARP Closings

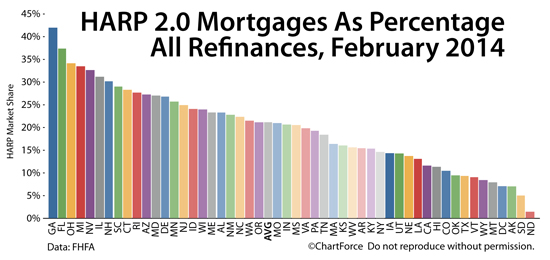

Through 2012, as HARP 2.0 gained traction, the program was exceedingly popular in states hard-hit by last decade's housing downturn. As a percentage of all closed refinances, HARP loans routinely topped 60% in places such as Nevada and Florida.

Today, HARP remains hugely important in Florida but rising home values have diminished the number of Home Affordable Refinance Program loans closed overall.

In February, for example, Georgia's HARP closings were highest relative to the other states for the second straight month. Prior to 2014, Georgia had not been first for HARP in more than two years. The complete top 10 list of states for HARP were :

- Georgia : 42.0% of closed conforming refinances were via HARP

- Florida : 37.4% of closed conforming refinances were via HARP

- Ohio : 34.1% of closed conforming refinances were via HARP

- Michigan : 33.5% of closed conforming refinances were via HARP

- Nevada : 31.2% of closed conforming refinances were via HARP

- Illinois : 31.2% of closed conforming refinances were via HARP

- New Hampshire : 30.2% of closed conforming refinances were via HARP

- South Carolina : 29.0% of closed conforming refinances were via HARP

- Connecticut : 28.3% of closed conforming refinances were via HARP

- Arizona : 27.7% of closed conforming refinances were via HARP

The states in which Home Affordable Refinance Program closings were less common in February included Alaska (7.1%), South Dakota (5.1%) and North Dakota (1.5%).

Nationwide, HARP closings accounted for 21.2% of all closed conforming refinances.

Also notable is that Florida and Nevada topped the nation in HARP loans closed over 125% loan-to-value. In both states, more than 1 in 10 closings were at the ultra-high LTV afforded by the HARP 2.0 program.

Nationally, 2.48% of HARP loans were over 125 percent LTV.

Get HARP Mortgage Rates

For today's homeowners with lost home equity -- regardless of whether you've been turned down for the Home Affordable Refinance Program in the past -- it's a good time to check today's HARP mortgage rates. Mortgage guidelines vary by bank, and those guidelines are getting more loose, on the whole.

Compare today's rates with a online quote. Rates are available at no cost, with no obligation to proceed, and no social security number is required to get started.