Japan returns to nuclear to get economy back on track

As part of the Strategic Energy Plan of Japan, the country’s government has decided to include nuclear as one of four base load energy sources.

While recent polls say that the majority of those surveyed are still concerned over plant safety, consumers and industry are struggling to meet the escalated costs associated with alternative, non-nuclear energy sources.

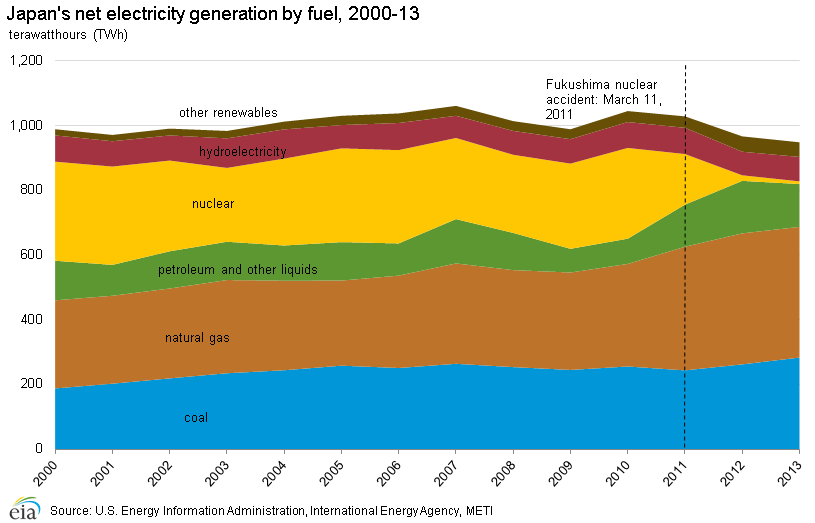

According to the United States Energy Information Administration (EIA), the change in energy balance in Japan since the 2011 Fukushima Daiichi plant and tsunami disaster has been extreme.

In 2010, nuclear accounted for 27% of Japan’s energy source, this was reduced to just 1% in 2013, after the Fukushima disaster at the Daiichi plant.

Natural gas use in Japan grew significantly, increasing from 13% in 2010 to 43% in 2013. Additionally, almost 4GW of additional coal capacity came online in 2013, increasing the share of coal-fired generation.

Alternative sources and price increases

The effect on energy bills has been palpable, money has poured out of the pockets of businesses and the consumers alike, as the use of alternative energy sources to nuclear has meant paying the price.

From studies conducted by the Japanese Ministry of Economy, Trade

and Industry, Eurostat, the EIA, and the Japan National Institute

for Environmental Studies;

residential and industrial electricity prices have increased by

19.4% and 28.4% respectively, between 2010 and 2013.

The Japan Chamber of Commerce and Industry (JCCI) has also stated that there has been a 28% surge in electricity prices after the Fukushima accident. Due to this rise in costs, a survey by the JCCI revealed that 61% of companies questioned said that this would result in job losses.

Impact of LNG imports

The IEEJ in their research has concluded that the increase in the

costs of electricity in

Japan, is partly explained by the cost in imports of Liquefied

Natural Gas (LNG).

In percentage terms, LNG imports accounted for a 5.5% share of

the total

amount of imports in 2010, this has now increased by 9% in 2014,

highlighting the

steep increase of LNG reliance.

The return of nuclear power

These high costs have resulted in the authorities to rethink their power strategy and to reconsider the use of nuclear power.

A spokesperson for the Japanese Authorities says: “Following the conclusions of the Strategy for Energy, it was decided by the government cabinet that nuclear energy provided the most cost effective, safe and reliable form of energy. It is necessary to use nuclear to meet the demand of the consumers and the general economy.”

“At the same time, the standard policy is that there will be less reliance on nuclear power compared to before what happened at Fukushima.”

The authorities say the nuclear energy accounted for 30% of the energy base, but the dependency level on nuclear after the policy reversal is likely to be lower than that figure.

Source: Financial Times; EIA

“One of the main reasons why the government has switched back to nuclear was down to the cost of importing energy such as oil, and using LNG power stations. Oil prices have been high over the past four years, and the exchange rates can result in imports being expensive.” The spokesperson adds.

When will the comeback occur?

To what extent that nuclear power can secure its place as part of Japan’s energy base is unforeseen, especially with a licensing process that might take an extreamly long time to complete.

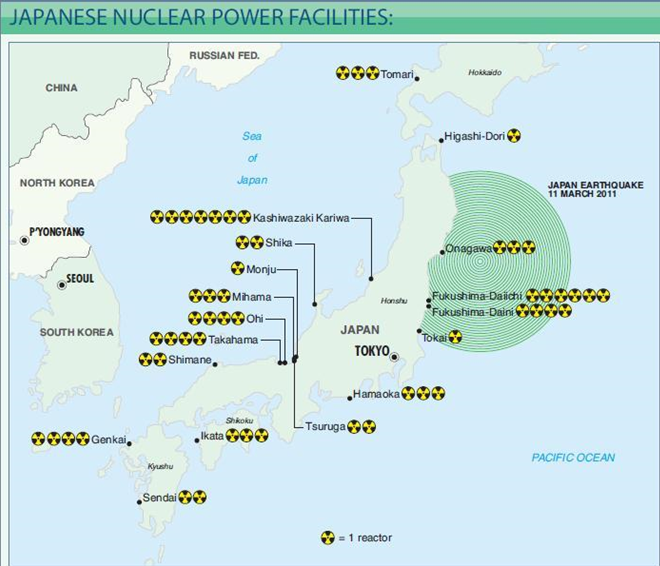

Despite this, there have been reports that units 1 and 2 at Sendai’s Kyushu Electric’s Power would be in operation soon.

However, the Japanese Nuclear Regulation Authority told Nuclear Energy Insider that many factors of the review process will have to be considered first, plus negotiations with local government before the plant is back online.

Tomoko Murakami, group manager, of the Nuclear Energy Group, Strategy Research Unit, at the Institute of Energy Economics, Japan (IEEJ), says: “I don’t think that Japan has reverted back to nuclear power as such, Japan’s long-term policy has not been drastically changed since 2012.”

“In the Strategic Energy Plan of 2014, the government states clearly that “Japan should decrease the share of nuclear as much as possible” in spite of the clear statement of “an important base load power,” Murakami added.

The Japanese public seem to be hardly convinced, that going back to being reliant on nuclear power is the right thing to do.

In a recent poll conducted by Nikkei, when asked the question do you agree with the restarting of nuclear power plants which have been proven to be safe by authorities, 62% said no, compared to 27% that said yes.

It appears that using nuclear energy again in Japan will take some getting used to, although that might get easier, as all the evidence says that nuclear’s prices appear to be right.

Until Japan has more domestic renewable energy sources connected to the grid to replace baseload nuclear energy, Japan's energy-hungry manufacturing sector will be short changed by energy imports and ultimately, Abenomics will fail to realise its potential.

© Nuclear Energy Insider | Terms & Conditions | +44 (0) 207 375 7500 | info@nuclearenergyinsider.com