Mortgage Rate Predictions For January 2015 (FHA, VA, USDA & Conv)

Current Mortgage Rates

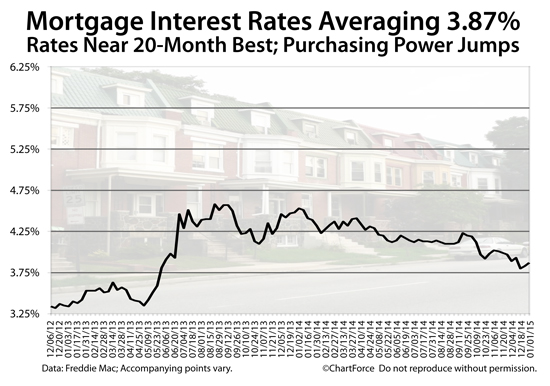

Mortgage rates continue to move lower.

According to Freddie Mac's weekly mortgage rate survey of more than one hundred banks, 30-year mortgage rates averaged 3.87% last week, marking the seventh straight week of sub-4 percent rates. The 15-year fixed rate mortgage rate averaged 3.15%.

Conventional mortgage interest rates remain near 20-month lows, boosting buyer purchasing power and putting millions of U.S. homeowners "in the money" to refinance.

Meanwhile, VA and FHA mortgage rates are even lower.

With mortgage interest rates well below 4 percent, every U.S. homeowner should be exploring their potential refinance savings. Even if you've refinanced in the past or recently bought a home, get a rate quote to see today's rates.

30-Year Mortgage Rates Average 3.87%

For the seventh straight week, 30-year mortgage rates are averaging less than four percent.

The average conventional 30-year fixed rate mortgage is 3.87%. The rate is available to "prime" borrowers paying an accompanying 0.6 discount points at closing.

Discount points are a one-time loan cost, where one discount point carries a cost equal to one percent of your first mortgage loan size amount.

As an illustration, 1 discount point on a Denver, Colorado loan at the 2015 conforming loan limit of $417,000 would carry a cost of $4,170 to be paid at closing. Discount points can be paid as cash or, for a mortgage refinance, they can be added to your loan size.

Discount points are typically tax-deductible.

15-year mortgage rates are low, too. Locking a 15-year mortgage rate at 3.15% also costs 0.6 discount points, on average.

Note, though, that Freddie Mac's weekly mortgage interest rate survey applies to conforming loans and conventional mortgage rates only. FHA mortgage rates and VA mortgage rates are not surveyed as part of the report; nor are mortgage rates for USDA loans.

Mortgage rates for FHA, VA and USDA loans are near 20-month bests, too, boosting buyer purchasing power close to 10% from the start of last year for loans with a 20% downpayment.

It's an excellent time to compare today's mortgage rates.

Click to get an instant rate quote.

Mortgage Rates In January

Last month, mortgage rates rates held below the psychologically-important 4 percent figure. When December began, 30-year mortgage rates averaged 3.97%. When it ended, rates averaged 3.87%.

Rates had dropped as low as 3.80% during the month, which suggests that interest rates may be finding a new, lower range. However, it may also suggest that the market is wound tight and sits ready to spring.

There are a number of factors which could affect this month's mortgage rates.

More Jobs In The Economy

Last month, the November Non-Farm Payrolls report showed 321,000 net new jobs added to the economy, raising this year's running total to 2.65 million jobs added overall. Job growth has topped 200,000 for ten straight months, and more than 9 million jobs have been added to the economy dating back to 2010.

Wage growth is finally improving, too, as the jobs market returns. Unemployment rates are down and the combination of market forces and minimum wage laws have shifted employee wages up.

Rising wages can be an inflationary force on the economy. Inflation is bad for low rates.

As the jobs market expands, expect the Fed to play a lesser role in holding today's mortgage rates down.

A Drop In Inflation Rates

The Federal Reserve also watches inflation rates. As inflation rates rise, the Fed is more inclined to remove or slow its market stimulus, which can cause mortgage rates to rise.

Furthermore, inflation is the enemy of low mortgage rates. This is because inflation devalues the U.S. dollar which, in turn, devalues dollar-denominated U.S. mortgage bonds. During periods of inflation, mortgage rates tend to rise.

Since 2012, though, inflation rates have been stable, but below the Federal Reserve's target rate of two percent. When inflation rates run too low for too long, disinflation can occur, and this can support low mortgage rates.

The Fed has taken steps to stimulate the economy and stoke inflation but, thus far, those efforts have yet to show themselves fully. And now, with oil prices dropping, some fear that Cost of Living indices will begin to show price drops.

For now, though, cheap oil means lower gas prices which may increase consumer spending through the holiday season. Expect a push-pull on inflation/disinflation forces throughout January and into early February 2015.

Strong inflation will send mortgage rates up. Weak inflation will send mortgage rates down.

A Strong U.S. Dollar Helps Mortgage Rates Drop

Weakness in non-U.S. economies will also affecting this month's mortgage rates. In general, as global economic weaken, U.S. mortgage rates improve. This is the result of an investing pattern known as a flight-to-quality.

"Flight-to-Quality" describes, during periods of economic or political uncertainty, the flow of money from risky assets toward safe ones. Investors seek safe assets to protect their principal investments, and to shield against loss.

So, because mortgage bonds are among the safest investment classes in the world, 30-year mortgage rates tend to improve when war is imminent; or, when large global economies face an uncertain future.

Investment in the U.S. dollar has been strong, too, which helps mortgage interest rates to drop. This is because mortgage rates are based on the price of mortgage-backed securities (MBS), which are priced in U.S. dollars.

As the value of the dollar rises, so does the inherent value of owning MBS. This drives demand for mortgage bonds higher which leads prices up. When bond prices rise, mortgage rates drop.

This is another reason mortgage rates moved lower in December. In January, the U.S. dollar may be more tightly linked to rates.

Click for today's live mortgage rates.

This Week's Economic Calendar

This week, there is very little on the U.S. economic calendar to affect current mortgage rates, save for Friday's release of the Non-Farm Payrolls report. Expect for markets to move on politics, momentum, and expectations for what the jobs report will read.

The complete calendar is as follows:

- Monday : San Francisco Fed President John Williams speaks

- Tuesday : ISM Manufacturing Index; PMI Manufacturing Index

- Wednesday : FOMC Minutes; Chicago Fed President Charles Evans speaks

- Thursday : Jobless Claims; Minneapolis Fed President Narayana Kocherlakota speaks; Boston Fed President Eric Rosengren speaks

- Friday : Non-Farm Payrolls; Richmond Fed President Jeffrey Lacker speaks

Note that there are a bevy of Federal Reserve members scheduled to speak this week. The markets will watch these speeches for clues about future Fed policy. The rhetoric of Fed speakers may cause mortgage rates to change. The week's big event, though, is Friday's Non-Farm Payrolls release.

Mortgage interest rates can change quickly, and without notice. It's a good, safe time to lock a low rate. Today's mortgage rates may not last.

Get Today's Rate Quotes Here

Mortgage rates are near 20-month lows. Home buyers have their greatest purchasing power of the year; and refinancing households are saving more money.

Compare today's live mortgage rates and see what you can save. Free mortgage rates are available online with no social security number required to get started and no obligation to proceed.

Copyright Full Beaker, Inc. 2015

http://themortgagereports.com/17072/mortgage-rate-predictions-for-january-2015-fha-va-usda-conv