U.S. Homes Flying Off The Shelves; Are Sellers In A Panic?

Home Sales Jump To 6-Month Best

U.S. home resales are climbing.

According to the National Association of REALTORS®, 5.19 million homes sold in March 2015 on a seasonally-adjusted, annualized basis, continuing this year's strong start for the housing market.

Current mortgage rates, which have been in the 3s all year, are helping to boost sales.

The typical prime mortgage borrower now gets access to rates near 3.75; with lower rates available to borrowers using FHA and VA loans.

Furthermore, an abundance of low- and no-downpayment mortgage programs have helped first-time and repeat buyers get more aggressive about purchase homes. 30% of last months buyers were first-timers.

It's all combining to help homes sell faster.

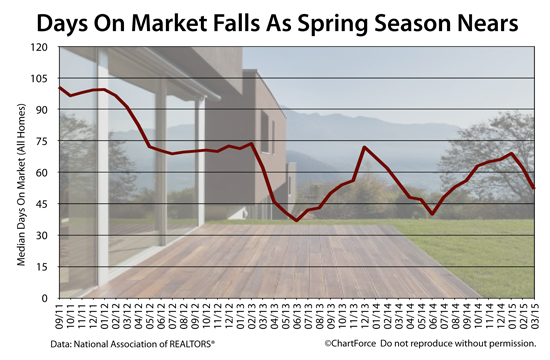

The median Days on Market for U.S. homes dropped to 52 days in March, which marks a 25% reduction from the start of the year; and the quickest pace of the last six months.

With 30-year mortgage rates below their year-ago levels, it's a terrific time to be a home buyer. Mortgage rates are low and housing payments are as affordable as they've been during any time in the last two years.

Existing Home Sales: 5.19 Million Homes Sold Annually

Each month, the National Association of REALTORS® publishes its Existing Home Sales report, a tally of sold homes which have been previously-occupied or are otherwise not "new construction"

The trade group's March 2015 report showed 5.19 million homes sold on a seasonally-adjusted annualized basis, a six percent increase from the month prior and a 10% increase from one year ago.

The increase comes at a time of dwindling home inventory, too.

There are now just two million homes for sale nationwide, a figure which puts into numbers what today's active buyers have already known for months -- the market for right-priced homes is highly competitive.

In March, Median Days on Market for an MLS-listed home was 52 days. This means that half of all homes sold were listed for fifty-two days or fewer, which is the highest percentage since September of last year.

Furthermore, 40% of homes sold in March sold within one month and many more were sold before ever getting listed at all, a sale-type known within real estate circles as "pocket listings".

Multiple-offer situations are common and home prices are climbing, as a result.

There are a number of reasons why today's homes may be selling more quickly.

One reason is seasonal. There are often more homes sold between March and September each year as compared to other months, and, after a particular frigid winter, pent-up demand may have spiked last month's data.

Median Days on Market showed a similar drop last spring; and the spring before that.

Another reason why homes may be selling more quickly is because today's mortgage rates are the lowest they've been since the start of the year; and the best they've been since May 2013.

Rents are rising nationwide but the purchasing power of buyer has climbed close to 11% since the start of last year. There are more buyers in today's market and they're getting busy with their buying.

40% Of Homes Sold Within A Month

The March Existing Home Sales report showed homes selling more quickly as compared to earlier in the year.

- January 2015 : Median Days on Market of 69

- February 2015 : Median Days on Market of 62

- March 2015 : Median Days on Market of 52

Demand for homes nationwide continues to outpace supply.

Median Days On Market can fall for a number of reasons. One reason is a general improvement in the U.S. economy. Another is the effect of falling mortgage rates during periods of rising rents; the answer to "Should I buy or should I rent" can change dramatically.

A different reason, though, is that today's sellers may feel less confident in their ability to sell their home.

According to a Fannie Mae consumer attitudes survey, 46% of consumers think now "is a good time to sell" a home -- a 6-tick increase from the month prior and the highest recorded measure since Fannie Mae began tracking such data.

When sellers start believing that "it's a good time to sell", they typically believe that housing is reaching -- or falling from -- a peak.

Falling confidence suggests that sellers are concerned about their future ability to get top-dollar which can result in home getting listed for cheaper prices. Homes are inclined to sell more quickly when sellers get nervous; and, may go under contract at the "the first reasonable offer".

The number of consumers who believe it's "good time to sell" is swelling. This suggests that savvy buyers can swoop in for good deals. This season's homes may soon begin listing at lower prices, and begin selling with fewer negotiations.

Strangely, though, data from NAR suggests that sellers have huge leverage over buyers.

At the current pace of sales, today's 2 million homes for sale would "sell out" in just four-and-a-half months and anytime supply drops below 6 months, it's said to favor sellers.

Home supply hasn't been above six months since August 3 years ago.

Get Today's Mortgage Rates

With mortgage rates low, competition for homes is fierce. Consider a pre-approval letter to accompany your bid. Pre-approvals signal that you're a serious buyer and that you're actually qualified to buy a home.

Compare today's mortgage rates now. Complimentary rate quotes are available online with no social security number required to get started and no obligation to proceed whatsoever.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Copyright Full Beaker, Inc. 2015; Some Images Copyright (c) 123RF Stock Photos

http://themortgagereports.com/17492/home-sales-national-association-of-realtors-mortgage-rates